THORChain Investors Guide

Introduction

THORChain is without exaggeration the project that has excited me most ever since the first learning of bitcoin.

Erik Voorhees

Do you wish you could go back in time and buy (more) bitcoin several years ago? If only you knew then, what you know now. What if I told you there’s a way? Well, kind of a way. You can’t go back in time, but you can apply your knowledge of the past to the present. There are reasons why bitcoin was so successful and why bitcoin continues to be the leading cryptocurrency. By applying those reasons to today’s cryptocurrencies, you can narrow in on the ones with the most upside potential.

THORChain’s RUNE token has >100x potential but without the lottery ticket odds. There are risks and they will be discussed, however, by the end of the report you’ll see how plausible that upside potential is and how well protected the downside is. THORChain is a type of asymmetric investment that only comes around once a decade.

To appreciate THORChain, let's go over what makes Bitcoin special and how THORChain compares. We'll start with the first sentence from the Bitcoin whitepaper.

A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution.

Satoshi Nakamoto

A purely peer-to-pool version of an exchange would allow online swaps to be done directly from one party to a market maker without going through a financial institution.

I’ve developed a new open-source peer-to-peer e-cash system called Bitcoin. It’s completely decentralized, with no central server or trusted parties, because everything is based on crypto proof instead of trust.

Satoshi Nakamoto

A new open-source peer-to-pool exchange system called THORChain has been developed. It’s completely decentralized, with no central server or trusted parties, because everything is based on crypto proof instead of trust.

The root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust. Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve. We have to trust them with our privacy, trust them not to let identity thieves drain our accounts.

Satoshi Nakamoto

The root problem with a centralized exchange (CEX) is all the trust that’s required to make it work. The CEX must be trusted not to steal from customers, but the history of CEXs is full of breaches of that trust. CEXs must be trusted to buy crypto and hold it in customer accounts, but they have opaque reserve reporting which increases the likelihood of fractional reserve banking. We have to trust them with our privacy, trust them not to let identity thieves drain our accounts.

Bitcoin uses peer-to-peer technology to operate with no central authority or banks; managing transactions and the issuing of bitcoins is carried out collectively by the network. Bitcoin is open-source; its design is public, nobody owns or controls Bitcoin and everyone can take part. Through many of its unique properties, Bitcoin allows exciting uses that could not be covered by any previous payment system.

Bitcoin.org

THORChain uses peer-to-pool technology to operate with no central authority or banks; managing liquidity pools and the approval of swaps is carried out collectively by the network. THORChain is open-source; its design is public, nobody owns or controls THORChain and everyone can take part. Through many of its unique properties, THORChain allows exciting uses that could not be covered by any previous exchange.

THORChain is not the next Bitcoin. THORChain complements Bitcoin and was modeled after Bitcoin. THORChain is the only decentralized exchange (DEX) that can swap bitcoin for thousands of other cryptocurrencies without a central authority or bank involved.

THORChain is being integrated into all the major crypto wallets. Wallet users will be able to swap inside their wallet and maintain custody of their crypto. They’ll have no idea they’re using THORChain since it works in the background - the best technology is that which you don’t know you’re using. Combined with first mover advantage, THORChain is poised to become core infrastructure for decentralized finance (DeFi) and cement it’s token RUNE as one of the sector’s top cryptocurrencies.

Note the difference between trading and swapping. Trading is when you buy and sell using fiat money. For example, if you sell stock ABC for some amount of dollars, then use those dollars to buy stock XYZ, you’re trading. If you could exchange stock ABC directly for stock XYZ without going into and out of dollars, then you would be swapping the two stocks. DEXs don’t use fiat money, therefore all cryptocurrencies are swapped for one another. Throughout this report and online, you’ll see the term swapping used instead of trading when referring to transactions on a DEX.

Biggest Problem in Crypto

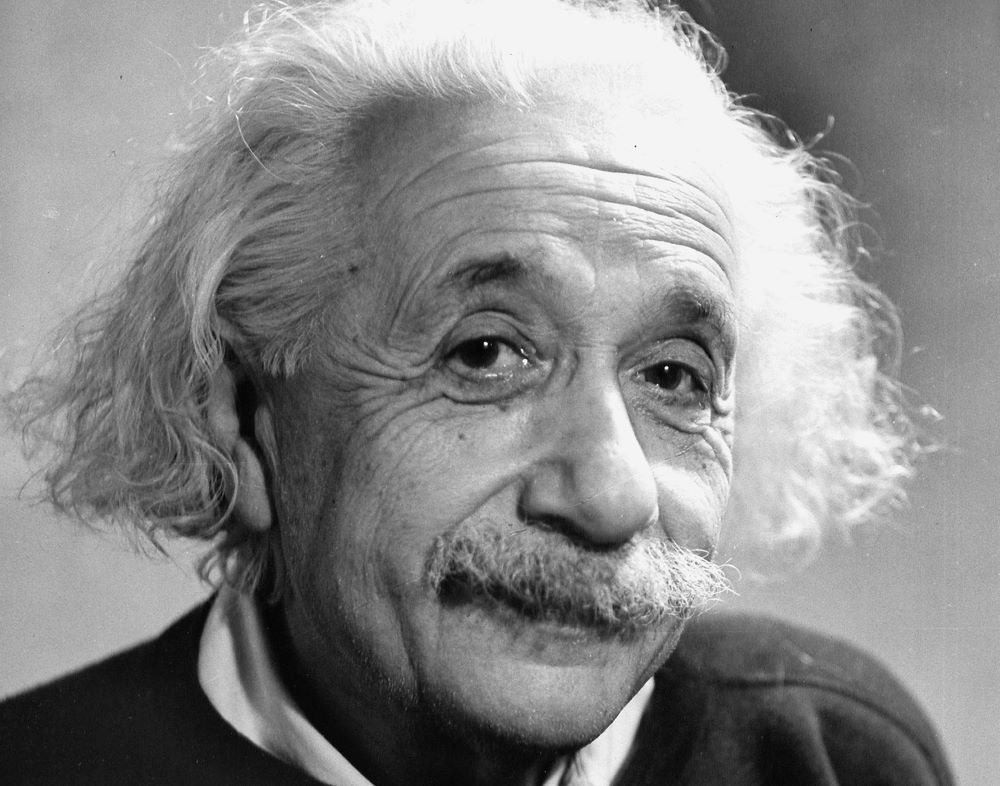

We cannot solve our problems with the same thinking we used when we created them

Albert Einstein

If you want to make a lot of money, invest in the solution to a large problem. Bitcoin solved the problems with conventional money and in turn has been the most successful investment of our lifetimes.

One of the biggest problems in crypto right now is the ability to swap bitcoin for other cryptocurrencies.

Ever since the invention of the second cryptocurrency, Litecoin, the only way to swap Bitcoin for Litecoin or any other crypto was through a centralized exchange (CEX). An exchange that has all your personal information, and more importantly, has custody and control over the crypto in your account. Remember, the point of crypto is cutting out third parties to protect your personal information and maintain custody of your assets. Therefore, using a CEX is actually the antithesis of crypto.

But if you wanted to trade your bitcoin for any other crypto, you had no choice. You had to use a CEX despite the obvious contradiction.

Unfortunately, this led to all the major disasters you’ve heard about in the sector.

In 2014, Mt. Gox was the largest exchange in the world handling about 70% of all bitcoin trading. The exchange was hacked and 650,000 bitcoin were stolen, about 5% of the total bitcoin supply!

QuadrigaCX became Canada’s largest crypto exchange by 2018 with 350,000 clients. After the mysterious death of the CEO, $190 million in crypto went missing, and the company declared bankruptcy. Investigators later concluded QuadrigaCX was a basic Ponzi scheme and likely never invested any client funds.

Celsius was the largest crypto lender with 1.7 million users. They filed for bankruptcy in June 2022 following the collapse of LUNA and the market. Users are owed $4.7 billion and are unlikely to recover much of it. It’s still unclear whether Celsius failed because of poor lending practices combined with the market crash and bank run, or if it was a fraud from the beginning.

Sam Bankman-Fried (SBF) was all the talk because of the collapse of FTX. Over 1 million Americans and 5 million others worldwide lost about $8 billion.

There are many other frauds and hacks that have occurred on various exchanges throughout the years. Of the 10 largest hacks of all time, six have occurred on CEXs. Hopefully this drives home the point that CEXs are one of the largest problems in the industry, if not the biggest problem of all. When you use a CEX to custody your assets, you never truly know if they’re holding your crypto or not.

I definitely personally hope centralized exchanges burn in hell as much as possible.

Vitalik Buterin, Ethereum Co-Founder

The obvious solution to a centralized exchange is a decentralized exchange (DEX). An exchange where you can trade with no central authority, or third party involved, and maintain custody of your crypto.

There are some DEXs like Uniswap, PancakeSwap, and Trader Joe. However, they can only trade tokens created on their respective layer 1 blockchains. For example, Uniswap is an Ethereum DEX that can only trade Ethereum based tokens (ERC20). PancakeSwap is a Binance smart chain DEX that can only trade Binance smart chain based tokens (BEP20). Trader Joe is an Avalanche DEX that can only trade Avalanche based tokens (ARC20). Follow the drift? Each layer 1 DEX can only trade their respective protocol’s tokens.

None of these DEXs can swap different layer 1 tokens between each other, most notably bitcoin with ethereum.

People have been working on this problem for over a decade. One of the early solutions was Atomic Swaps, but they never caught on. Atomic swaps require two people to find each other at the exact same time, with the exact same crypto to swap, for the exact same amount & price. It’s like a dating app that requires two people to swipe right at the exact same time for there to be a match. It technically works but can’t scale.

People have been working on this problem for over a decade. One of the early solutions was Atomic Swaps, but they never caught on. Atomic swaps require two people to find each other at the exact same time, with the exact same crypto to swap, for the exact same amount & price. It’s like a dating app that requires two people to swipe right at the exact same time for there to be a match. It technically works but can’t scale.

Another solution that’s been developed is using a smart contract called a bridge and wrapping tokens. A wrapped token is just an I.O.U.

