GENERAL,BITCOIN

Trump Could Send Bitcoin to $500,000

December 6, 2024

Bitcoin just made history going over one hundred thousand United States Dollars!

There’s a lot of people doing the Trump dance right now. I know you want to do it too. It’s okay, do it, nobody is watching you.

The markets are crediting Trump’s election victory for bitcoin’s strength. In my opinion, it wouldn’t have mattered who won the election, bitcoin was still going to rally. Had Kamala won, then I think the news cycle would be about the Democrats printing money, and bitcoin’s rally would be justified by inflation.

With Trump winning, the narrative driving bitcoin isn’t inflation, it's a pro-crypto US government.

In my Donald Trump is a Bitcoiner article from August, I wrote the following:

The majority of the market is pricing in crypto failing, crypto being made illegal, etc. They completely discount the fact it could succeed and be embraced.

No one is positioned for the USA embracing crypto. If you fancy yourself a savvy contrarian investor, you should be betting on the USA becoming pro-crypto.

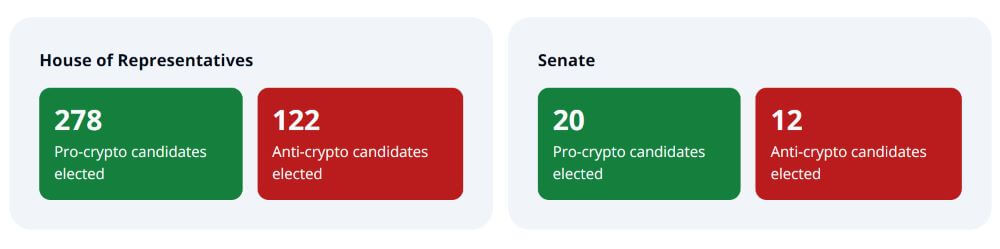

Not only is the next President of the USA pro-crypto, so is the majority of Congress.

For the first time in history, the United States President, Senate, and House of Representatives are all pro-crypto. And if that isn’t enough, the next SEC Chairman is pro-crypto.

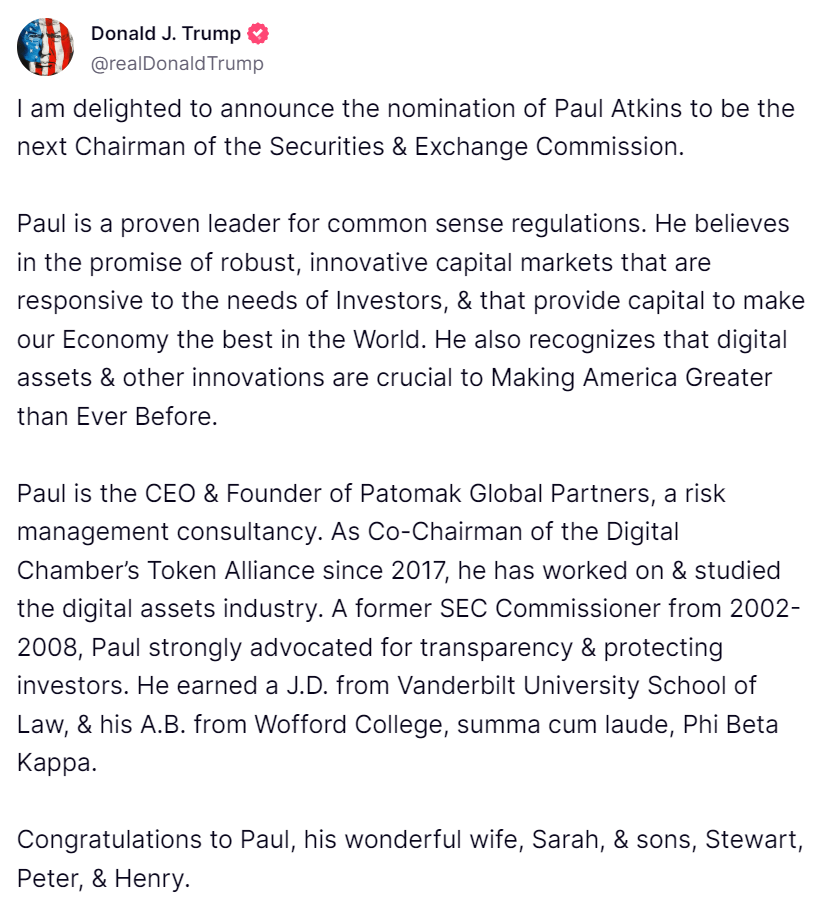

One of Trump's campaign promises was that he would fire SEC Chairman Gary Gensler for his weaponization of the commission against the crypto industry. Gensler is saving Trump the trouble and already announced his resignation. Then Trump wasted no time in announcing Gensler’s replacement.

