GENERAL,THORCHAIN

Crypto is About to Take Off

May 12, 2025

Over the last several days, cryptocurrencies across the board have started rallying. I think the bottom is in and we’re heading into an altcoin bull market.

What’s causing everything to go up now is the same thing that caused everything to go down last quarter.

Liquidity

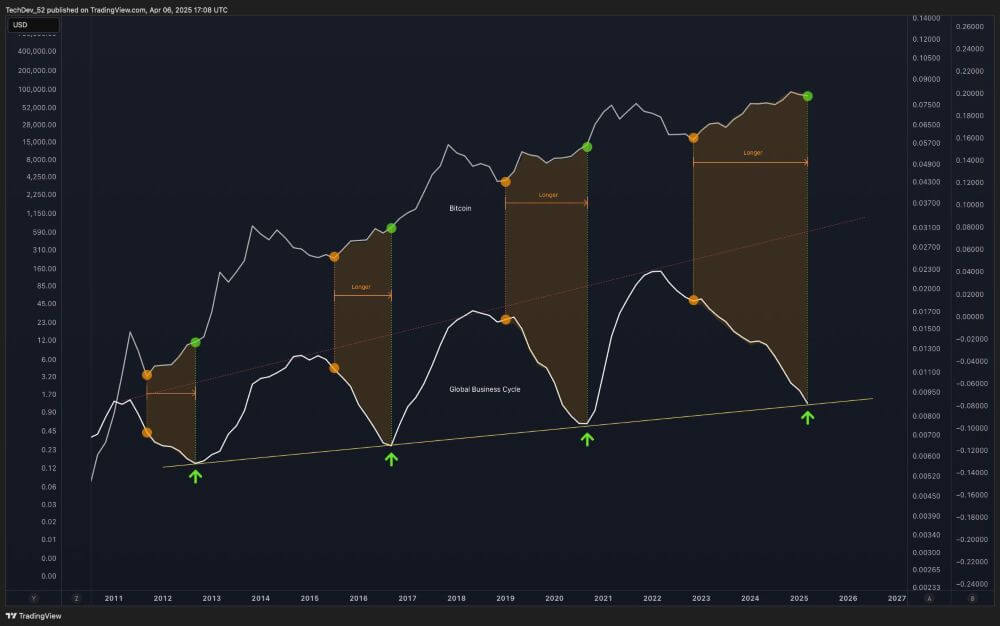

Global liquidity went down and took the crypto market down with it. Check out this chart from December.

I had an email exchange with a client at the end of December about this and told him this chart is one thing that has me wondering about the short-term. Maybe the sector sells off as it’s correlated to Global M2. Global M2 is a representation of the total liquidity in world financial markets. Basically, how much the money supply is growing or shrinking.

I had an email exchange with a client at the end of December about this and told him this chart is one thing that has me wondering about the short-term. Maybe the sector sells off as it’s correlated to Global M2. Global M2 is a representation of the total liquidity in world financial markets. Basically, how much the money supply is growing or shrinking.

Boy did this correlation ever hold. Over the next few months, bitcoin sold off, and the rest of crypto tanked.

Nothing changed in the fundamentals of crypto. Liquidity conditions did. That’s all. The money supply shrank around the world therefore investors sold what they had to, to come up with the cash for whatever their current needs were.

If I had known the correlation would have held so strong I would have sold last December, but I didn’t. If the correlation was so strong then, perhaps it will continue over the next few months? I believe it could, so let's have a look at the chart now.

The correlation suggests bitcoin could go to $150,000 over the next three months. I can only imagine what it will do for altcoins, but it should be the exact opposite of what happened to altcoins over the last quarter.

The correlation suggests bitcoin could go to $150,000 over the next three months. I can only imagine what it will do for altcoins, but it should be the exact opposite of what happened to altcoins over the last quarter.

If you haven’t had the gumption to buy yet, now is probably your last chance to get in cheap before the whole market goes up.

And it’s not just crypto. Liquidity affects all markets. All markets should start rallying over the next few months.

Trillions in Debt to Refinance

Raoul Pal has been banging this drum for years now and I agree with him. I highly recommend you watch his recent presentation explaining his thesis. It has a bunch of charts that demonstrate how well everything is correlated to changes in the world's liquidity.

I’ve written about this in the past and bring it up when I talk to you on the phone.

The US government has to roll over about one third of its debt and they’ll have crippling interest payments if they do it at current rates. It’s the exact same scenario as someone with a low interest rate on their mortgage having to refinance at a much higher rate. The increase in interest payments could cause them to lose their house. But when it’s the government who can’t afford to make their interest payments, what do they lose?