That’s as good as money sir. Those are I.O.U’s.

Lloyd Christmas, Dumb and Dumber

Think of a bridge like a goldsmith vault, and the receipt you get for storing gold there is a wrapped token. You could then trade the receipt/wrapped token for the same value as the gold backing it, because buyers of the receipt/wrapped token trust they can give it to the vault/bridge and get actual gold back. But you know all too well the problems throughout history with paper gold.

WBTC is bitcoin wrapped in an ethereum contract. WBTC is paper bitcoin, an I.O.U. for bitcoin. 1 BTC goes into the contract, 1 WBTC token comes out as the receipt. WBTC can then be used on Uniswap and any other ethereum based application.

On December 1st, 2023 there were 160,293 bitcoin held inside WBTC. On September 1st, 2022, there were 247,660 bitcoin. A lot has been withdrawn since the collapse of FTX and the market’s concerns about third party custody.

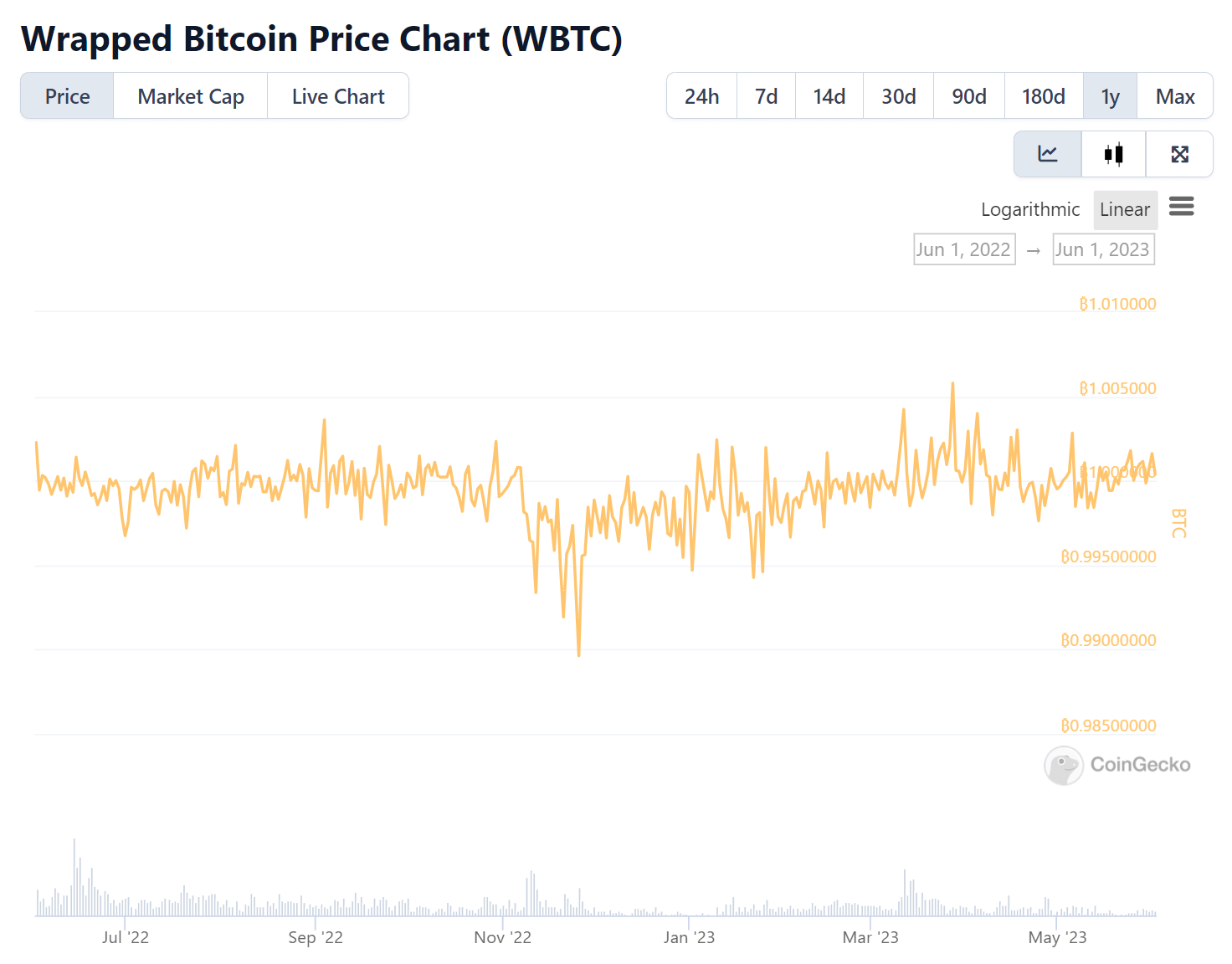

The market was so worried about counterparty risk, you can see them panic selling their WBTC in November 2022, driving the price below par with bitcoin. Overall, it was only 1-2% below par, so not the end of the world, but still noticeable.

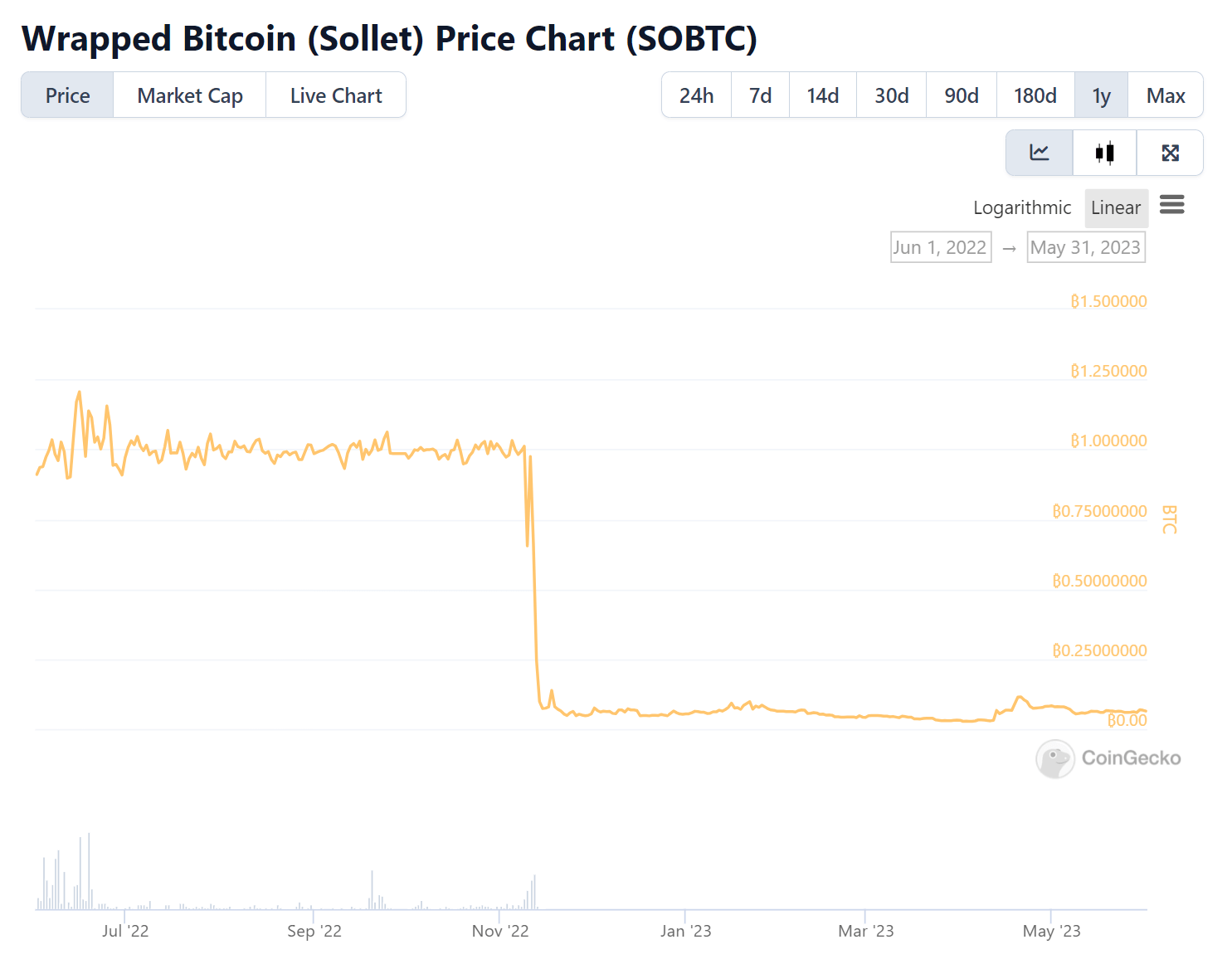

However, the collapse in the price of wrapped bitcoin on the Solana network must have felt like the end of the world for some people.

Sam Bankman-Fried’s FTX had their version of wrapped bitcoin on the Solana network, called SOBTC. The collapse of FTX led to redemptions of SOBTC being stopped. That means people can’t exchange their SOBTC tokens for the bitcoin backing them. There’s supposed to be 16,150 bitcoin in SOBTC, worth about $452 million. All people can do is wait and see what happens with FTX or sell the SOBTC tokens on the secondary market. Rather than risk getting nothing for them, some people have been selling them for 3 cents on the dollar!

Counterparty risk isn’t the only concern with bridges and wrapping tokens. You also have smart contract risk. What if the code to the bridge gets hacked?

The WBTC smart contract is controlled by BitGo. Let’s assume they’re trustworthy and we don’t have to worry about them not delivering bitcoin when WBTC is redeemed. There’s still the risk that someone hacks the WBTC smart contract and steals the bitcoin. Since the bitcoin is being held inside an ethereum contract, it no longer has the protection of the Bitcoin protocol itself. This means a token held inside a bridge is only as safe as the bridge itself.

This makes bridges targets for hackers and has resulted in the top two hacks of all time, totaling $1.2 billion.

The largest hack of all time happened in March 2022 on Axie Infinity’s Ronin network. 173,600 Ethereum and 25.5 million USDC, worth $614 million, were stolen.