Notice Trump is making it clear Paul Atkins is pro-crypto.

This is setting the stage for 2025 to be a very good year for us.

$500,000 Bitcoin

Could bitcoin go to $500k during this bull run? It’s on the table of possibilities and isn’t far fetched when you break it down.

For many years now, bitcoiners have had their sights on the orange coin reaching parity with the gold coin. Michael Saylor always says that bitcoin isn’t competing with the dollar as a medium of exchange, it’s competing with gold as a store of value. This narrative has even reached The Fed.

The other day Jerome Powell said:

People use bitcoin as a speculative asset. It’s just like gold, only it’s virtual, it’s digital. It’s not a competitor for the dollar, it's really a competitor for gold.

The idea of bitcoin being digital gold is already universally accepted. The next step is for the bitcoin price to start competing with the gold price.

The market cap of bitcoin right now is $2T. The market cap of gold is $18T. For bitcoin to have the same market cap of gold, the price would have to 9x from here. Said differently, bitcoin at $900,000 means it will have the same market cap as gold. But that’s assuming the gold price stays constant around $2,700/oz. I expect the gold price to go up too. So, bitcoin could go to $500,000 and still not come close to gold’s market cap.

BITCOIN Act

The only way I could see bitcoin going to $500k next year is if the US government passes the Boosting Innovation, Technology, and Competitiveness through Optimized Investment Nationwide (BITCOIN) Act.

This bill was introduced by Senator Cynthia Lummis in July.

The bill states:

Just as gold reserves have historically served as a cornerstone of national financial security, Bitcoin represents a digital-age asset capable of enhancing the financial leadership and security of the United States in the 21st century global economy.

The Secretary shall establish a Bitcoin Purchase Program which shall purchase not more than 200,000 Bitcoins per year over a 5-year period, for a total acquisition of 1,000,000 Bitcoins.

To ensure the long-term stability and security of the Strategic Bitcoin Reserve, the Secretary shall hold all Bitcoin acquired through the Bitcoin Purchase Program for not less than 20 years.

Trump promised to create a strategic bitcoin reserve if he got elected. But he didn’t say anything about buying 1,000,000 bitcoins. Instead, he vowed not to sell the 200,000 tokens currently held by the government and will roll those over into the reserve.

Mike Novogratz thinks there’s a low probability the reserve will get approved. But if it does, he thinks bitcoin could go to $500k because it will force other countries to follow suit.

Politicians around the world are embracing bitcoin and more will get on board after seeing it be a deciding factor in the US elections.

You know about El Salvador. But did you know Bhutan has almost triple the amount of bitcoin, making it the fifth largest country in the world by bitcoin holdings? Bhutan has been quietly mining bitcoin since 2020.

Argentina’s central bank opened a bitcoin mining exhibit, as a form of art, alongside spheres of shredded paper currencies. The central bank wants to give people insight into how cryptocurrencies work and the technology behind them, without judging or promoting them.

Maya Parbhoe, a presidential candidate of Suriname, is campaigning to make bitcoin legal tender in Suriname if she is elected.

Slawomir Mentzen, a presidential candidate in Poland, is campaigning to create a strategic bitcoin reserve and make Poland a cryptocurrency haven.

Brazil’s Congressman Eros Biondini has proposed a bitcoin sovereign strategic reserve that would make up 5% of the central bank’s national reserves.

Russia is becoming more crypto-friendly too. Especially after the sanctions placed on her by the US. Which lead Putin to say:

Who can ban bitcoin? Nobody. And who can prohibit the use of other electronic means of payment? Nobody. Because these are new technologies.

The game theory is playing out in real time. Politicians know they can’t stop a decentralized cryptocurrency. If they try, they’ll prove to the world how impotent they are and their economies will be left behind at the same time.

Whereas the politicians who embrace crypto, will be elected, and their economy will stand to benefit. Politicians around the world are embracing crypto whether they like it or not.

Getting back to the US, Michael Saylor believes the bitcoin reserve will get approved. He uses history as his guide, reminding us the United States was built by purchasing Manhattan, the Louisiana Territory, California, Texas, and Alaska. The next great frontier is cyberspace and the obvious thing to do is to own it. Therefore, it’s in the United States’ interest to pass the BITCOIN Act.

