GENERAL,THORCHAIN (RUNE)

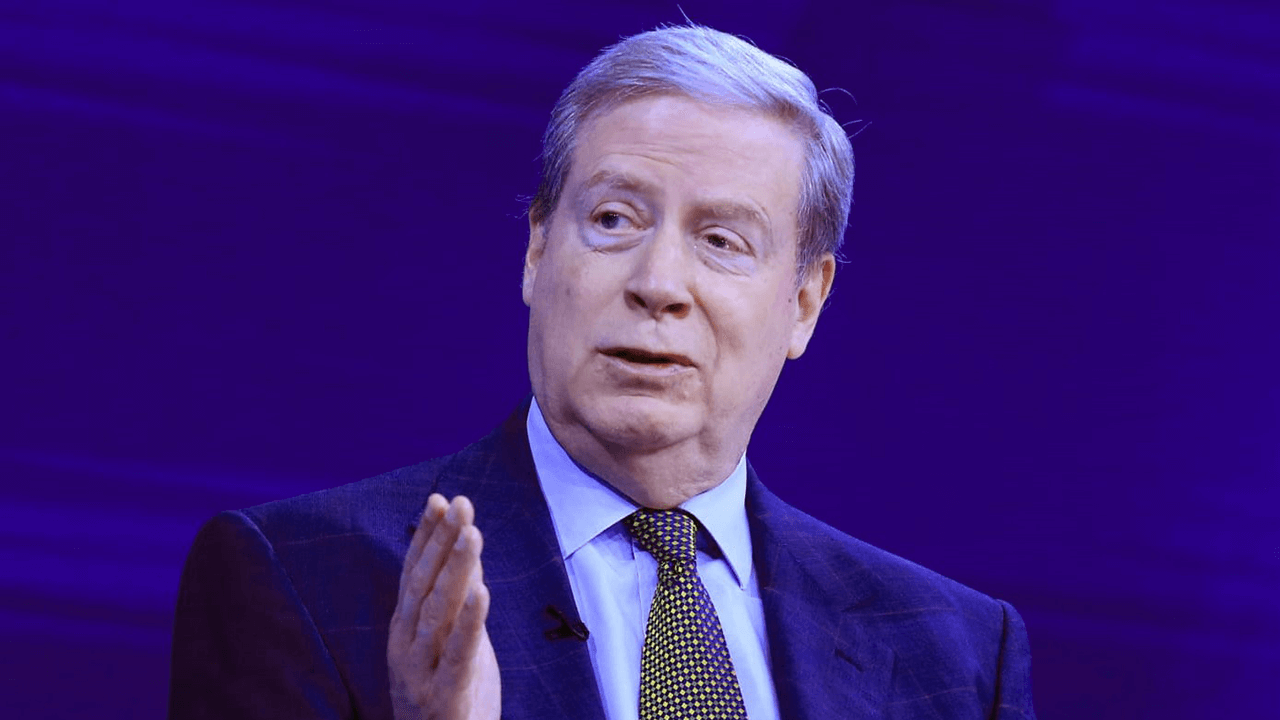

Invest Like Stanley Druckenmiller

May 22, 2024

Many people think Warren Buffet is the best, however, he pales in comparison to Stanley. Warren is just more popular.

Over a thirty-year period, Warren Buffett turned $1,000 into $177,000, with 24 up years and 6 down years. That’s a compounded return of 19%/year.

Over the same thirty-year period, Stanley Druckenmiller turned $1,000 into $2,600,000! With no down years. Up every year, including 2008. That’s a compounded return of 30%/year. But there’s a catch. Those returns were for his fund with charities as investors, so there were no taxes. If you take into account taxes, $1,000 would have turned into $300,000. That’s still better than Buffet with a compounded return of 21%/year.

I’m against taxes for moral reasons, however, the math above highlights the practical reason to be against them. But I digress.

George Soros

Yes, I know he’s evil. Let's put ad hominem attacks aside for now. The reason Soros can do what he does is because of the wealth he’s created from his investing acumen. You should learn from him and use your wealth to create the world you want.

