GENERAL,BITCOIN,THORCHAIN

Now is the Time to Buy

July 21, 2025

Have you ever wished to invest in something right before it was about to take off?

Now's your chance to do it.

The setup in crypto right now is as good as you're going to get before the whole sector starts making new highs. This isn’t buying the bottom, this is buying the breakout.

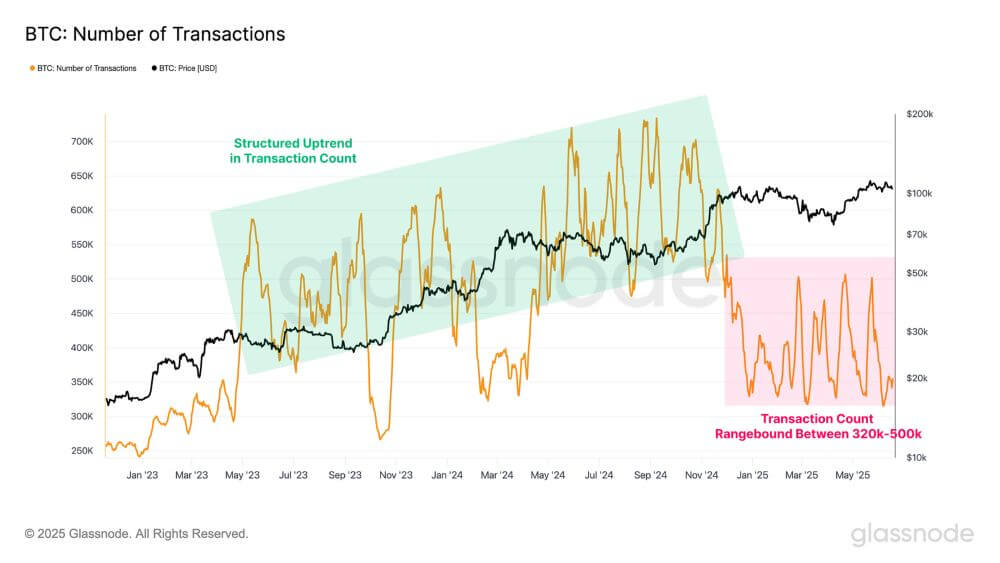

Bitcoin broke out of the $110,000 level to make new highs. But it doesn’t seem to be getting much news coverage. The lack of interest in bitcoin is echoed by the quiet onchain transaction activity over the last year and a half.

Not only are people not paying much attention to bitcoin’s new highs, they also aren’t paying attention to how the current bitcoin price was predicted.

Not only are people not paying much attention to bitcoin’s new highs, they also aren’t paying attention to how the current bitcoin price was predicted.

