BITCOIN

Bitcoin is Now Mainstream

January 25, 2024

On January 10, 2024, the SEC approved all eleven bitcoin ETFs.

It’s been a long winding road to get here. The first bitcoin ETF application was submitted over 10 years ago, in July 2013, by the Winklevoss Twins. Since then, it’s been a herculean effort to get these ETFs approved.

Even right up to the day before the approvals there was drama.

On January 9th, the official SEC Twitter account was hacked. Apparently, someone was able to SIM swap the phone number the account was connected to and posted this official looking tweet.

The bitcoin price spiked up immediately and then came down just as quickly once Gary Gensler and the SEC confirmed the account was compromised. Someone made a quick buck on the volatility.

But it begs the question, if the SEC can’t even secure their own social media account, how can they help protect investors? The answer is they can’t. They're just as competent as the DMV.

The activity on January 9th was enough to suck out the energy in the market, that in theory, should have happened on January 10th. But instead, the bitcoin price action on the actual day of approval was ordinary at best and since then has been steadily going down.

GBTC Drives Down Bitcoin Price

You can see in the GBTC Discount/Premium to NAV Chart how the discount has slowly disappeared over the last year as we got closer to the ETFs being approved.

Now that GBTC is a proper ETF, the shares will trade at par going forward.

After a couple weeks of trading, we’re seeing net outflows on GBTC which is being blamed for the drop in bitcoin price. As I type, $3.4 billion of GBTC has been net sold.

$1 billion of that was the FTX bankruptcy estate selling their GBTC shares. Presumably, they were waiting for the ETF to be approved so they could sell at par.

Then there are probably still investors looking to unwind their arbitrage trade from the days when GBTC was trading at a premium. Remember, it was the GBTC arbitrage trade that contributed to the crypto sector blowing up in the summer of 2022. Three Arrows Capital (3AC) and BlockFi were two of the more notable names that went down because of the premium on GBTC turning into a discount.

The trade went like this. Buy GBTC through a private placement, so you could buy the shares at par value to bitcoin. When the shares come free trading after the 6 months to 1 year restriction period, sell them in the secondary market at a premium. GBTC shares were consistently selling at a 40% premium in the secondary market, so it was a big arbitrage. To hedge risk, you short the bitcoin price at the same time you buy the GBTC shares through the private placement.

This trade works wonders so long as GBTC trades at a premium to NAV. However, the trade blows up when the GBTC shares trade at a discount to NAV. Which occurred for the majority of 2021 and 2022 that ultimately forced 3AC and BlockFi into bankruptcy.

There might be some other investors that have held on to this trade for the last few years and are now able to exit it with minimal losses.

Also, simply buying GBTC at a 50% discount a year ago proved to be a great speculation. Some investors, even those who don’t particularly care about bitcoin, must have seen the opportunity to buy bitcoin at half off and wait to sell when the ETFs are approved (after the discount goes to zero and there’s lots of volume to close the trade).

The above explains why investors are dumping their GBTC shares, but it doesn’t necessarily mean this is the reason for the drop in the bitcoin price. Overall, I think blaming the GBTC outflows is just a headline to explain normal price action. The bitcoin price had been rallying quite well over the last year and especially the last few months. It was time for a breather. Looking back at it, I believe the bitcoin ETF was a simple buy the rumor and sell the news event.

I would not be surprised to see bitcoin drop to the $30-32k area. It would be nice to see it happen before the next leg higher. Pullbacks and consolidations are good for the long-term trend. It’s like taking breaks while working. Rather than working several hours straight, if you take a few breaks, you can work much longer and more focused.

Bitcoin ETFs Have Been a Success

Despite the bitcoin price going down since the approval of all the ETFs, the ETFs are off to an amazing start.

The bitcoin ETFs are now the second largest commodity ETFs in the world.

The first being gold with a total of $93 billion in AUM, then bitcoin with a total of $28 billion in AUM, and in third is silver with a total of $11 billion in AUM. I believe within the next few years the bitcoin ETFs will have more AUM than the gold ETFs.