Soros went through eight different portfolio managers until he hired Druckenmiller in 1988. Druckenmiller lasted twelve years with Soros and was behind the legendary Breaking the Bank of England trade. Soros takes all the credit in the media, however, it was Druckenmiller's idea.

It’s fascinating to hear Druckenmiller talk about the trade, but more importantly, all his experience that led up to it.

Lost Tree Club Speech

In January 2015, Stanley Druckenmiller gave a speech recounting his career and the lessons he’s learned along the way. The speech has been transcribed into a pdf here and raw text here. Following are the highlights with some grammatical revisions on my part to make it easier to read.

The first thing I heard when I got in the business was bulls make money, bears make money, and pigs get slaughtered. I'm here to tell you I was a pig. I strongly believe the only way to make long-term returns in our business that are superior is by being a pig. I think diversification and all the stuff they're teaching at business school today is probably the most misguided concept everywhere.

If you look at all the great investors that are as different as Warren Buffett, Carl Icahn, Ken Langone, they tend to have very, very concentrated bets. They see something, they bet it, and they bet the ranch on it. And that's kind of the way my philosophy evolved. Maybe one or two times a year do you see something that really, really excites you. If you look at what excites you and then you look down the road, your record on those particular transactions is far superior to everything else, but the mistake, I'd say, 98 percent of money managers and individuals make is they feel like they have to be playing in a bunch of stuff. If you really see it, put all your eggs in one basket and then watch the basket very carefully.

My first mentor taught me two things. First, never, ever invest in the present. It doesn't matter what a company’s earning, what they have earned. He taught me that you have to visualize the situation 18 months from now, and whatever that is, that's where the price will be, not where it is today. Too many people tend to look at the present, ‘oh this is a great company, they've done this’, or ‘this central bank is doing all the right things’. But you have to look to the future. If you invest in the present, you're going to get run over.

The other thing he taught me is earnings don't move the overall market; it's the Federal Reserve Board. And whatever I do focus on the central banks and focus on the movement of liquidity. Most people in the market are looking for earnings and conventional measures. It's liquidity that moves markets.

You don't need 15 stocks or this currency or that. If you see it, you have to go for it because that's a better bet than 90 percent of the other stuff you would add onto it.

That's not what I learned from George Soros, but I learned something incredibly valuable, and that is, when you see it, to bet big. So what I said was already evolving, he totally cemented it.

I’d say 90 percent of the ideas Soros was using came from me, and it was very insightful and I'm a competitive person, frankly embarrassing, that in his personal account working about 10 percent of the time he continued to beat the funds I was managing. And again it's because he was taking my ideas and he just had more guts. He was betting more money with my ideas than I was.

Probably nothing explains our relationship and what I've learned from him more than the British pound. In August of 1992 my housing analyst in Britain called me up and basically said that Britain looked like they were going into a recession because the interest rate increases they were experiencing were causing a downturn in housing. At the same time, if you remember, Germany. The wall had fallen in 1989 and they had reunited with East Germany, and because they'd had this disastrous experience with inflation back in 1923, they were obsessed with the deutsche mark and not having another inflationary experience. So, the Bundesbank, which had a history of worrying about inflation, was raising rates like crazy. That all sounds normal except the deutsche mark and the British pound were linked. And you cannot have two currencies where one economic outlook is going this way and the other outlook is going that way. So, in August of 1992 there was $7 billion in Quantum. I put $1.5 billion, short the British pound based on the thesis I just gave you. Fast-forward to September, next month. I wake up one morning and the head of the Bundesbank, Helmut Schlesinger, has given an editorial in the Financial Times, and I’ll skip all the flowers. It basically said the British pound is crap and we don't want to be united with this currency. I thought well, this is my opportunity. I decided I’m going to bet like Soros on the British pound against the deutsche mark.