The second largest hack happened in August 2021 on the Poly Network. A dozen different cryptocurrencies were stolen, worth $611 million. In a strange twist of events, the hacker returned the stolen crypto saying he did it for fun. More likely, he realized he would have a hard time selling them.

Bridges also increase the incentives for a 51% attack on a protocol. Vitalik Buterin goes into further detail on this reddit post if you want to learn more. The main takeaway is:

The fundamental security limits of bridges are actually a key reason… I am pessimistic about cross-chain applications… it's always safer to hold Ethereum-native assets on Ethereum or Solana-native assets on Solana than it is to hold Ethereum-native assets on Solana or Solana-native assets on Ethereum.

Vitalik Buterin, Ethereum Co-Founder

Bridges aren’t an effective solution to cross chain swaps, and if anything, are creating new problems.

Almost every single negative thing you’ve heard about crypto – frauds, thefts, hacks - has occurred on bridges and CEXs. It’s a billion dollar problem, and the solution to such a problem stands to be worth billions.

It just so happens there is a solution.

THORChain.

THORChain Fixes This

I don't think this is an exaggeration to say that when I discovered THORChain and learned about it, it was the most exciting feeling I had gotten since learning about bitcoin back in 2011

Erik Voorhees

Erik Voorhees is one of the first bitcoin billionaires and is one of the first people to speak publicly about crypto over a decade ago. Early on he saw the need for a cryptocurrency exchange and started ShapeShift in 1. However, as he mentions in the clip above, ShapeShift was still a CEX.

When Erik Voorhees & ShapeShift learned of THORChain, they recognized it for what it was - the solution to one of the biggest problems in crypto.

When THORChain’s Multi-Chain Chaosnet went live in April 2021, ShapeShift was one of the first websites to have it integrated into their backend. This turned ShapeShift from a CEX into a DEX overnight. After a decade of searching, Erik finally found what he was looking for.

THORChain is Better Than CEX

All the theft and fraud with centralized exchanges could have been avoided if people didn’t leave their crypto on the exchange. Those who bought their crypto, then transferred it to a hot or cold storage wallet, were safe from the frauds and thefts of the past.

The problem is people want to be able to trade their crypto, so they leave it on the exchange. It’s a hassle to constantly transfer your crypto from a CEX to your wallet, back and forth, back and forth. Plus, every time you do that you introduce the potential for user error and risk sending your crypto to the wrong address only to lose it for good.

Many crypto users are aware of the risks with CEXs and use them as little as possible. They maintain custody of their crypto in hot or cold storage and use DEXs to swap. However, to swap between different blockchains they have to use bridges and wrapped tokens, which introduces a whole new set of risks. It’s no different than having custody of a piece of paper that’s a receipt for gold. It’s just not the same thing.

What’s needed is the ability to swap layer 1 tokens, without bridges, and maintain custody. The solution has to be able to swap crypto, with no wrapped tokens, within your wallet.

THORChain is that solution.

THORChain is true DeFi. It’s the only DEX that can swap bitcoin without wrapping it and from within a user’s wallet.

Based on the Nakamoto coefficient measure of decentralization, THORChain is consistently ranked near the top of the list as one of the most decentralized crypto currencies in the sector. Just like Bitcoin, THORChain has no CEO, board of directors, or head office.

Decentralization is the value proposition in crypto, not blockchain. Decentralization is what makes a crypto secure from theft and attacks, whether from insiders or outsiders. The more decentralized a crypto is, the more difficult it is for any one person or entity to defraud or attack the protocol. CEXs and bridges are highly centralized which makes them more susceptible to fraud and hacks.

THORChain is economically secure. Nodes that secure THORChain have to post a bond that’s always larger than the amount they could possibly steal or lose to hackers. Should a theft or hack occur, the nodes could lose some or all their bond, which incentivizes them to secure the network. Whereas CEX management teams and programmers have no money at risk if their exchange or bridge is hacked. CEXs and bridges are economically insecure.

THORChain is open source. Anyone can review the code and propose changes. Anyone can build on top of THORChain. Anyone at any time can audit the holdings and transactions on the protocol. Whereas CEXs are closed source, no one can review their inner workings, and they can’t be audited at will, if at all.

Being a pragmatically run exchange, versus run by humans, means no fractional reserve banking can take place. Every penny of crypto has to be accounted for otherwise THORChain will stall until it's rectified. With CEXs, fraud can last a long time and continue to metastasize until it blows up in everyone’s face.

Every human being on the planet can use THORChain. All that’s required is a smartphone and a crypto wallet. There’s no KYC, no account to open, no one to ask permission to use THORChain. This means the 1.7 billion unbanked people in the world, and 4.3 billion underbanked people in the world, can access THORChain. Whereas CEXs require KYC and having a bank account, automatically excluding the unbanked and underbanked. CEXs can arbitrarily deny you the ability to open an account, or worse, freeze your account after you’ve put crypto into it. That’s not possible with THORChain since it’s permissionless and you always maintain custody of your crypto.

THORChain is the only DEX that can swap bitcoin and tether, the largest trading pair on CEXs. The largest crypto exchange in the world, Binance, can trade bitcoin with several hundred different tokens. THORChain on the other hand, with its DEX aggregation feature, enables bitcoin to be swapped with several thousand different crypto currencies.

THORChain is more than just a DEX for swapping layer 1 tokens. The DEX forms the base for much larger potential.

THORChain has synthetics which can be used by high frequency traders. Swapping layer 1 tokens means you’re subject to their respective block times on each chain, which can be cumbersome for

active traders. Synths are basically a layer 2 on THORChain and settle within seconds, mimicking the experience of trading on a CEX.

THORChain has a savers feature where people can earn yield on their bitcoin and other crypto. THORChain is the first and only DeFi protocol that can offer native bitcoin yield. The yield comes from the swapping fees on the network, not from lending it out.

THORChain developers are currently working on a lending feature. If enabled, users would be able to deposit their bitcoin and other tokens and borrow against them. This would be another first in crypto, the ability to borrow against layer 1 bitcoin in DeFi.

Also proposed are order books (to place limit orders) and perpetual futures.

If all these features come to fruition, it would make THORChain more than just a DEX. It would make it the first and only commercial bank for bitcoin. But not just any commercial bank, a primary dealer too.

Primary dealers in the U.S. are market makers in treasuries and are the only banks permitted to trade directly with the Fed. When you include their commercial banking business, it makes them the largest and most powerful banks in the world. Topping the list are J.P. Morgan, Wells Fargo, and Goldman Sachs.

If Bitcoin is the central bank of crypto, and THORChain is the only market maker for bitcoin in DeFi, THORChain is poised to become the largest primary dealer and commercial bank of DeFi. If Bitcoin makes the Fed obsolete, THORChain will make J.P. Morgan, Wells Fargo, and Goldman Sachs obsolete.

How do you like them apples!?

Now that you know how unique and special THORChain is, let’s get to the fun part. How much money could you make?

Upside Potential

… DeFi is going to continue to move towards greater adoption and will eventually reign supreme.

Patrick Hillman, Binance Chief Strategy Officer

Decentralization is the future. DEXs are the infrastructure of the future. THORChain is the only DEX that can swap bitcoin therefore it’ll be part of that future. To get an idea what that future will look like, let’s look at the past.

In the 1800’s, America was still being settled. By 1860 the U.S. was the 9th largest economy in the world. Despite the civil war from 1861-1865, the US entered the Gilded Age and by 1890 was the world’s largest economy. This rapid economic growth was made possible by the direct investment into infrastructure, most notably the railroads.

Railroad mileage in the United States tripled between 1865 and 1881. Transported freight increased by 643%. Steel production increased by 7,986% within 16 years. U.S. steel production surpassed the combined totals of Britain, Germany, and France!

Those who made this possible, such as J.P. Morgan, Andrew Carnegie, and Cornelius Vanderbilt, became the wealthiest people in the world. Their families are still living off those fortunes 140 years later. The list isn’t complete without mentioning John D. Rockefeller, considered the richest person in modern history.

Standard Oil Company was established in 1863. 16 years later, Rockefeller controlled 90% of the United States refining capacity. Rockefeller made his fortune by consolidating and vertically integrating America’s oil refineries, transportation, and distribution. He had a monopoly on the entire oil industry’s infrastructure.

The above is meant to illustrate the importance of infrastructure to a developing economy and the fortunes that can be made by those who provide it.

Crypto is a new frontier being settled. And like any physical territory, the crypto economy can’t reach its true potential without infrastructure. THORChain is poised to become a core piece of crypto infrastructure that enables DeFi to reign supreme.

Just as railroads made it easy to transport people and goods across vast distances, connecting markets like never before, THORChain makes it easy to transport tokens and value across blockchains, connecting those networks like never before. THORChain’s protocol is a crypto railroad, and RUNE is the token making up the rails.

THORChain Will Dwarf CEXs

In 5-10 years DEXs will be bigger than CEXs.

CZ, Binance Founder & CEO, circa 2022

Binance is the largest crypto exchange in the world. How can THORChain become bigger than Binance?

A decentralized network can grow much bigger than a centralized network because there are no barriers to entry. Anyone around the world, from individuals to corporations, from the first world to third world, can contribute as they please to a decentralized network. For example, consider Uber and Airbnb.

Uber is the largest taxi company in the world but doesn’t own any taxis. Uber’s inventory of taxis is decentralized which made it possible to grow much quicker and larger than any centralized taxi company. Airbnb is the largest hotel company in the world but doesn’t own any hotel rooms. Their inventory of hotel rooms is decentralized, again, making it possible to grow much quicker and larger than any centralized hotel chain could manage.

THORChain’s inventory is decentralized, which means it can grow much quicker and larger than its centralized counterparts, such as Binance.

Uber and Airbnb still have some centralized aspects though. You have to create an account with them just like you have to create an account with Binance. This is a barrier to entry and limits their growth.