Bitcoin Price Predictions

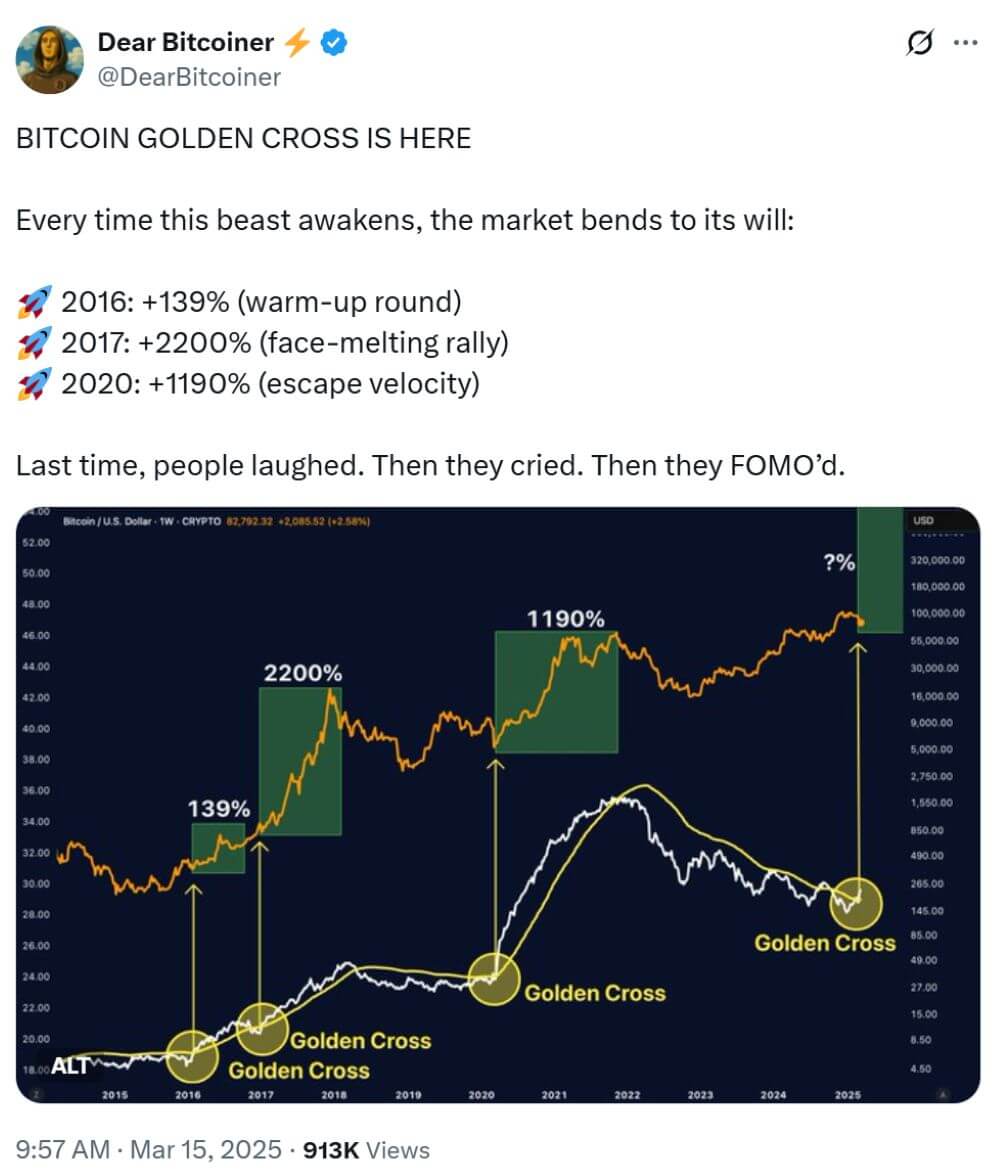

Check out this post from March 15.

Bitcoin is up 40% since then and appears to have lots more room to run. The average of those three rallies above is 1,176%. On March 15 the bitcoin price was just over $84,000. If bitcoin rallies 1,176% from that point, it’d be $988,000! We can hope, right?

Bitcoin is up 40% since then and appears to have lots more room to run. The average of those three rallies above is 1,176%. On March 15 the bitcoin price was just over $84,000. If bitcoin rallies 1,176% from that point, it’d be $988,000! We can hope, right?

If bitcoin got to $1M, it would have roughly the same market cap as gold, the north star for bitcoiners. I believe it will happen one day but I don’t know when.

The indicator that has really captured people's attention is the correlation of the bitcoin price to the global money supply (Global M2). Global M2 has proven to be a great leading indicator. By shifting the chart backwards about 3 months the correlation becomes apparent.

TechDev_52 has done a great job of illustrating this with his charts below. He posts all kinds of interesting charts on Twitter and has a great newsletter.

The yellow line is Global M2 and the white line is bitcoin.

If the correlation continues to hold, bitcoin should reach $150,000 in September.

Could it keep going? We’ll just have to see what the Global M2 is in September.

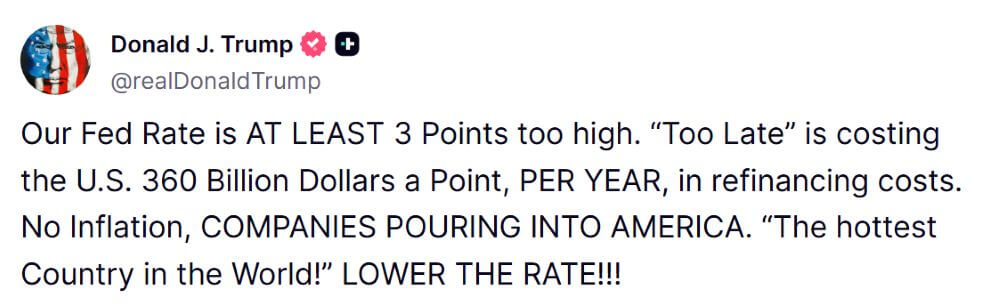

I think M2 is about to explode higher. The US passed the One Big Beautiful Bill Act to increase the debt ceiling by $5 trillion and Trump has been begging for the Federal Reserve to cut interest rates.

$360 billion dollars a point, times 3 points, is $1.08 trillion a year. That’s why Trump is screaming to lower rates. It will cost the US trillions of dollars to roll over the debt at current interest rates.

However, Jerome ‘Too Late’ Powell is not succumbing to the peer pressure and holding rates firm. Therefore, Trump is looking to replace him. I bet you there will be a new Fed Chairman come September and rates will be cut. Could you imagine a new Fed Chairman cutting rates by 3% in one meeting?

That would set the markets on fire.

There’s currently $7.4 trillion sitting in money market funds that will suddenly stop earning any interest. In theory, that money will start taking on more risk in search of yield.