I go in the office and I said, ‘George, I'm going to sell $5.5 billion worth of British pounds tonight and buy deutsche marks. Here's why I'm doing it, that means we‘ll have 100 percent of the fund in this one trade.’ And as I'm talking, he starts wincing like what is wrong with this kid, and I think he's about to blow away my thesis and he says, ‘That is the most ridiculous use of money management I ever heard. What you described is an incredible one-way bet. We should have 200 percent of our net worth in this trade, not 100 percent. Do you know how often something like this comes around? Like once every 20 years. What is wrong with you?’ So, we started shorting the British pound that night. We didn‘t get the whole $15 billion on, but we got enough that I'm sure some people in the room have read about it in the financial press.

- Stanley Druckenmiller, Lost Tree Club Speech

I couldn’t agree more with everything Stanley says. All the empirical knowledge I’ve gained over the years has led me to the exact same conclusions.

So, what should you do if you’re looking for outsized investment returns?

Be Like Druck

- Follow the Fed/central bank

- Invest in the future, not the present

- Concentrate on one idea and bet big on it

Let’s consider the Fed and what they’re going to do.

I believe they’re going to cut rates. They have to in order to bail out the US government. About $10 trillion worth of treasuries mature this year that need to be rolled over. That’s about one third of total US government debt and about one third of United States GDP.