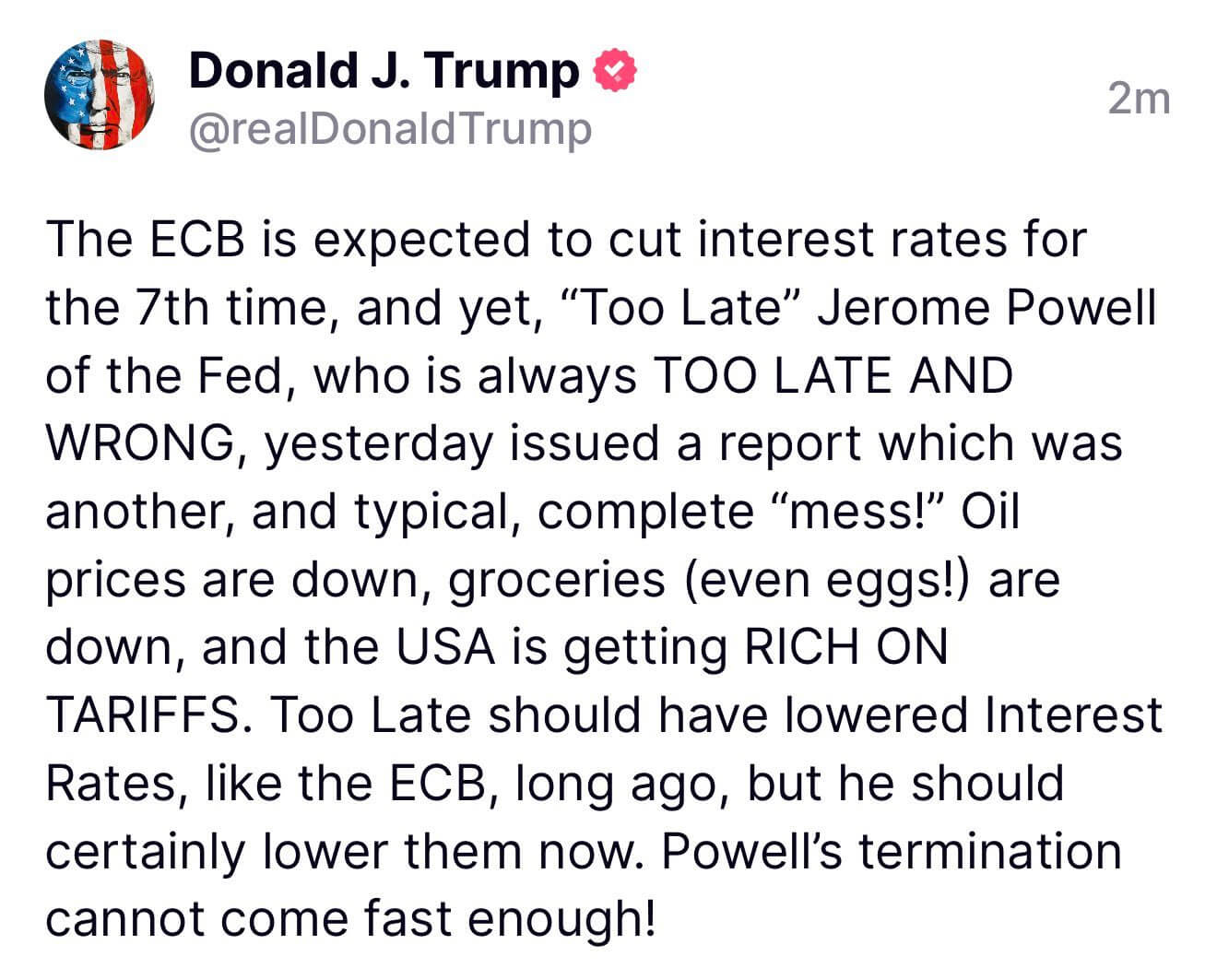

This is why Trump has been publicly criticizing Jerome Powell.

The US government needs interest rates lower to refinance its debt and the consequence of that will be a lot of money created. When this happens, it’s the assets further out on the risk curve that tend to perform the best.

Global Business Cycle

It isn’t just the US that has to roll over debt. All countries around the world are in a similar position and they’re all kicking the can down the road too. The easing and tightening of liquidity around the world has created an oscillating effect on the business cycle.