When will this bitcoin reserve be created? As I type, Polymarket is showing a 27% chance it will happen within the first 100 days of Trump taking office.

It may not happen as quickly as we want, but it will happen if Trump is true to his word. Then the real question is, how big will it be?

Free Ross

Ross Ulbricht created the Silk Road website in 2011. It was an e-commerce site like Ebay, but with an emphasis on security and privacy. The site enabled users to connect to Silk Road without revealing their identity or location and without their internet providers knowing about it. Bitcoin was used to pay for goods listed on the site to help stay anonymous.

Silk Road eventually became a mecca for selling drugs, which led to the arrest of Ulbricht, who is currently serving two life sentences plus 40 years without parole. It’s an egregious punishment that does not fit the crime.

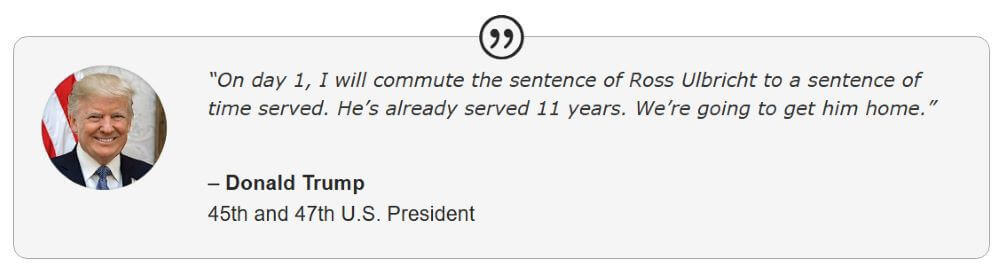

For many years now there’s been a #FreeRoss campaign to raise awareness and lobby for his early release. The movement made its way to Trump and he campaigned saying he will pardon Ulbricht on day one of his presidency.

The best signal we can get as to whether or not Trump will honor his campaign promises is if he follows through with freeing Ross. If so, then the market might start pricing in the approval of the bitcoin reserve and crypto could rally. If not, then the crypto market might sell off, thinking Trump won’t deliver on his promises.

Markets like predictability. If the market believes Trump will deliver on his promises, they will start pricing them in.

Trump Transition Team

When Trump was first elected President in 2016, people were voting more against the establishment than they were voting for Trump, the person. I believe this year’s election was similar, in that people weren’t necessarily voting for Trump, they were voting for those surrounding Trump.

You’re familiar with RFK Jr. and JD Vance. You know about Elon Musk and Vivek Ramaswamy heading up the Department of Government Efficiency (DOGE). But do you know who came up with the DOGE acronym?

Howard Lutnik did. He’s the CEO of Cantor Fitzgerald and co-chair of Trump's Transition Team. He has hundreds of millions of dollars exposure to Bitcoin and expects to have billions. If anyone has a vested interest in the bitcoin reserve getting approved it’s him.

He has quite the incredible back story. It’s filled with adversity and triumph, it’s heartbreaking and heartwarming. Anthony Pompliano did a podcast with Lutnik where he recounts his life story and I highly recommend you listen to it.

After I was done listening, I couldn’t help but feel bullish about America. If guys like Lutnik are rolling up their sleeves and getting their hands dirty, maybe there is hope for the USA yet. And bitcoin could play a pivotal role.

Thank you for reading.

I’m the founder of Youxia Crypto, an asset management company specializing in crypto. I can help you buy and sell precious metals too. I believe crypto is more than just about trying to make money, it’s about creating freedom for oneself and the rest of the world. I’m a contrarian, voluntaryist, and proponent of Austrian Economics. I enjoy skiing, beach volleyball, scuba diving, live music, yoga, and traveling.

The intended use of this material is for informational purposes only and is not intended to be an offer or solicitation for the sale of any financial product or service or a recommendation or determination that any investment strategy is suitable for a specific investor. Investors should seek financial advice regarding the suitability of any investment strategy based on the objectives of the investor, financial situation, investment horizon, and their particular needs. This information is not intended to provide financial, tax, legal, accounting or other professional advice since such advice always requires consideration of individual circumstances. The investments discussed herein are not insured by the FDIC or any other governmental agency, are subject to risks, including a total loss of the principal amount invested. Past performance is no guarantee of future returns.