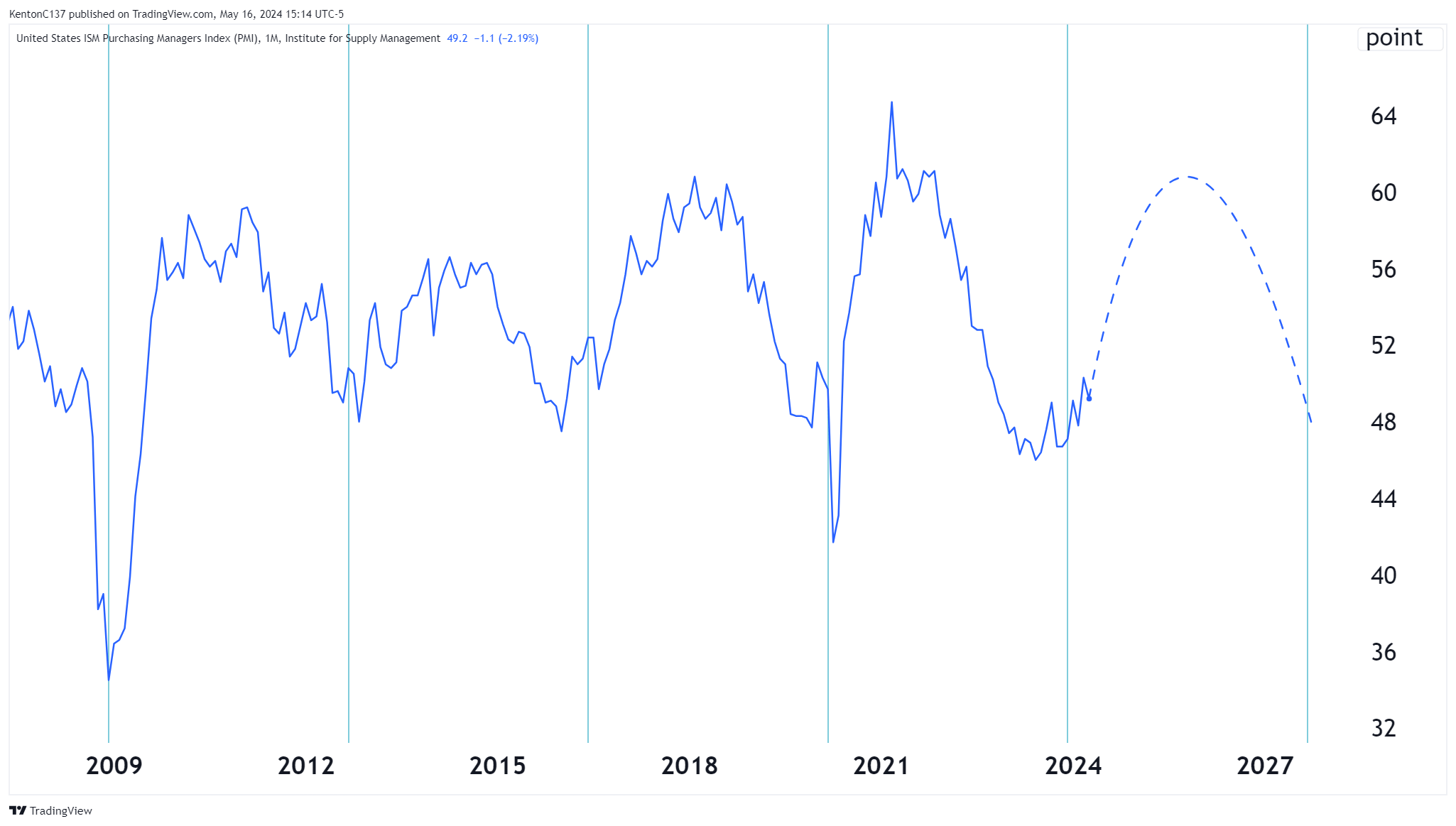

Ever since QE began in 2008, we’ve been on roughly a four-year liquidity cycle where the debt from the bailout needs to be rolled over. That means the initial debt from 2008 expired in 2012, was rolled over for another four years to 2016, then rolled over another four years to 2020, and again another four years into 2024. Every time this debt rolls over, it grows like a snowball rolling down a hill. To avoid a debt avalanche, the Fed has to help the Treasury roll this debt further into the future (which only increases the risk of a debt avalanche burying people!)