How high could bitcoin go in this scenario? It could go to $300,000.

Check out the charts below. The one on the left is the gold price. Gold bugs have been pointing out the cup and handle formation for several years now. The gold price followed the pattern in textbook fashion. The trough to $1,000/oz was equal in proportion to the rally up to $3,400/oz. If the same pattern holds for bitcoin, the price will go to $300,000 later next year.

Crypto Market Predictions

Crypto Market Predictions

That all sounds great for bitcoin, but what about the rest of the crypto market? Ethereum is within 10% of making a new all-time high and it looks like it will get there.

The passing of the GENIUS Act is going to make stablecoins a household thing. Start getting comfortable with the idea of using stablecoins because if you don’t the world will leave you behind. The majority of these stablecoins will be built on ethereum and I believe that’s what’s driving the ethereum price right now.

Now, let’s take a look at the chart for TOTAL3 (the entire market cap of crypto excluding bitcoin and ethereum).

Notice the rally during the 2017 bull market. TOTAL3 went up about 1,750%.

Then the chart created a symmetrical triangle pattern up to 2020. During the 2021 bull market TOTAL3 went up 1,750% from the breakout of the triangle, a textbook example.

Over the last 4 years, the chart has been building a large ascending triangle pattern. When it breaks out, how high could it go? If we have another textbook breakout, it too should go up 1,750% from the resistance line, putting TOTAL3 at $21 trillion. Right now, TOTAL3 is about $1 trillion, so that would add $20 trillion to its market cap (20x).

$20 trillion is no small potatoes. Sound far-fetched?

TOTAL3 includes the market cap of stablecoins. Stablecoin usage is about to go through the roof, therefore, they alone could easily add several trillion in market cap.

Now, check this out.

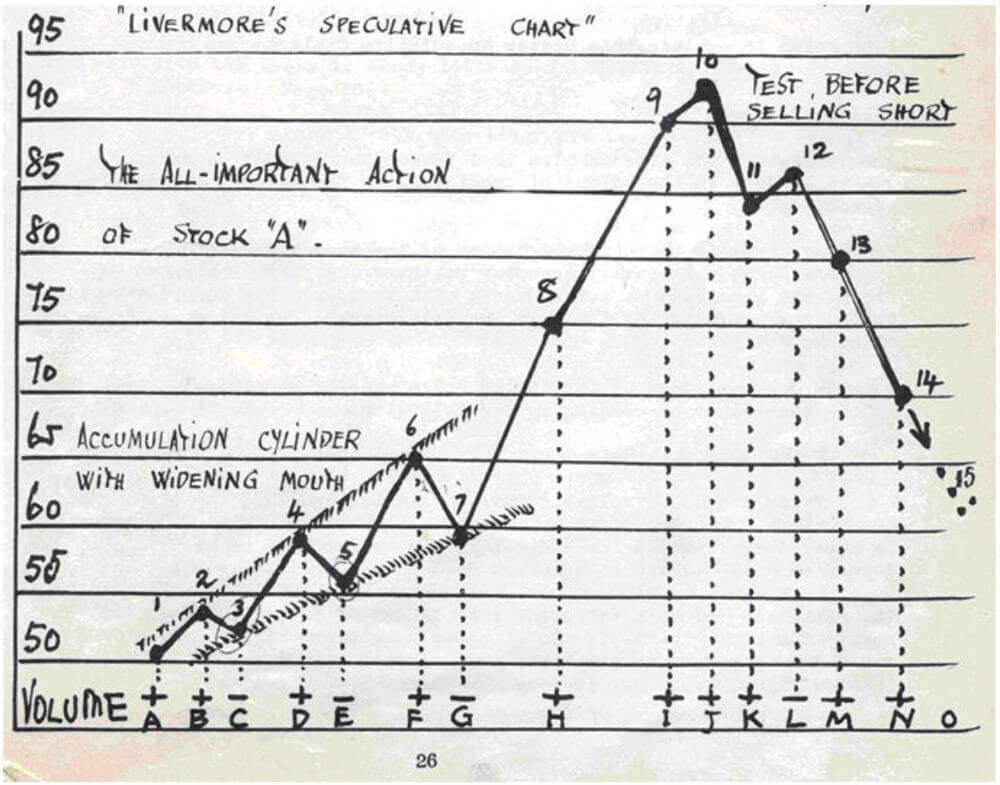

Have you heard of Jesse Livermore? He's regarded as the greatest trader of all time. He was a pioneer of trend following and technical analysis.

Jesse observed the pattern above and calls it the accumulation cylinder with widening mouth. The TOTAL3 chart appears to be following this path, so I traced the pattern above and overlaid it on the TOTAL3 chart.

Cool hey?

Livermore’s indicator corroborates the upside potential for TOTAL3.