Whereas there’s no account to open with THORChain. All you need is a smart phone. THORChain can be integrated into the back end of any wallet, website, or app. Users of these front ends have no idea they’re using THORChain, it’s just happening in the background. Front ends install THORChain for two reasons. It’s a feature all their users want, and they get a way to monetize their audience.

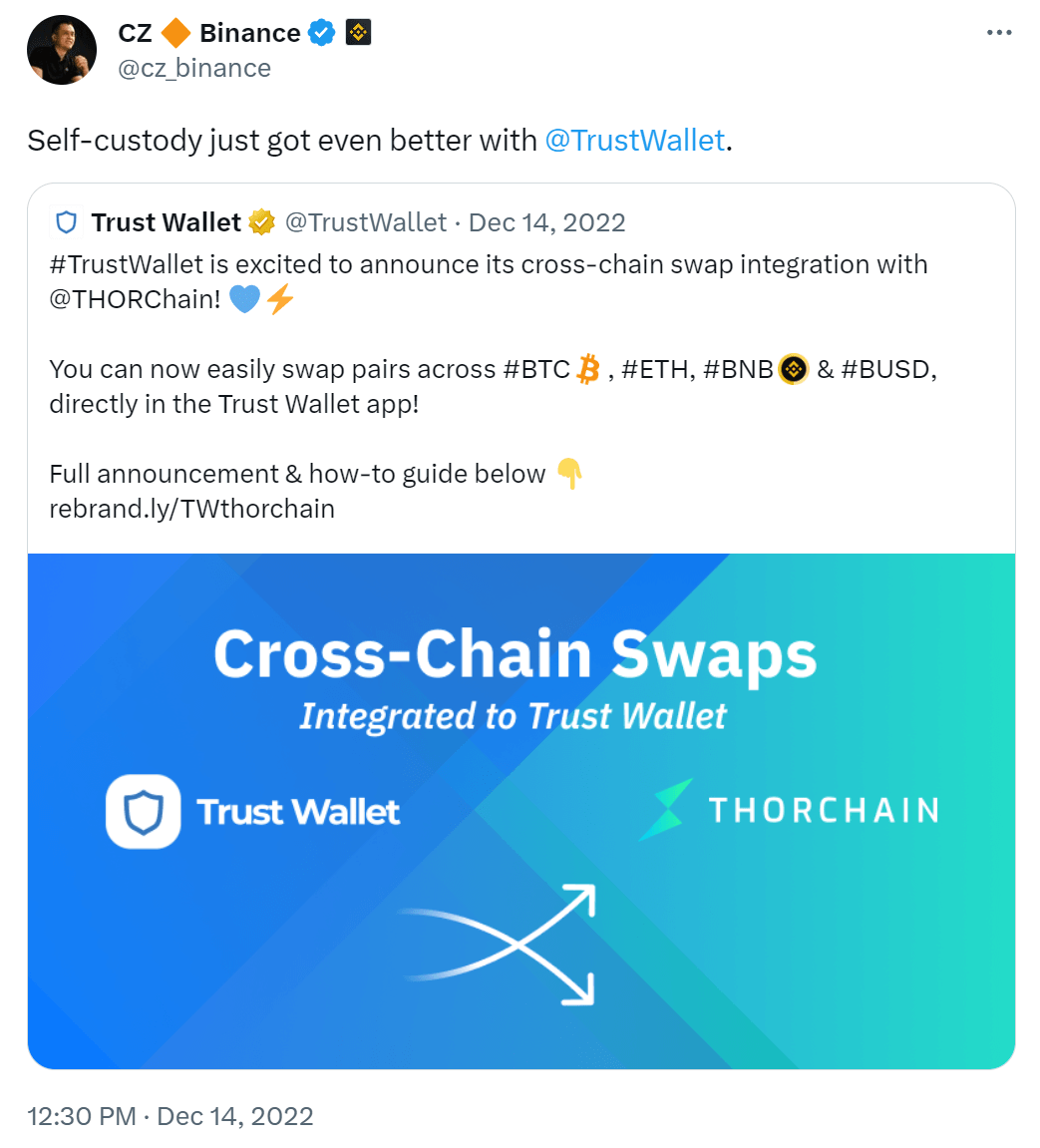

Crypto wallets, websites, and apps follow the Silicon Valley business model of getting lots of users then finding a way to monetize them later. Crypto wallets have been around for several years without any means to generate revenue. Until now. By integrating THORChain, a front end can customize their own commissions on each swap and start a revenue stream. Just like Trust Wallet has done.

In the video above, CZ mentions Trust Wallet, Binance’s official crypto wallet and their way of betting on DeFi. Trust Wallet is one of the most popular wallets in crypto with over 60 million users. For years it had no income. That changed in December 2022.

By integrating with THORChain, Trust Wallet now has a way to start making some money.

Trust Wallet is only one example though. There are already multiple wallets that have THORChain integrated into their back ends and even more working on it. As each new integration goes through, the more pressure it puts on others to follow suit because who wants to use a wallet that can’t swap bitcoin? Within weeks of Trust Wallet’s announcement, two more wallets jumped on the bandwagon after being pressured by their users.

All right, enough hype! You want to see some numbers. I know, I know.

It’s important to go through the above so you can appreciate the size of the problem and the size of the solution, to grasp the size of the upside. Because the numbers get mind boggling big and you wouldn’t believe me if I just threw them out there. They would sound too fantastic, and you’d dismiss them as unlikely. The above was necessary, not just to consider the genuine potential of THORChain, but to demonstrate the probability of it succeeding.

Huge upside potential is worthless if it has a low chance of happening. That’s why you don’t bother with lottery tickets, they’re a waste of time, let alone money. The probability of winning is just too low. The probability of an investment being successful is much more important than its upside potential.

When you find an opportunity that has a decent chance of success combined with high upside potential - an asymmetric bet - then that is worth your time and money.

THORChain is an asymmetric bet worth paying attention to. It’s not a worthless idea in a whitepaper. It exists. It’s truly unique. It’s being used. It’s being adopted. The only question that remains is how big will it get?

RUNE Could Be the #3 Crypto

Bitcoin has been the #1 crypto by market cap since it was invented. Ethereum has been #2 for several years now. But what about the #3 spot? The position has seen its fair share of different crypto rotate in and out.

During the bull market in 2021, Binance (BNB) catapulted to #3 by market cap. When Coinbase (COIN) went public in 2021, its market cap relative to the crypto sector put it at #5.

As of December 1st, 2023, BNB is #4 and COIN is #6. Despite the strength in bitcoin, we're still in a bear market. Trading activity on the exchanges is down, taking valuations down with it. Many still have cash on the sidelines indicated by USDT being the #3 crypto by market cap.

If DEXs become bigger than CEXs, then it’s plausible RUNE could be the #3 crypto by market cap one day.

Right now, RUNE hangs out in the upper range of the top 100 crypto by market cap, making it a solid mid cap in the world of cryptocurrencies. However, THORChain is still tiny relative to its peers as you can see in the following charts.

The volume traded on Binance dwarfs all other exchanges. If we remove Binance from the chart, we can see the others more clearly.

Notice the volume on THORChain is a rounding error on both charts. It barely registers. Also, notice the navy-colored bars on the charts above. They’re all the DEXs in the top 100 crypto. If we compare just the DEXs with each other, THORChain still looks like small. And remember, these other DEXs can’t handle bitcoin.

For every $1/day of trading volume on THORChain there’s $8/day volume on Uniswap.

For every $1/day of trading volume on THORChain there’s $10/day volume on Coinbase.

For every $1/day of trading volume on THORChain there’s $60/day volume on Binance.

Said differently, there’s over eight times more volume on Uniswap, over ten times more volume on Coinbase, and over sixty times more volume on Binance!

THORChain is tiny and has a lot of room to grow.

Let’s explore how big it could get.

Valuation Analysis

The following are some ways to value THORChain’s RUNE token relative to Binance’s BNB token and Coinbase’s COIN shares.

On December 1st, 2023, RUNE was $6.46/token. With 337.87 million RUNE outstanding that works out to a market cap of $2.18 billion.

The COIN IPO closed with a $63.31 billion market cap. If THORChain were to have a $63.31 billion market cap, RUNE would be $187.38/token.

During the COIN IPO, the market cap of BNB was $85.06 billion. If THORChain were to have a $85.06 billion market cap, RUNE would be $251.75/token.

The COIN market cap on December 1st, 2023 was $32.00 billion. If THORChain were to have a $32.00 billion market cap, RUNE would be $94.71/token.

The BNB market cap on December 1st, 2023 was $34.68 billion. If THORChain were to have a $34.68 billion market cap, RUNE would be $102.64/token.

As of December 1st, 2023, Coinbase claims to have 120 million verified users, and Binance boasts having 140 million registered users. Based on all the front ends that have integrated THORChain, it has about 70 million potential users. COIN is trading for $292/user and BNB is trading for $247/user, and if RUNE had a similar valuation, it would trade between $51.17/token to $60.49/token.

A more direct approach to valuing RUNE is based on how much crypto is held as inventory on the exchange. The way THORChain is designed, RUNE will always have a minimum market cap of around 3x the value of the crypto in inventory. RUNE can’t trade below this value, it’s the floor price. Think of this like the NAV or book value. However, RUNE can and does trade above this value, which is the premium the market prices in for future growth. The community refers to this as the growth multiple. It’s like a P/NAV or P/Book multiple. The RUNE token can trade at whatever premium the market sees fit to price in the future growth of THORChain. This premium has been over 20x and during the bear market settled around 3x.

The next section “HOW THORCHAIN WORKS” will go into further detail how RUNE derives a minimum value. For now, just accept this rule of thumb:

RUNE market cap is always at least 3x the total value of crypto in inventory.

Therefore, to estimate the potential value of RUNE we need to estimate the potential value of crypto that could be held in inventory.

To keep things simple, let’s ignore Ethereum, stable coins, and all other cryptocurrencies and just consider how much bitcoin could end up on THORChain.