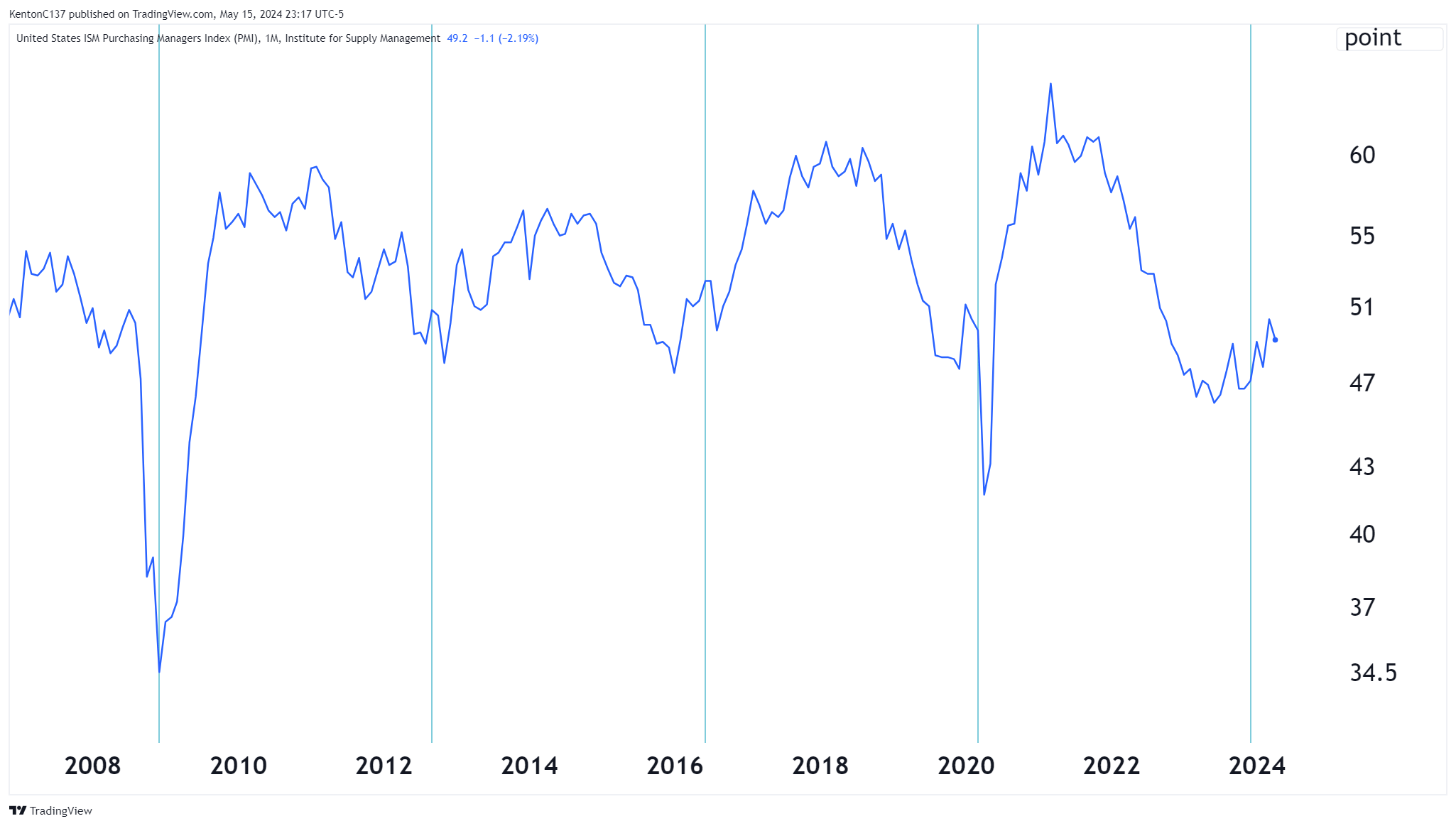

By doing so, the Fed created a liquidity cycle that shows up in the business cycle as demonstrated by the ISM Index. The ISM Index is a leading indicator for economic activity in the United States. A reading above 50 indicates an expansion of U.S. manufacturing, while a reading below 50 indicates a contraction.