The engineer in me always does back calculations to see if my math makes sense. For example, is there another way we can put a $21 trillion TOTAL3 into perspective?

At the previous two bull market tops, the market cap of bitcoin equaled TOTAL3 both times. If that relationship is maintained, then TOTAL3 topping out at $21 trillion would give bitcoin a $21 trillion market cap.

If bitcoin has that high of a market cap, it would be just over $1,000,000. The same result using the golden cross example above.

When could this happen? By the end of 2026, if you follow through with the projections above.

Could you imagine? It honestly sounds like a stretch to me. But that’s based on the current environment. If Trump gets his way in the next few months, the landscape could completely change. We could have a massive round of QE equal to Trump's ego, fueling a rally in all markets, and then maybe the numbers above aren’t so fanciful after all.

Regardless, crypto is on the verge of a big breakout. I don’t know how high it will go, so we’ll just have to wait and see.

Astrology For Men

There’s a saying that technical analysis is astrology for men. I know the scenarios laid out above are wishful thinking, however, they give us an idea of what's possible. This helps you remove your emotions from the decision-making process. In fact, emotions are what technical analysis is trying to measure. By understanding the market's emotions you can trade against them.

Every time I ignore technical analysis because of “the fundamentals” I get burned. I pride myself on being an intellectually honest person, so I can’t ignore the results.

Fundamental analysis is good to understand what type of investment you’re dealing with and how it should react in different situations. It will help you know if you should double down or cut loose. But after you understand your investment, you have to pay attention to the charts (the market’s emotions) to get an idea of when to buy/sell.

It’s not hard either. In fact, the more simple and basic you keep it, the better. Every free charting program offers the RSI indicator. It’s my favorite. You don’t have to understand what it is, just see what it looks like at the highs and lows and the pattern should be obvious.

That will help you immensely in trying to decide when to buy/sell something. It makes my job a lot easier too because you don’t have to simply trust me, we can look at the chart together and I can point it out to you.

Technical analysis isn’t foolproof. It doesn’t always work. But it can work more often than you think and it will at least give you some peace of mind that you’re doing everything you can to pick the best entry/exit points.

Youxia RUNE Fund

In 2017 it was ICOs. In 2021 it was NFTs. In 2026 I believe it will be memecoins that define this bull market, so I’ve got a small basket of them to speculate on.

The problem is there are literally millions of different memecoins. It really is a guessing game to know which ones will go anywhere. So I just use fun money with them.

My serious bet is on THORChain (RUNE). There aren’t millions of different THORChains out there. There are maybe a few, depending on how you look at it. THORChain is truly one of a kind and has a 4-year head start on its network effects.

It’s one of a handful of cryptos with intrinsic value and operating a genuine business. All the bad news is behind it. It has no block rewards, no inflation. All the revenue is from real users paying real money to use it. THORChain has been integrated into Trust Wallet, Ledger, and dozens more. MetaMask and others are working on integrating it too. Eventually, every wallet in the world will have THORChain in it.

The only question that remains is how big will it get?

Right now, 275 million people have access to THORChain. But at most 0.1 million users per month. That’s 0.03%. If only 1% of the 275 million people started using it, usage would go up 33x.

And that’s just the beginning.

It’s still early for THORChain and the crypto market. But time is running out if you want to get in while it’s cheap. Don’t want to miss out on it? Then invest in the Youxia RUNE Fund.

You don’t have to worry about how to set up a crypto wallet, how to do your taxes, etc. I take care of all that for you. All the crypto exchanges are backlogged right now and it's taking some people weeks to open an account. You can invest in the Youxia RUNE Fund in about 20-30 minutes and we’ll hold your hand through the process.

You’ll be immediately invested in one of the highest quality cryptocurrencies and be positioned for the breakout in the sector.

Email/call me to get started.

Thank you for reading.

I’m the founder of Youxia Crypto, an asset management company specializing in crypto. I can help you buy and sell precious metals too. I believe crypto is more than just about trying to make money, it’s about creating freedom for oneself and the rest of the world. I’m a contrarian, voluntaryist, and proponent of Austrian Economics. I enjoy skiing, beach volleyball, scuba diving, live music, yoga, and traveling.

The intended use of this material is for informational purposes only and is not intended to be an offer or solicitation for the sale of any financial product or service or a recommendation or determination that any investment strategy is suitable for a specific investor. Investors should seek financial advice regarding the suitability of any investment strategy based on the objectives of the investor, financial situation, investment horizon, and their particular needs. This information is not intended to provide financial, tax, legal, accounting or other professional advice since such advice always requires consideration of individual circumstances. The investments discussed herein are not insured by the FDIC or any other governmental agency, are subject to risks, including a total loss of the principal amount invested. Past performance is no guarantee of future returns.