To see how the business cycle affects bitcoin, check out these charts from TechDev on twitter. They’re quite compelling, so you should spend some time to understand them.

If the chart above is too busy for you, this one below should make things simple. The altcoin market is primed to explode higher.

You know what the chart above reminds me of? Silver from 2008 to 2011. The silver chart made the same pattern, and when the price broke out, it went straight up for 8 months. Silver went from $20/oz to $50/oz, an increase of 250%.

You know what the chart above reminds me of? Silver from 2008 to 2011. The silver chart made the same pattern, and when the price broke out, it went straight up for 8 months. Silver went from $20/oz to $50/oz, an increase of 250%.

Could the next 8 months for the altcoin market mirror what silver did back then? I don’t see why not. The setup on the chart is the same and the macro conditions are the same.

Could the next 8 months for the altcoin market mirror what silver did back then? I don’t see why not. The setup on the chart is the same and the macro conditions are the same.

Take a closer look at this chart again. Notice it begins at the end of 2010. Just when silver started its breakout. Notice how the global business cycle was going up. All markets were going up at the end of 2010 and beginning of 2011. It also caused the first bitcoin bull market where bitcoin ran up to $32. (I bet you wish you would have bought bitcoin at $32, but you would have had to ride it down to $2 (-94%) before it started going back up again).

After the global business cycle turned down, bitcoin, silver, and all other markets went down with it.

History doesn't repeat, it rhymes. Markets are the same. Therefore, using history as a guide for the crypto market, when the business and liquidity cycles start going up so too should crypto.

Youxia RUNE Fund

I still think meme coins will stand out in this bull market. There are literally millions of them, so it’s a bit of a guessing game to pick the winners. But I’m still dabbling in them for fun.

My largest, more serious bet is on THORChain (RUNE). The reason I have so much conviction in it, is because it’s really hard for it to go to zero. The THORFi default in January proved that. Despite the trouble, THORChain survived and is now stronger than ever.

Development on new features, adding new chains, and new integrations, is moving forward full steam ahead.

Work is being done on making swaps faster and cheaper. Order books will make arbitrage more efficient which means better quotes for users. Ripple (XRP) and Solana (SOL) will be trading on THORChain soon. Several more tokens will follow. The app-layer is going to launch any day now. This is like a layer 2 on THORChain which will offer all kinds of features to users, such as futures/perps trading.

All of the above will attract users and volume to the protocol, increasing revenue. It’s important to understand that this revenue is direct buy pressure on the RUNE token. When a regular company increases their revenue, that money goes into a bank account, not buying the shares, and you hope the share price goes up to reflect that. Whereas with THORChain, the revenue is buying RUNE tokens, so an increase in revenue is automatically an increase in buy pressure on RUNE.

There are no block rewards on THORChain, and 5% of the revenue goes towards burning RUNE, making the supply deflationary. Therefore, it’s technically just a matter of time for the RUNE price to go up. How high could it go?

My long-term target is $261.

At this price, THORChain would have the same market cap as Binance, the largest crypto exchange in the world. Binance should keep going up in value, and I believe THORChain will become larger than Binance, so the upside potential is huge.

The bad news is behind THORChain, the last few months should be the bottom for the RUNE price, and we have the winds in our sails with the liquidity and business cycles turning around.

By investing in the Youxia RUNE Fund, not only is it an easy way to buy RUNE, you also start earning yield on it. The yield comes from operating nodes on the network, which you can’t do on your own.

$1 invested today could yield $1 per year, all while sitting on a large capital gain.

Contact me to learn more.

Thank you for reading.

I’m the founder of Youxia Crypto, an asset management company specializing in crypto. I can help you buy and sell precious metals too. I believe crypto is more than just about trying to make money, it’s about creating freedom for oneself and the rest of the world. I’m a contrarian, voluntaryist, and proponent of Austrian Economics. I enjoy skiing, beach volleyball, scuba diving, live music, yoga, and traveling.

The intended use of this material is for informational purposes only and is not intended to be an offer or solicitation for the sale of any financial product or service or a recommendation or determination that any investment strategy is suitable for a specific investor. Investors should seek financial advice regarding the suitability of any investment strategy based on the objectives of the investor, financial situation, investment horizon, and their particular needs. This information is not intended to provide financial, tax, legal, accounting or other professional advice since such advice always requires consideration of individual circumstances. The investments discussed herein are not insured by the FDIC or any other governmental agency, are subject to risks, including a total loss of the principal amount invested. Past performance is no guarantee of future returns.