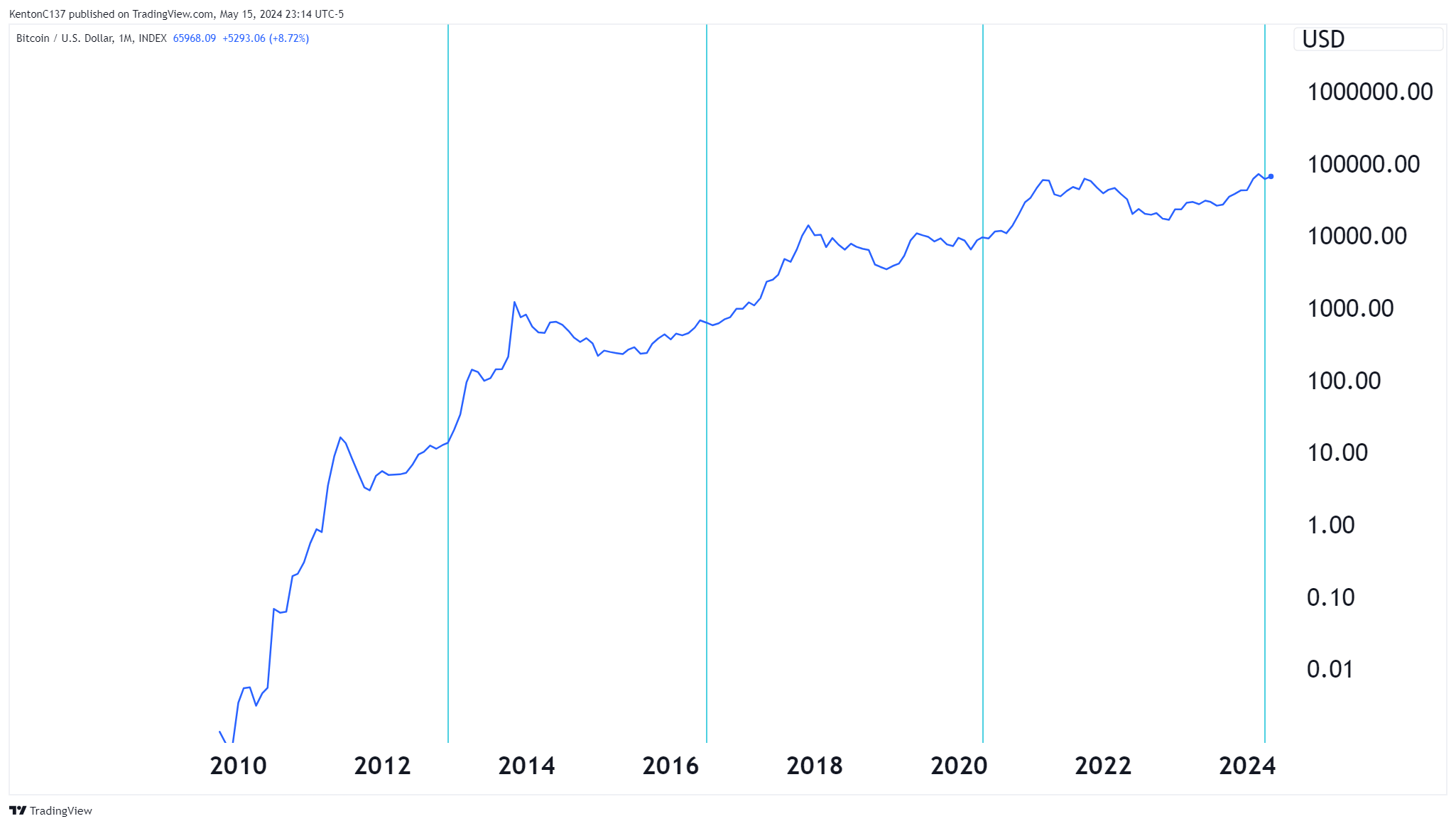

It just so happens, the bitcoin halving cycle is on pretty much the same schedule.

When bitcoin becomes functionally more scarce, US Dollars become functionally more abundant. When this happens, the bitcoin price and crypto market rallies.

Looking forward, if the liquidity cycle continues like it has over the past, we should see the Fed ease financial conditions this year to create liquidity, which will cause a rally in the business cycle. With history as a guide, this should peak in the middle of 2025.

If this happens, everything will rally. The stock market will make new all-time highs and risk assets like crypto should really take off.

With that being said, let's move to step 2.

Invest in the Future

The traditional financial system (TradFi) is collapsing and the Fed monetizing US government debt only exacerbates it. A new system, decentralized finance (DeFi), is being developed before your eyes, so that’s where you need to invest.

Buying bitcoin is the obvious bet. Ethereum too. But I know you want more torque, something that could outperform both of them.

Meme coins will probably do quite well. But those are just investing in hype. They will come down as quickly as they go up and timing the moves can be tough. They definitely need the liquidity cycle to play out in order for that trade to work. It would be nice to have some downside protection in case the liquidity cycle doesn’t play out as expected, or even better, invest in something that doesn’t need the cycle to succeed, but will benefit even more if it does.

You need something no one knows about today, but will be obvious a few years from now. Something that only thousands of people use today, but millions could be using 18 months from now. Something with a huge economic moat that could make it one of the biggest cryptocurrencies.

THORChain - Next Top 10 Crypto

Bitcoin has been the #1 crypto by market cap since it was invented. Ethereum has been #2 for several years now. But what about the #3 position?

During the 2021 bull market, Binance (BNB) catapulted to #3, and it’s currently #4. When Coinbase (COIN) went public in 2021, its market cap relative to the crypto sector put it at #5. Today it’s #6.

There’s already precedence for a crypto exchange being the #3 crypto, and two exchanges still hold positions in the top ten. Therefore, it stands to reason, if an exchange grows bigger than Binance or Coinbase, it should easily make the top 10 list and, if anything, take the #3 spot.

What exchange could dwarf Binance and Coinbase? A decentralized exchange (DEX).

Don’t take it from me, take it from CZ, the founder of Binance.

In 2022, CZ said in 5-10 years decentralized exchanges (DEXs) will become bigger than centralized exchanges (CEXs) like Binance and Coinbase. Adjusting for the time of the quote, in 3-8 years DEXs will become bigger than CEXs.