A good indicator of how much bitcoin could find its way to THORChain is WBTC. People put bitcoin into WBTC so they can use it in DeFi on Ethereum. They want to earn yield on their bitcoin and swap it on DEXs. THORChain offers yield on bitcoin and the ability to swap on a DEX, but without wrapping and is decentralized. Therefore, it’s reasonable to expect a similar amount of bitcoin, if not more, could end up on THORChain.

On September 1st, 2022 there were 247,660 bitcoin wrapped in WBTC. On December 1st, 2023 there were 160,293 bitcoin held in WBTC. The large decline is the result of FTX collapsing. The market got spooked about counterparty risk, and since WBTC is a centralized wrapped token, they didn’t want to take any chances and started withdrawing.

If 160,293 bitcoin ends up in THORChain’s inventory, and the bitcoin price is $40,000, that would be $6.41 billion worth of bitcoin in inventory. Times by three and RUNE would have a market cap of $19.24 billion, which works out to $56.93/token. If we give it a 3x growth multiple, that would be $170.79/token.

If 247,660 bitcoin ends up in THORChain’s inventory, and the bitcoin price is $40,000, that would be $9.91 billion worth of bitcoin in inventory. Times by three and RUNE would have a market cap of $29.72 billion, which works out to $87.96/token. If we give it a 3x growth multiple, that would be $263.88/token.

THORChain enables people to earn yield on their crypto therefore another way to estimate the amount of bitcoin that could end up in inventory is by looking at the companies offering yield on crypto. Celsius, BlockFi, Voyager, and several more offer people yield on their crypto by lending it out. The demand for these companies is a good indicator for the demand to earn yield on bitcoin.

In April 2022, Celsius was promoting they had over 150,000 bitcoin deposited on their platform. Add in the other companies and we easily get over 250,000 bitcoin pretty quickly, similar to the amounts held in WBTC.

All the above is just considering bitcoin. Add in Ethereum, stable coins, and all the other crypto and we get a RUNE token price in the $100’s quite easily.

Also remember, Celsius, BlockFi, and Voyager all collapsed in the summer of 2022 and filed for bankruptcy. In the fall we had the collapse of FTX and the exodus from WBTC. All of this highlights the risks and problems with centralized companies, reinforcing the need for a decentralized alternative like THORChain, increasing the probability of attracting the same amount of bitcoin if not more.

To appreciate the valuations above you need a deeper understanding of how THORChain works and how the RUNE token derives its value.

RUNE is one of the only cryptocurrencies in the world that has an objective value.

Yes, a crypto that is backed by something!

How THORChain Works

The way exchanges, brokerage firms, and market makers work in traditional finance (TradFi) is a bit different than crypto.

In TradFi you have exchanges like the NYSE and NASDAQ that list various stocks. You have brokerage firms like Robinhood that act as interfaces to the exchanges and enable people to trade stocks. And you have market makers like Citadel that provide the exchanges with liquidity, an inventory of stocks to buy and sell. Sometimes the brokerage firm and market maker are the same company, like Interactive Brokers.

In crypto, exchanges such as Binance and Coinbase are also brokerage firms. Binance decides what crypto it wants to list on their exchange and they’re also the interface you use to trade on their exchange. Then there are unique market makers like GSR and Cumberland that provide liquidity. These traditional companies operating in crypto are referred to as CeFi (centralized finance).

DeFi is structured a bit differently than CeFi. A DEX like THORChain is the exchange and market maker in one. The various front ends (wallets, websites, apps) that run THORChain in the background can be viewed as brokerage firms.

These front ends are available to everyone on the globe, you just download their software. Which means anyone in the world can access THORChain. Unlike TradFi brokerage firms, where you have to fill out a bunch of paperwork to apply for an account.

Like any exchange, THORChain decides what tokens it wants to list. It has the top cryptocurrencies by market cap available to swap with more being worked on, such as Monero. With THORChain’s DEX aggregation feature, it’s possible to swap bitcoin with several thousand different cryptocurrencies. Binance only supports several hundred.

Where it gets a bit tricky is understanding how market making and swapping works on THORChain. THORChain is an automatic market maker and its inventory of crypto to swap is held in liquidity pools. Understanding how this works is key to appreciating the upside potential in the RUNE price.

Liquidity Pools

Liquidity pools are always two different assets and they’re always balanced 50/50 by dollar value. For example, every liquidity pool on THORChain is paired with RUNE. The bitcoin pool has equal dollar amounts of BTC and RUNE in it. The ethereum pool has equal dollar amounts of ETH and RUNE in it. And so on. Since the dollar amounts of the two assets are always equal in a liquidity pool, at any given time there’s 50% of various crypto and 50% RUNE in total on THORChain.

When someone contributes inventory to a liquidity pool, they become a liquidity provider (LP), and they essentially buy units of that pool. If you deposit $1,000 of BTC into THORChain’s bitcoin pool, you’ll end up with LP units that are backed with $500 worth of BTC and $500 worth of RUNE. You can also deposit a mixture of BTC and RUNE into the pool. Say you deposit $800 of BTC and $200 of RUNE into the pool, you still end up with LP units that are backed with $500 worth of BTC and $500 worth of RUNE. No matter what ratio you deposit in the pool, your LP units will always be backed 50/50 BTC/RUNE.

THORChain’s liquidity pools are what give RUNE an objective value. Since every pool is paired with RUNE, and as long as there’s crypto in the pools, RUNE has an objective minimum value. The RUNE market cap can’t trade below the total value of all the other crypto in the pools.

Swapping

Remember, the difference between trading and swapping. Trading is when you buy and sell using fiat money. For example, if you sell stock ABC for some amount of dollars, then use those dollars to buy stock XYZ, you’re trading. If you could exchange stock ABC directly for stock XYZ without going into and out of dollars, then you would be swapping the two stocks. DEXs don’t use fiat money, therefore all cryptocurrencies are swapped for one another.

How does swapping in liquidity pools work?

Assume the bitcoin pool size is $2,000, with $1,000 of BTC and $1,000 of RUNE in it. If someone has $100 of BTC and they want to buy RUNE, their $100 of BTC is deposited into the pool and the pool sends $100 of RUNE to the buyer. The amount of BTC in the pool goes up to $1,100 and the amount of RUNE in the pool goes down to $900, but the total dollar value of the pool remains the same at $2,000. $100 in value goes in, $100 in value comes out. But the pool is not balanced 50/50 anymore. This is where arbitrageurs come in. Arb bots would sell $100 of RUNE to buy $100 of BTC and balance the pool back to $1,000 BTC and $1,000 RUNE.

What if someone has $100 of ETH and wants to buy BTC with it?

$100 of ETH is deposited into the ETH pool and $100 worth of RUNE is withdrawn from the pool. The $100 of RUNE is deposited into the bitcoin pool, and then $100 of BTC is withdrawn from the pool and delivered to the buyer. Arb bots would take the other side and sell BTC to buy ETH, which balances the pools back to 50/50. In this scenario, the buyer has no idea RUNE is moving from one pool to another. All the buyer sees is the BTC leaving their wallet and the ETH showing up. The RUNE movements happen behind the scenes and the buyer doesn’t have to know anything about RUNE or THORChain to execute the swap.

To keep the math simple in the examples above, I’m ignoring the price movements in the pools and the fees charged on each swap.

The fees generated on all the swaps are how the LP’s make money. These liquidity fees, or yield, are what encourage people to offer their crypto as inventory in the pools. By contributing crypto into the pools and becoming an LP you earn your pro rata share of all the fees going into that pool.

When someone buys/sells crypto on THORChain they drive the price up/down on the pool. The price is determined by a formula that considers the size of the swap relative to the size of the pool. Therefore, the larger the swap, the more you will move the price of the crypto you’re trying to buy/sell.

These price movements are unique to THORChain and result in crypto trading at different prices than other exchanges. This is what arbitrageurs take advantage of. They make a profit by closing the price gap which in turn rebalances the pools.

This preprogrammed pricing formula, along with arbitrageurs and continuous liquidity pools, is what makes THORChain an automatic market maker.

Walmart - Exchange & Market Maker

If this is the first time you’ve read about liquidity pools, I’m sure it sounds confusing. Let’s try and relate it to something more tangible using Walmart as an example.

Walmart, like an exchange, decides what products to list and gives people the ability to buy them. Walmart, like a market maker, has an inventory of products and will sell them to people or buy them back when returned.

Imagine every product in Walmart as a liquidity pool. A toothpaste pool, a socks pool, a toaster pool, etc., and they’re all paired 50/50 with USD. For example, if Walmart has 50 toasters selling for $20 each that would be $1,000 worth of toasters in the pool. If the pool is balanced with USD, then there’s $1,000 of USD in it. So, the size of the toaster pool is $2,000 and it’s balanced 50/50 by dollar value.

When you go to Walmart to buy a toaster, you put $20 USD into the toaster pool and take out a toaster. The number of toasters in the pool goes down by 1 and the amount of USD in the pool goes up by $20. We then have 49 toasters in the pool worth $980 and the USD in the pool is $1020, but the total dollar value of the pool is still $2,000. To rebalance the toaster pool at 50/50, Walmart will remove $20 USD from the pool and buy a new toaster from the manufacturer. Then the pool is back to 50 toasters worth $1,000 and $1,000 worth of USD, rebalancing the pool back to 50/50.

Now go the other way around.

You have a toaster, and you want to return it for your money back. You put your toaster into Walmart’s toaster pool and get $20 USD out of it. The number of toasters in the pool goes up to 51 and is worth $1020, the amount of USD in the pool goes down to $980, but the total dollar value of the pool is still $2,000. Only the ratio has changed. This time, Walmart removes the toaster from the pool and sends it back to the manufacturer for a refund. There are now 50 toasters, the $20 USD comes back into the pool, and it’s rebalanced back to 50/50 by dollar value.

In reality, Walmart doesn’t keep $1 of USD for every $1 of products they have in inventory, it’s more like 1 cent of USD for every $1 of inventory. And Walmart makes a profit differently than THORChain. But the overall operations of the two are similar. If USD goes into Walmart, a product comes out. If a product goes into Walmart, USD comes out. And Walmart constantly rebalances its inventory.