This tweet below does a great job of comparing the volume traded on the bitcoin ETFs relative to the rest of the market.

Said differently, the eleven bitcoin ETFs had over 22x more volume than all ETFs approved in 2023 - combined!

List of Bitcoin ETFs

There are now eleven spot bitcoin ETFs trading on the New York Stock Exchange. Several of them have already put out commercials to advertise and I encourage you to watch them. Maybe we’ll see them during this year's Super Bowl.

Grayscale Bitcoin Trust

TickerSymbol: GBTC

Website

Commercial

Blackrock iShares Bitcoin Trust

Ticker Symbol: IBIT

Website

Commercial is on the website link

ARK 21Shares Bitcoin ETF

Ticker Symbol: ARKB

Website

Commercial

WisdomTree Bitcoin Fund

Ticker Symbol: BTCW

Website

Commercial

Invesco Galaxy Bitcoin ETF

Ticker Symbol: BTCO

Website

No Commercial

Bitwise Bitcoin ETF

Ticker Symbol: BITB

Website

Commercial featuring The Most Interesting Man in the World

VanEck Bitcoin Trust

Ticker Symbol: HODL

Website

Commercial

Bonus: The story behind the term HODL

Franklin Bitcoin ETF

Ticker Symbol: EZBC

Website

No commercial, but if you go to their Twitter account you will notice Ben Franklin has the red laser eyes

Fidelity Wise Origin Bitcoin Trust

Ticker Symbol: FBTC

Website

No Commercial

Valkyrie Bitcoin Fund

Ticker Symbol: BRRR

No website or commercial

Bonus: The ticker symbol comes from the Money Printer go Brrr meme

Hashdex Bitcoin ETF

Ticker Symbol: DEFI

Website

Commercial *my personal favorite

Did you watch the commercials? Please do. Then go look for commercials on the gold and silver ETFs. Or any other ETFs for that matter. Do you see where I’m going with this? No other ETFs have been marketed like this before in history. And I expect the marketing to continue, with Larry Fink leading the charge every time he gets interviewed by the financial news media.

My enthusiasm for the Bitcoin ETFs does not mean I think you should buy them. I think the ETFs are great for convincing people bitcoin is a legitimate investment and they’ll help drive up the price.

If you want exposure to bitcoin, you should buy physical bitcoin, and take self custody of it. The ETFs are just paper bitcoin. You will never be able to take delivery of the underlying bitcoin. The whole point and value proposition of bitcoin is being able to take self custody of your wealth, and prevent anyone else from taking it from you.

If I had to choose one of the ETFs to buy, it would be Fidelity’s (FBTC). Fidelity has been pro-crypto for several years now. They’re the first major TradFi company to embrace crypto. They’re leaders in the space, not followers. So I like to think they can be trusted.

Also, Fidelity is doing their own version of self custody, by self custodying their bitcoin ETF. Whereas all the other ETFs are using Coinbase as their custodian. Coinbase custodying all that bitcoin will make it a target. And perhaps they could do some funny business with commingling bitcoin between the funds? I’m not sure how and I don’t want to imply anything. I’m just thinking out loud.