The only way a DEX has a chance of dwarfing Binance is if it trades bitcoin and it just so happens that 99% of bitcoin trading on DEXs occurs on only one exchange.

THORChain (RUNE).

THORChain has a huge first mover advantage, which gives it an equally big economic moat.

THORChain set a new record in March with 50 thousand unique users. To put this into context, Coinbase has 8 million unique users per month. If THORChain gets to 8 million users per month, that would be a 160x increase! The RUNE price may not go up 160x, but it would go up.

To help us get there, is the founder of THORChain.

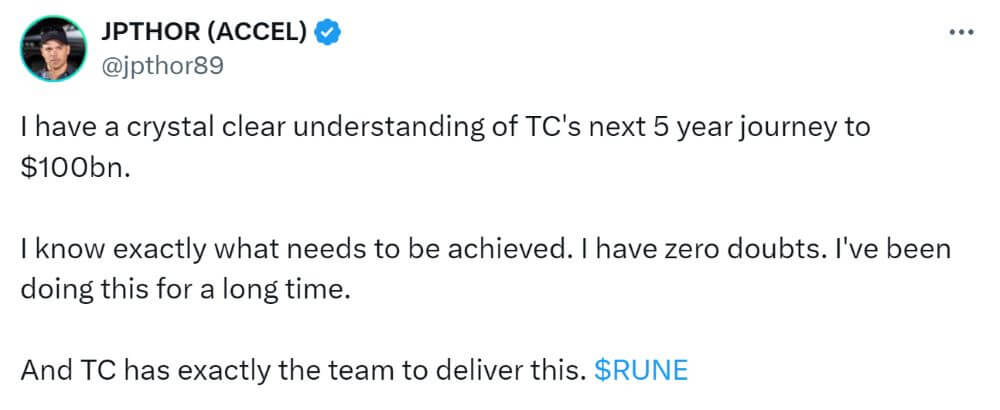

JP spent six years developing THORChain from nothing to a $2 billion protocol under the pseudonym Leena. To take RUNE to the next level, JP has committed himself to focus on promoting THORChain now that development is mostly done. It’s hard to be an anonymous promoter, therefore, he doxxed himself.

Yours truly was one of the first people to meet with JP after he started down this path. A few weeks ago, we talked for 3 hours over breakfast in New York City. I had to cut it short because of another commitment, but I’m sure we could have kept going another 3 hours.