Decentralized Liquidity

A big difference between Walmart and THORChain is who owns the inventory. Walmart owns all the products on its shelves. Whereas THORChain doesn’t own any crypto in its pools.

The crypto in the pools comes from people all over the world. An LP could be a housewife in Nigeria or a hedge fund in New York. Anyone can become an LP and provide their crypto as inventory on THORChain. Just like anyone can offer their vehicle as inventory on Uber or their house as inventory on Airbnb.

The platforms with decentralized inventories become the biggest in their sectors.

Facebook is the world’s largest media company, but it doesn’t create any of its content. YouTube is the largest video platform in the world, but it doesn’t create any videos. Alibaba is the largest retailer in the world, but it doesn’t carry an inventory.

Despite their success, Uber, Airbnb, Facebook, YouTube, and Alibaba are still centralized entities. Their management still prevents some people from using their platforms. Whereas THORChain is decentralized, open, and permissionless. THORChain can’t prevent anyone from providing inventory in the pools therefore it has no limit to how big its inventory can grow.

Actually, there is a limit of sorts. It’s a pre-programmed formula that caps how much crypto can be put in the pools based on the security available to protect the pools. Other than this programmed cap, there’s no individual that can stop you from adding crypto into the pools.

The limit on the size of the liquidity pools, called the hard cap, is based on how much RUNE is bonded with the nodes in the network. To be economically secure, the node bonds have to be worth more than the crypto in the liquidity pools. Since it takes ⅔ of the nodes to access the crypto in the pools, the hard cap is set at the amount bonded by the lowest ⅔ of nodes. As the dollar value of that bonded amount goes up so will the hard cap, making more room in the pools.

Decentralized Security

We have these liquidity pools with millions (eventually billions) of dollars of crypto in them, but how are they secured? What controls and protects all that crypto in the pools?

This is where node operators come into play. It’s the nodes on THORChain that safeguard the network and hold the private keys to all the crypto in the pools.

To swap native layer 1 tokens without wrapping them, all the crypto in the pools must be held on their native blockchains. Therefore, all the BTC in the bitcoin pool is held in a regular bitcoin address. All the ETH in the ethereum pool is held in a regular ethereum address. And so on. The key to each address is split up amongst the nodes, no single node ever has access to an entire key.

The keys are distributed amongst the nodes through a technology called Threshold Signature Scheme (TSS). TSS is like a multi-party computation (MPC) wallet where one key is broken up into shards rather than a multi-sig wallet that uses many different keys. Through TSS, each node only has a portion of the private key to any address.

The keys to each crypto address are broken up into as many pieces as there are nodes. If there are 85 nodes on THORChain, then each key is broken up into 85 pieces and each node is given a piece.

Through TSS, we only need 2/3 of the pieces put back together to create the whole key. So, if we have 85 nodes on the network, we only need 57 of them to put their pieces together to re-create the key and access the crypto in that address.

A node gets its piece of the keys when it churns into the network. Every few days there’s a churn. This is when some nodes are removed, new nodes are added, the pools get moved to a new address, new keys are created, and pieces distributed.

Nodes that want to leave, have been banned by other nodes, have been in the network the longest, have the most infractions, or aren’t running the latest version of the protocol are at the top of the list for being churned out of the network. A node that is churned out can always get back in at the next churn. The only qualifying factor for being churned in is the size of the bond posted by the node. Nodes with the largest bond are at the front of the line to get in.

The churning process is designed to keep the network healthy and ensure good acting nodes stay in the network and bad acting nodes get kicked off. And since anyone can run a node, the nodes are decentralized, which makes the security decentralized.

The bonds posted by the nodes are what secures the network.

Only RUNE can be used for the bond to become a node and the amount bonded is always larger than the value of the crypto in the pools. The bond is held in escrow and is the financial incentive for nodes to act responsibly. If a node underperforms and impedes the network, they’ll get slashed. Like getting speeding or parking tickets. Nodes must operate judiciously otherwise they’ll lose money.

What if all the nodes got together to steal the crypto in the pools? In theory they could. But if they did, the market would see THORChain has failed and everyone would sell RUNE, driving the price to zero. Therefore, the RUNE posted as a bond by the nodes would also go to zero. Since that bond is larger than the value of the crypto in the pools, the nodes would lose more money than they stole.

This is what makes THORChain economically secure. Those that are entrusted with protecting the crypto in the pools have the most to lose should something bad happen to that crypto. Imagine if Sam Bankman-Fried had to post a $20 billion bond to have $10 billion in customer deposits? He would think twice before stealing anything.

Tokens that are wrapped or bridged aren’t economically secure either. The people in control of the wrapped tokens have no money to lose if they get hacked, just their reputation. THORChain’s economic security ensures the people who are trusted to protect the network always have more to lose than what can be stolen or lost. This incentivizes the node operators to do everything in their power to defend the network.

THORChain is designed to have the value of bonded RUNE be the same as the value of crypto in the pools. The target is to have $1 bonded in the network for every $1 in the pools.

Every line above is the same, just written differently each time to help you visualize things.

The numbers above are always in flux so the ratio of crypto to RUNE is also in flux. The numbers above represent the network when it’s in balance. When this balance is struck, the fees generated on the platform are split evenly between the liquidity pools and node operators.

The fee split between the pools and nodes is managed by the incentive pendulum.

If nodes keep joining the network and increasing the amount bonded, it becomes inefficient to have all that capital tied up in bonds. Having all that extra money in the node bonds does not increase the security of the network. The network is already economically secure if nodes risk losing $2 to protect $1 of crypto. The network isn’t any more secure if nodes risk losing $10 to protect $1 of crypto.

When the total value of the bonds gets bigger than the total value of the liquidity pools, the incentive pendulum kicks in, and the fee split gets skewed towards the liquidity pools. The reduction in yield to the nodes is meant to discourage them from adding to the bond, perhaps even withdraw, and the increase in yield to the liquidity pools is meant to encourage money moving there.

If LP’s keep joining the network and increasing the value of the liquidity pools relative to the bonds, the incentive pendulum kicks in, and the fee split gets skewed towards the node operators. The reduction in yield to the liquidity pools is meant to discourage LP’s from adding to the pools, perhaps even withdraw, and the increase in yield to the nodes is meant to encourage more money coming into the bonds to secure the network.

If the network has more value in the liquidity pools relative to the bonds, it becomes insecure. When this happens, it makes economic sense for the nodes to collude and steal the crypto from the pools.

In the example above, node operators would only have to spend $2 to steal $5 of crypto.

To prevent this from happening there’s a hard cap on how big the liquidity pools can get. The cap is equal to the total bond of the bottom 2/3 of nodes. The network automatically prevents anyone from adding to the pools to avoid going over this limit.

If the pools reach the hard cap, the incentive pendulum will stop sending fees to the pools and all the fees will go towards the node operators, encouraging more money to be bonded in the network and encouraging LP’s to withdraw from the pools.

Rune Deterministic Price

As long as there’s bitcoin, ethereum, stable coins, etc. in the liquidity pools, RUNE will have a value. When the network is in balance, the value of RUNE is 3x the value of the crypto in the pools.

This means the market cap of RUNE cannot go below 3x the value of the crypto in the pools putting a floor in the RUNE price. The community refers to this floor price as the deterministic price. No other cryptocurrency derives value like this.

THORChain’s liquidity pools are a cross section of all the top cryptocurrencies, representing about 95% of the market cap of the whole sector. Therefore, THORChain’s liquidity pools represent the whole crypto market. Since RUNE is the other half in all these pools, the value of RUNE is directly proportional to the value of the whole crypto market. This makes RUNE akin to an ETF on the whole crypto market!

Assume the amount of crypto in the pools remains constant. If the crypto market goes up in value, RUNE’s deterministic price will go up. If the crypto market goes down in value, RUNE’s deterministic price will go down.

Now assume the value of the crypto market remains constant. As new crypto is added to the pools, RUNE’s deterministic price will go up. If crypto is withdrawn from the pools, RUNE’s deterministic price will go down.

RUNE’s deterministic price is like the book value or net asset value of a stock. All stocks trade at some P/B or P/NAV which represents the premium the market is pricing in for future growth. The valuation multiple used with RUNE is called the growth multiple. The growth multiple is the RUNE price you see quoted online divided by the deterministic price. Since the deterministic price is the absolute floor price for RUNE, it’s impossible for the growth multiple to go below 1. The closer the growth multiple is to 1, the better the entry price you’re getting.

In summary, there are three variables that influence the RUNE price:

How much crypto is in the liquidity pools

The total value of the crypto market

The growth multiple

It’s fair to assume all three variables would go up during a bull market, and during a bear market all three variables would go down. You can see this happening in the chart below.

RUNE’s price chart looks pretty ugly. Pun intended! The chart appears to have bottomed out. It’s interesting to note the deterministic price has been more stable than the actual RUNE price. Every peak and valley in the chart can be explained with a news/market event, however, the persistent decline in the RUNE price is mostly from the persistent decline in the growth multiple.

The growth multiple is how the market prices in the future expected size of THORChain. It represents how big the market believes THORChain will get.

As of December 1st, 2023 the RUNE price is $6.46, the deterministic price is $1.74, and therefore the growth multiple is 3.7x.

The market is pricing in THORChain to grow 3.7x from its current size.

The current size is $184.5 million of crypto in the pools. So, the market is pricing in a total of $682.7 million crypto ending up in the liquidity pools. I’m expecting billions to end up in the liquidity pools, therefore I believe the market is mispricing RUNE.

How will billions of dollars’ worth of crypto find its way into THORChain?

There’s a theory called the Liquidity Black Hole that explains it.

Liquidity Black Hole

Every participant that interacts with THORChain has a financial incentive to do so.

The permissionless open-source nature of THORChain makes it possible for any wallet, website, or app to integrate it in their backend. It doesn’t cost them anything to do it, just their developers’ time to add the code. These front ends want to incorporate THORChain because they can customize their own fees on each swap and monetize their audience.

When a wallet integrates THORChain, it introduces new users and new volume to the liquidity pools. The wallet collects their fees on the swaps and gains new users because they’re offering a new feature that users want and other wallets don’t have. Competing wallets see this and want in on the action too, otherwise they’ll be left behind. They integrate THORChain and the cycle continues.