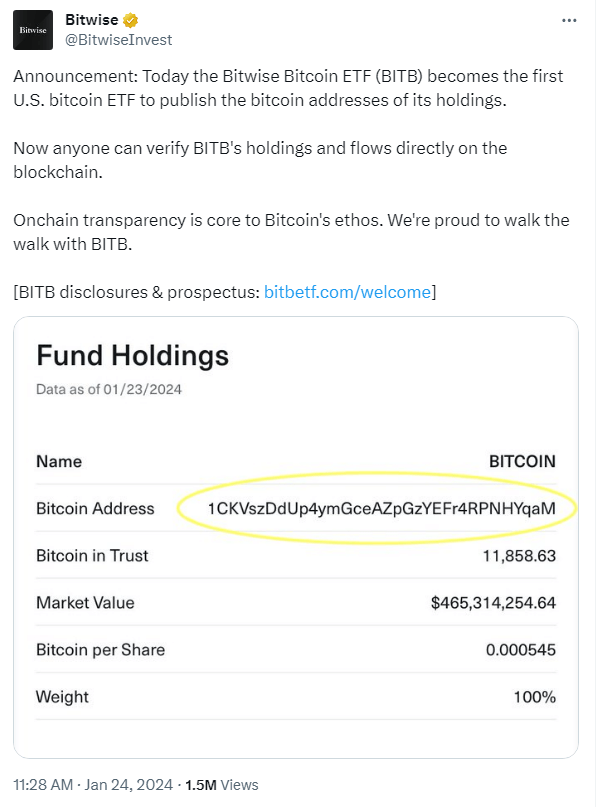

Ideally, every bitcoin ETF will make their bitcoin address public and prove without a shadow of doubt that they have the bitcoin backing their shares.

Bitwise just publicized their ETF bitcoin address.

I sincerely hope this forces the other ETFs to follow suit. If they don’t disclose the addresses, I’m sure internet sleuths will figure out the bitcoin addresses that belong to each ETF.

Youxia Crypto RUNE Fund

The sell-off in bitcoin is not in isolation. The whole sector has pulled back. THORChain (RUNE) has come down over the last several weeks making this a great time to buy. I have some clients topping up their positions and onboarding some new ones. You should join them!

During the last bull market, RUNE got up to $21. That was when THORChain just launched. It had no users, no volume, and a lot of bugs yet to be worked out. Fast forward to today, and the fundamentals have completely changed. There are over 70 million potential users, $5 billion/month volume, dozens of updates and even more bugs fixed. And this is just a snapshot in time, these numbers will continue to go up. Yet the RUNE price is only $4. The price has gone down considerably while the fundamentals have gone up considerably.

As the first decentralized exchange to swap bitcoin, THORChain will garner more attention in this bull market. Therefore, I expect RUNE to reach and surpass its previous high.

When you invest in the Fund, you get direct exposure to the RUNE token for capital gains potential. The Fund uses the tokens to run nodes on the network and collect yield.

Running nodes is where it gets fun. The nodes secure the exchange and, in return, they collect revenue from the swapping fees. The exchange will grow proportionally with the revenue from the fees. Therefore, the yield should prove to be as good as the capital gain.

$1 invested today could yield $1/year and eventually $1/month. All while sitting on a large capital gain.

The plan is to compound the yield for the first few years and wait for the token price to go up, then start paying the yield out to you as income. Ideally, the fund will last for decades. There’s no reason to wind it up if we can collect passive income for years to come.

You can invest with fiat, crypto, or a mix of fiat and crypto.

To learn more about THORChain review these links:

Read - THORChain (RUNE) Investors Guide

Video - THORChain (RUNE) Introduction - Explained for Beginners

Let me know if you're interested in investing and would like to know how.

Thank you for reading.

I’m the founder of Youxia Crypto, an asset management company specializing in crypto. I can help you buy and sell precious metals too. I believe crypto is more than just about trying to make money, it’s about creating freedom for oneself and the rest of the world. I’m a contrarian, voluntaryist, and proponent of Austrian Economics. I enjoy downhill skiing, scuba diving, live music, yoga, and traveling.

The intended use of this material is for informational purposes only and is not intended to be an offer or solicitation for the sale of any financial product or service or a recommendation or determination that any investment strategy is suitable for a specific investor. Investors should seek financial advice regarding the suitability of any investment strategy based on the objectives of the investor, financial situation, investment horizon, and their particular needs. This information is not intended to provide financial, tax, legal, accounting or other professional advice since such advice always requires consideration of individual circumstances. The investments discussed herein are not insured by the FDIC or any other governmental agency, are subject to risks, including a total loss of the principal amount invested. Past performance is no guarantee of future returns.