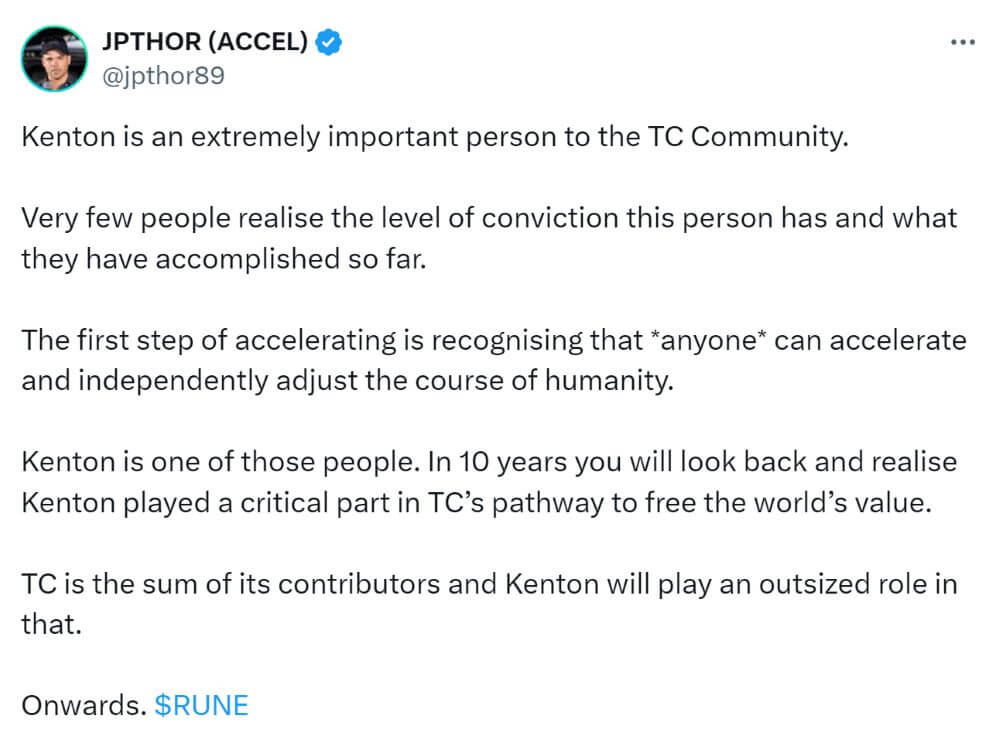

I’ve exchanged numerous texts with Leena over the years and have been active in the community, so he knew who I was. He had an idea of what I was doing with my fund, but didn’t know the full extent. Once he understood, he had this to say:

Humbling words.

It’s obvious to me, and those who understand THORChain, that RUNE has the potential to go up 100x over the next several years and distribute passive income for decades. If you want to get philosophical about it, THORChain also plays a crucial role in creating financial freedom for the world. Therefore, I’m concentrating on this one idea and betting big.

Like Druck, I see the opportunity and I’m pigging out on it. You can too.

Youxia RUNE Fund

Virtually every investment fund in the world spreads your money over a few dozen investments. Therefore, the fund manager has to understand, follow, and manage all of those positions, diluting the attention and influence over all those investments.

In my thinking, concentrating your bets decreases your overall risk because where you tend to be in trouble is if you have 35 or 40 names.

If you start paying attention to one. If you have a big massive position, it has your attention.

My favorite quote of all time is maybe Mark Twain: ‘Put all your eggs in one basket and watch the basket carefully.’ I tend to think that’s what great investors do.

- Stanley Druckenmiller

The Youxia RUNE Fund has one position. The RUNE token.

By concentrating on one position, I can focus much more time and energy on it. I understand this one position better than any fund manager understands all of their positions. By being active in the community and running nodes, the fund has more influence making it an agent in its own success.

Operating nodes does more than influence the direction of the protocol. It increases the security of the network and, in return, collects a portion of the swap fees as revenue. This revenue is collected by the fund and will eventually be paid out as passive income to investors.

Your real upside potential is passive income versus capital gains.

If RUNE goes up 100x, it’s because the yield goes up 100x. The RUNE price is inextricably linked to the yield in the network. For every $1 you invest today, you could end up yielding $1/year and, maybe, $1/month.

To appreciate the numbers above requires a deeper understanding of THORChain. Use these links to learn more:

Read - THORChain (RUNE) Investors Guide

Video - THORChain (RUNE) Introduction - Explained for Beginners

Let’s recap. The Fed is doing QE to infinity. TradFi is the present, DeFi is the future. THORChain is what you can concentrate and bet big on.

Thank you for reading.

I’m the founder of Youxia Crypto, an asset management company specializing in crypto. I can help you buy and sell precious metals too. I believe crypto is more than just about trying to make money, it’s about creating freedom for oneself and the rest of the world. I’m a contrarian, voluntaryist, and proponent of Austrian Economics. I enjoy downhill skiing, scuba diving, live music, yoga, and traveling.

The intended use of this material is for informational purposes only and is not intended to be an offer or solicitation for the sale of any financial product or service or a recommendation or determination that any investment strategy is suitable for a specific investor. Investors should seek financial advice regarding the suitability of any investment strategy based on the objectives of the investor, financial situation, investment horizon, and their particular needs. This information is not intended to provide financial, tax, legal, accounting or other professional advice since such advice always requires consideration of individual circumstances. The investments discussed herein are not insured by the FDIC or any other governmental agency, are subject to risks, including a total loss of the principal amount invested. Past performance is no guarantee of future returns.