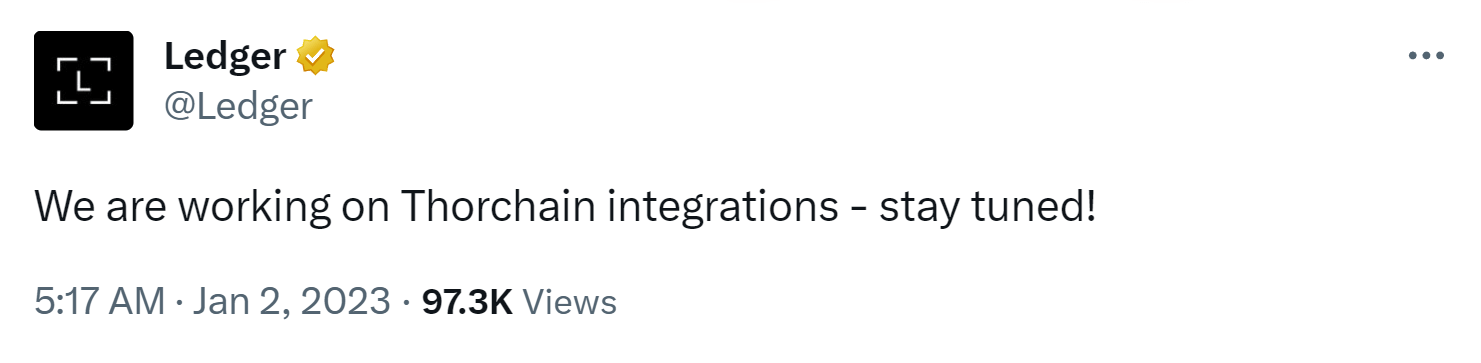

It will get to a point where not having THORChain integrated will hurt a wallet because they’ll lose users to their competition. Therefore, this virtuous cycle will continue until every crypto wallet in the world integrates THORChain. Several already have, most notably Trust Wallet. Ledger is working on it along with many others.

Other wallets will piggyback on Trust Wallet and Ledger’s due diligence. If THORChain passes their internal tests, then it must be good enough for the average wallet to integrate.

This is how THORChain becomes core infrastructure in crypto. Like infrastructure in the physical world, THORChain is buried and out of sight. Just as you take running water for granted, people will start taking for granted the ability to swap bitcoin within their wallets. They will come to expect it just like expecting a glass of water at a restaurant.

Wallets integrating THORChain, and increasing swap volume, creates two more virtuous cycles.

The first cycle starts with an increase in swap fees, that increases the yield to the liquidity pools. People see the yield going up on the pools and they add more crypto to the pools. As the pools get bigger, the cost to swap in them goes down. The cheaper it is to swap, the more volume it will attract from traders. The swap volume goes up and the cycle continues.

This cycle will continue until the liquidity pools reach a steady yield dictated by the market.

The second virtuous cycle also starts with an increase in swap fees. These increase the yield to node operators. The increase in yield encourages new nodes to join which increases the RUNE bonded in the network. The increased bond size means network security goes up enabling the liquidity pools to get bigger. As the pools get bigger, the cost to swap in them goes down. The cheaper it is to swap, the more volume it will attract from traders. The swap volume goes up and the cycle continues.

This cycle will continue until the yield on the nodes reaches a steady state dictated by the market.

When we add all three virtuous cycles together, we get the Liquidity Black Hole.

Each cycle amplifies the other, like a black hole getting stronger as it gets bigger.

There’s nothing to stop the Liquidity Black Hole since THORChain is decentralized and permissionless. Crypto from all over the world will be sucked into the liquidity pools and they’ll keep growing until they reach a natural saturation point.

Additional Features

This whole chapter only reviewed the basic function of THORChain, the automated market maker. THORChain has other features, and several more are being developed.

A drawback of swapping layer 1 to layer 1 tokens is the gas fees you must pay on each blockchain. For the average user they’re palatable. However, they can add up for active traders and become prohibitive to a particular trading strategy. Especially for arb bots. THORChain has made swapping extremely cheap through synthetics (synths).

Synths are kind of like a layer 2 on THORChain. Users can deposit a layer 1 token into a liquidity pool, and instead of receiving LP units, they can receive a synthetic representation of that token that’s always pegged 1:1 by price. I know, this is like a wrapped token... Synths can only be swapped on THORChain and only subject to THORChain’s gas fees and block times. This means active traders and arb bots can swap much cheaper and quicker than regular layer 1 tokens. When synths were activated, the swap volume on the liquidity pools went up by an order of magnitude and increased the yield going to the pools.

Synths also make it possible for single sided savers.

Savers is a way for users to earn yield on their crypto without going directly into a liquidity pool. When someone becomes an LP in the bitcoin pool, they have price exposure to two tokens, BTC & RUNE. But not everyone wants that. With single sided savers, a user can deposit bitcoin, maintain 100% price exposure to bitcoin, and receive yield in bitcoin. The swap fees on the liquidity pools are split between LP’s and single sided savers. The LP’s keep a larger portion of the fees for enabling this service.

There’s billions of dollars of demand for people to earn yield on their crypto demonstrated by the early success of BlockFi, Celsius, and Voyager. Unfortunately, they all blew up last year, highlighting the problems with centralization. THORChain’s single sided savers is the decentralized solution.

The failed entities above also lent billions of dollars to their clients using crypto as collateral. A lot of people want to borrow against their bitcoin instead of selling it. Instead of selling bitcoin, paying capital gains taxes, and having no more upside exposure to the price, people would rather keep their bitcoin for continued price exposure, delay paying taxes, and borrow against it to free up some capital. To meet this demand, THORChain developers created a lending feature.

The lending design has gone through several changes over the last couple of years. In its current form, users deposit their collateral to THORChain and can borrow against it at some programmatic collateralization ratio. The loans have no interest, no liquidation levels, and no maturity date. They’re a game changer in the world of crypto.

How’s that possible? It’s because THORChain does not directly hold on to the collateral, it uses the collateral to its own advantage.

Consider a typical loan in TradFi. A bank will lend you money against collateral. If the value of your collateral drops toward the loan value, the bank will sell it to make themselves whole before the collateral drops below the loan value. Basically, a margin call. Now imagine instead, the bank taking your collateral, selling it, and using the proceeds to do share buybacks on its stock? The bank would get an immediate benefit from their share price going up. However, when you repay your loan to get your collateral back, the bank would have to issue new shares, sell them, and use the proceeds to buy your collateral back. This would hurt the bank’s share price.

This is how lending works on THORChain.

When a loan is opened, THORChain will sell the collateral to buy RUNE, then burn those RUNE tokens. This is deflationary on the RUNE supply and creates upward pressure on the RUNE price. The more loans taken out on THORChain, the more it will drive up the RUNE price.

The user’s collateral is effectively held in equity of RUNE.

When a user wants their collateral back, they have to pay back their loan.

When the loan is closed, THORChain mints new RUNE tokens to buy the collateral and deliver it back to the user. This is inflationary on the RUNE supply and will have downward pressure on the RUNE price.

The net effect on the RUNE supply, whether inflationary or deflationary, depends on the price movements of both RUNE and the collateral from the opening of the loan to the closing of it.

If the RUNE:COLLATERAL price ratio goes up from the loan origination to the loan closure, the net effect on the RUNE supply will be deflationary. If the RUNE:COLLATERAL price ratio goes down from the loan origination to the loan closure, the net effect on the RUNE supply will be inflationary.

Therefore, the main risk with the lending feature is the price ratio of RUNE:COLLATERAL. If it goes against us, and THORChain experiences a bank run of sorts where everyone is redeeming their loans at once to get their collateral back, it could cause a death spiral on the RUNE price.

This might be giving you flashbacks of the Terra LUNA/UST collapse. The design of THORChain’s mint/burn mechanism is completely different than LUNA/UST. For example, there’s a cap on the RUNE token supply at 500 million (there’s 327 million RUNE outstanding right now). Should the cap ever get hit, the protocol will pause the ability to access collateral until the RUNE supply goes back down.

If you have reservations about a mint/burn mechanism being introduced to THORChain, know this. It’s impossible for the mechanism to cause the RUNE price to collapse straight out of the gate. The loans have to be opened first before they can be closed. Opening the loans is what causes the run up in RUNE price from which it could fall. The fall in RUNE price would then be proportional to the initial rise in price.

In reality, the best-case scenario for THORChain is the borrowers never pay back their loan. Paying off the loan means RUNE has to be minted which inflates the supply. THORChain doesn’t want that to happen, therefore it doesn’t want the loan to be paid back. This is how, and why, THORChain can offer no interest, no liquidation, no maturity date on the loans. Having interest, liquidation levels, and a maturity date would only encourage users to pay back their loan.

This lending design is revolutionary even by DeFi standards.

Lending alone could drive a lot of users to THORChain and drive up the RUNE price. But that’s not all.

One of the advantages CEXs still have over DEXs is the ability to place limit orders. Right now, all the swaps on THORChain are market orders. Having the ability to enter limit orders would open the door to more users and volume. Therefore, developers are working on order books so that users can place limit orders.

Streaming swaps are also being discussed. These could make swapping on THORChain extremely cheap, compared to any CEX or DEX. Since swap fees are based on the size of the swap, smaller swaps have less fees. What if you broke your swap into hundreds or even thousands of tiny swaps that execute every few seconds? No human is going to do this, but it can be done by a program quite easily. Lowering the cost to swap, especially if it’s cheaper than CEXs, will drive more volume to THORChain.

When I reference trading volume on CEXs like Binance I’m just talking about their spot volume. It doesn’t include derivatives/futures trading. Futures trading in crypto, and all markets for that matter, dwarf spot trading. If THORChain had futures trading it could easily double or triple its total swap volume. Developers have been tinkering with how to introduce a perpetual futures contract on THORChain. They’re not sure if it’s technically possible yet but it’s something they have cooking in the oven.

Now that you understand how THORChain works, how the RUNE token derives value, the implications of the Liquidity Black Hole, and all the features being developed, go back and review the valuation analysis.

The numbers should hit home better now. And perhaps you can envision those valuations as just the beginning.

For a more thorough understanding of how THORChain works please review the developer documents on this link:

Risks

This is crypto. You could lose all the money you invest in RUNE.

What’s the probability of RUNE going to zero? It’s a thumb suck to try and guess something like that, but I believe there’s a single digit percent chance.

If THORChain does fail for some reason in the future, I believe it will happen after a run up in the RUNE price, giving you time to recover your initial investment.

You can’t avoid risk when investing, especially if you want to significantly increase your net worth. What you can do is mitigate the risk through position sizing.

With investments like RUNE, you don’t put all your money into it. You only invest 5-10% of your portfolio. That way if the worst-case scenario happens, and your investment in RUNE goes to zero, it only affects 5-10% of your portfolio. The other 90-95% of your portfolio will be fine and you should be able to recover from it.

Whereas if RUNE truly does take off and go up 100x, the 5-10% you invested will 5x-10x your portfolio.

This is how speculating works. You look for asymmetric bets and risk a little to make a lot.

The following is a list of risks in no particular order and how THORChain mitigates each risk.

Hackers

Every cryptocurrency is susceptible to being hacked. Especially as they go up in value and the prize for a would-be thief gets bigger. However, if a hack occurs it doesn’t necessarily mark the end of said crypto. It depends on the circumstances and severity of the hack.

For example, Bitcoin was hacked in its early days.

On August 15, 2010, someone in the Bitcoin community noticed 184.5 billion bitcoin were created and split evenly between two different addresses. The solution was simple but would come at a slight cost. In order to update the code to prevent it from happening again, and to erase all those extra bitcoin, a soft fork was required. Bitcoin was effectively restarted from a point in time just slightly before the hack took place. This means some transactions that occurred between the time stamp on the fork and the hack would be erased/reverted to an earlier state. A small price to pay at the time, but nonetheless, a price to pay.

Another notable hack was The DAO on the Ethereum network.

The DAO made headlines in the spring of 2016 raising 11.5 million ETH (worth $150 million) from over 11 thousand people. It was one of the earliest and biggest projects built on Ethereum at the time. As quickly as they raised the money, about one third of it was stolen. 3.6 million ETH were transferred to an account subject to the 28-day holding period under the terms of The DAO Ethereum smart contract.

The hacker didn’t have direct access to the ETH yet, and this gave the community time to discuss how to respond. The debate was intense. In the end, a hard fork of Ethereum went through so the funds in The DAO could move to a recovery address where they could be exchanged back to ETH by their original owners. The hard fork meant a new Ethereum chain was created and that is the one you know and think of today. The original Ethereum chain, where the hack occurred, still exists as Ethereum Classic. Despite its sordid history, Ethereum Classic has consistently ranked in the top 25 cryptocurrencies by market cap.

THORChain Hacks

THORChain has been hacked a few times. But unlike the hacks on Bitcoin, The DAO, and others, these hacks were expected.

Expected?!

Yes. Well sort of.

Imagine you have $1 billion, and you want a vault to store it in. Before you put your billion dollars in the vault you want to be confident the vault is secure. The people who built and installed the vault can give you all the assurances in the world that it’s safe and secure, but you want a way to double check. Rather than risk $1 billion in the vault right away, you put $10 million in it. You tell the world, especially thieves, that if they can steal the $10 million, they can have it. If the money is stolen, it’s a small price to pay to figure out how they did it, so you can fix it. Rather than hire a consultant for $10 million to audit the vault, you get the actual people who would try to steal from you auditing the vault. And if they can’t break into the vault, you keep your $10 million.

THORChain developers implemented a similar strategy with launching the protocol. To appreciate how, it helps to go through the history of THORChain leading up to the hacks.

In September 2020, Single Chain Chaosnet (SCCN), colloquially called Chaosnet, was launched. This alpha version of THORChain was only able to trade Binance Chain (BEP2) tokens and was meant to test the technical, economic, and security design of the protocol. To encourage participation in Chaosnet, the project treasury promised to replace any assets that were hacked, stolen, and/or lost. Leading up to the launch there were numerous disclosures to outline the risks of Chaosnet. Such as this from Aug 21, 2020:

Chaosnet is a decentralized network, you are interacting with a network which is not within the control of the THORChain team. Chaosnet is an experiment in liquidity and security, it’s high risk and not for use by new users. Chaosnet has real assets at risk which act as an incentive to encourage attacks on the network by profit seeking actors. All assets staked, bonded or being swapped are at risk of permanent loss. By participating in Chaosnet you understand that you’re taking full responsibility for any potential loss of assets; neither node operators nor THORChain team will be held accountable. Chaosnet is designed to expose the network to scrutiny & attack in order to prove the security & economic incentives are correct; and to demonstrate the network is resilient, performant and overall fit-for-purpose.

The rationale for Chaosnet is based on game theory & behavioral economics (i.e.) without genuine incentives for all agents it’s not possible to test the hypothesis or design assumptions underpinning the network. Chaosnet is a vital step before THORChain’s Mainnet. Persistent security bounty means real assets incentivize agents to attack the network for a potential reward.

Assets bonded & staked on the network therefore could be drained, stolen, or irrevocably lost through malicious actors, disruptive node behavior or technical malfunction. Chaosnet is a decentralized, permissionless network based on game theory and using complex & immature technology. There are likely many attack vectors which have not been identified during audits and testing.

THORChain Chaosnet Risk Summary

SCCN operated until April 2021 attracting ~$200M in total value locked. Many bugs were worked out and updates made over those months but there were no hacks or major issues. Therefore, THORChain was deemed ready for its next phase of testing, the beta version called Multi Chain Chaosnet (MCCN).

MCCN is where actual layer 1 bitcoin, ethereum, and other assets would be pooled and swapped on their native blockchains. No longer just the wrapped BEP2 tokens on SCCN. SCCN continued to operate in parallel to MCCN.

The exact same risk factors to SCCN applied to MCCN.

The assets being deposited into MCCN were purposely gated by a ‘liquidity cap.’ This cap started out small and was gradually lifted as confidence grew and proved the economic & security model and demonstrated the resilience & performance of the network.

Here’s a timeline of events on MCCN.

- April 13, 2021 MCCN launched with 500k RUNE liquidity cap.

- April 26, 2021 Liquidity cap raised to 750k RUNE.

- May 5, 2021 Liquidity cap raised to 1.5M RUNE.

- May 19, 2021 Liquidity cap raised to 2.25M RUNE.

- May 25, 2021 Liquidity cap raised to 3.0M RUNE.

- June 8, 2021 Liquidity cap raised to 4.5M RUNE.

- June 24, 2021 Liquidity cap raised to 5.5M RUNE.

- June 28, 2021 Liquidity cap raised to 7.0M RUNE. Black hat hacker stole ~$140k. Network was halted for 6 hours to fix and update the protocol.

- July 2, 2021 Liquidity cap raised to 10.0M RUNE.

- July 9, 2021 White hat hacker discovered a bug in the Ethereum router affecting ERC777 tokens. Network was halted for 5 days to fix and update the protocol.

- July 14, 2021 Network resumed trading.

- July 15, 2021 Black hat hacker sole ~$8M of ETH via the Ethereum router. Network was halted for 6 days to fix and update protocol.

- July 21, 2021 Network resumed trading.

- July 22, 2021 Grey hat hacker stole ~$8M worth of ERC20 tokens via the Ethereum router. Network was halted indefinitely to regroup and re-evaluate.

All the vulnerabilities were on the Ethereum router. Bitcoin and all other chains operated without incident and still do to this day. Chaosnet served its purpose by identifying the security issues and where the code and design needed to be improved.

Remember, the timeline above occurred during the peak of the bull market in 2021. The developers could have opened THORChain up wide and allowed hundreds of millions to flow in, but they didn’t. Despite the steadily increasing liquidity cap, it was kept small enough for the treasury to cover any losses. Also, when hacks like this have happened to other protocols in the past, many of their developers would tuck their tail between their legs and walk away. THORChain developers did the opposite. They doubled down on their efforts and brought in more people to help.

Over the next couple months, all users were made whole from the treasury, as was promised.

Here are the four problems that led to the exploits and how they were fixed.

Problem 1: The Ethereum Code was Unaudited

THORChain code was audited as part of SCCN, but the updated MCCN code was not. An audit was scheduled with Trail of Bits, but unfortunately had not begun at the time of the first attack. Both Trail of Bits and Halborn Security performed two simultaneous audits while the network was halted.

Problem 2: There was no Official Bounty Program

As part of SCCN a bounty program had been released, but it was not refreshed as part of MCCN. This was overlooked. Thus, there were no publicly clear incentives and campaigns for white hat hackers to be onboarded and find vulnerabilities. To rectify this, a $1 million bounty program was established with Immunify, the leading bug bounty platform for crypto projects.

Problem 3: There was no Ongoing “Red Team”

All exchanges have active security teams, whether it’s a stock or crypto exchange. THORChain needed a 24/7 continuously running red team to review the code line-by-line on each new update, as well as actively monitor the network. A red team called THORSec was created to fill this role. The team is composed of world-class white hat hackers - security experts who have uncovered major exploits of other networks in the past. THORSec is funded by the treasury, but distinct from core developers and external auditors. The responsibilities of THORSec include:

- Review and approval of pull requests to THORChain’s open-source codebase.

- Provide 24/7 monitoring of the protocol.

- Respond to issues, events, and incidents.

- Create run books and procedures for network updates, chain additions, and hard forks.

- Monitoring for connected chain vulnerabilities, upgrades, and hard forks that could impact THORChain.

Problem 4: THORChain had no Active Security Monitoring

THORChain’s autonomous nature made it vulnerable. THORChain happily executed the attack transactions and there was nothing anyone could do about it, except for all the nodes shutting down their machines. Six different solutions were implemented and are discussed below.

Automatic Solvency Checker