General

Crypto Banks Collapsing is the Reason for Crypto

March 20, 2023

The collapse of Silicon Valley Bank (SVB) is all the talk right now. SVB is the second largest bank failure in U.S. history and the largest bank to collapse since 2008. The default threatens to take down the whole financial system a la 2008 style.

The uninformed narrative going around is that SVB, along with Silvergate Bank and Signature Bank, collapsed because of crypto. But there’s a lot more to the story than “it’s crypto’s fault.” If anything, it was crypto’s success that led to the failures.

To appreciate the whole story let’s go back three years in time. Back to when the world lost its mind in March 2020.

The markets were crashing, and the Fed came in with bailout after bailout to prop them up. The Federal Reserve Act states the Fed can only buy U.S. government bonds, nothing else, however the Fed ignored the Act by announcing a program to buy corporate bonds. The Fed did this because the corporate bond market went zero bid, which means the whole market was effectively worth zero. There were literally no buyers. Only sellers. $10.9 trillion of bonds became worth zero inside a week. To put that into context, the subprime crisis from 2007-2008 was caused by $1.3 trillion in mortgage-backed securities (bonds) going to zero.

The Fed didn’t even have to buy any of those corporate bonds to instill confidence back into markets. Just the announcement was enough to stop the crash and put in a bottom.

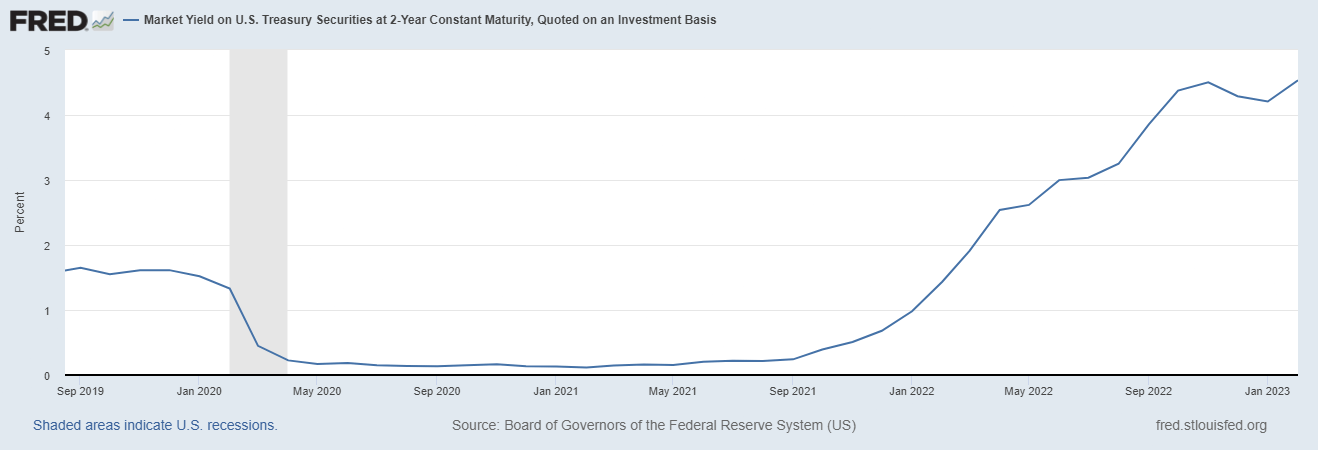

Notice how interest rates collapsed in March 2020 when the Fed started a new round of quantitative easing. Then notice how low interest rates were for the rest of the year and 2021.

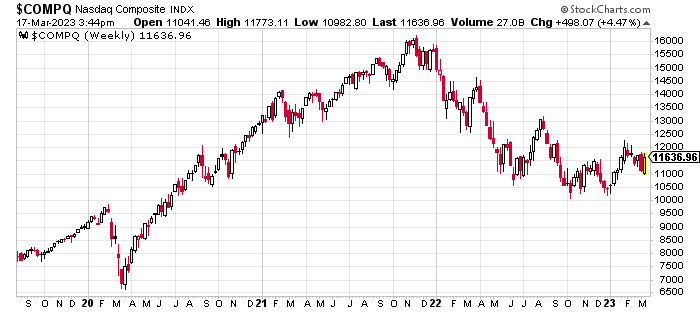

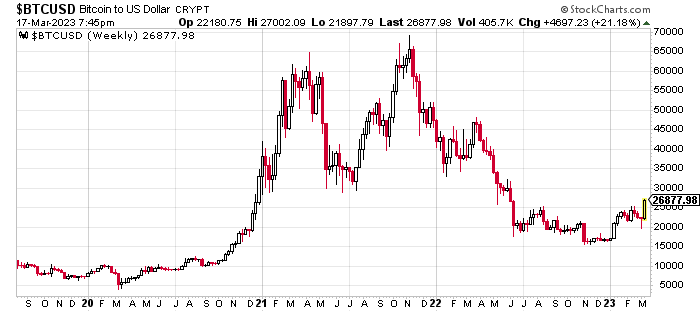

This low interest rate environment fueled an epic rally in stocks and, eventually, crypto.

With the success in tech and crypto, a lot of companies raised a lot of money in 2020 and 2021. And they had to put it somewhere. A few banks branded as tech and crypto friendly banks: Silvergate, Signature, and SVB all experienced huge growth in their businesses taking on all these new clients and deposits.

Everyone was happy. Until 2022.

2022 was, how should we say, bad for the crypto market. Disaster after disaster. The collapse of LUNA set off a daisy chain of events that led to the collapse of several of the largest entities in crypto culminating with FTX. Silvergate had exposure to FTX, and since their whole customer base was crypto related, the bank experienced a run as everyone became paranoid about counterparty risk. 60% of Silvergate’s deposits ($8.1 billion) left in one quarter. Apparently worse than that experienced by the average bank run in the Great Depression.

Silvergate couldn’t meet all the withdrawals at once because they had all the depositors’ money in investments that were down. Were those bad investments in crypto? Nope, it was bonds.

2022 wasn’t just a bad year for crypto. 2022 was a bad year for all asset classes. In fact, 2022 was the worst year for bonds in modern history.

Even if you go back 250 years, you can’t find a worse year than 2022. That’s a record low dating to 1754. You’d have to go all the way back to the Napoleonic War era for the second-worst showing, when long bonds lost 19% in 1803.

Edward McQuarie, professor from Santa Clara University

You know banks take on deposits and lend them out to make money. In a fractional reserve system, they can lend out multiples of the deposits they hold. Silvergate didn’t exactly do this though, they just took depositors money and bought long dated bonds to collect the interest. In theory, it’s safer because the bonds are liquid and can be sold when depositors want their money back. But remember, Silvergate saw their deposits explode higher in 2020-2021, and that’s when they bought all their bonds. They bought bonds at the top. Come 2022, all those bonds they bought were down big time. Therefore, when Silvergate experienced a bank run at the end of 2022, they were forced to start selling those bonds at a loss. This led to their demise.

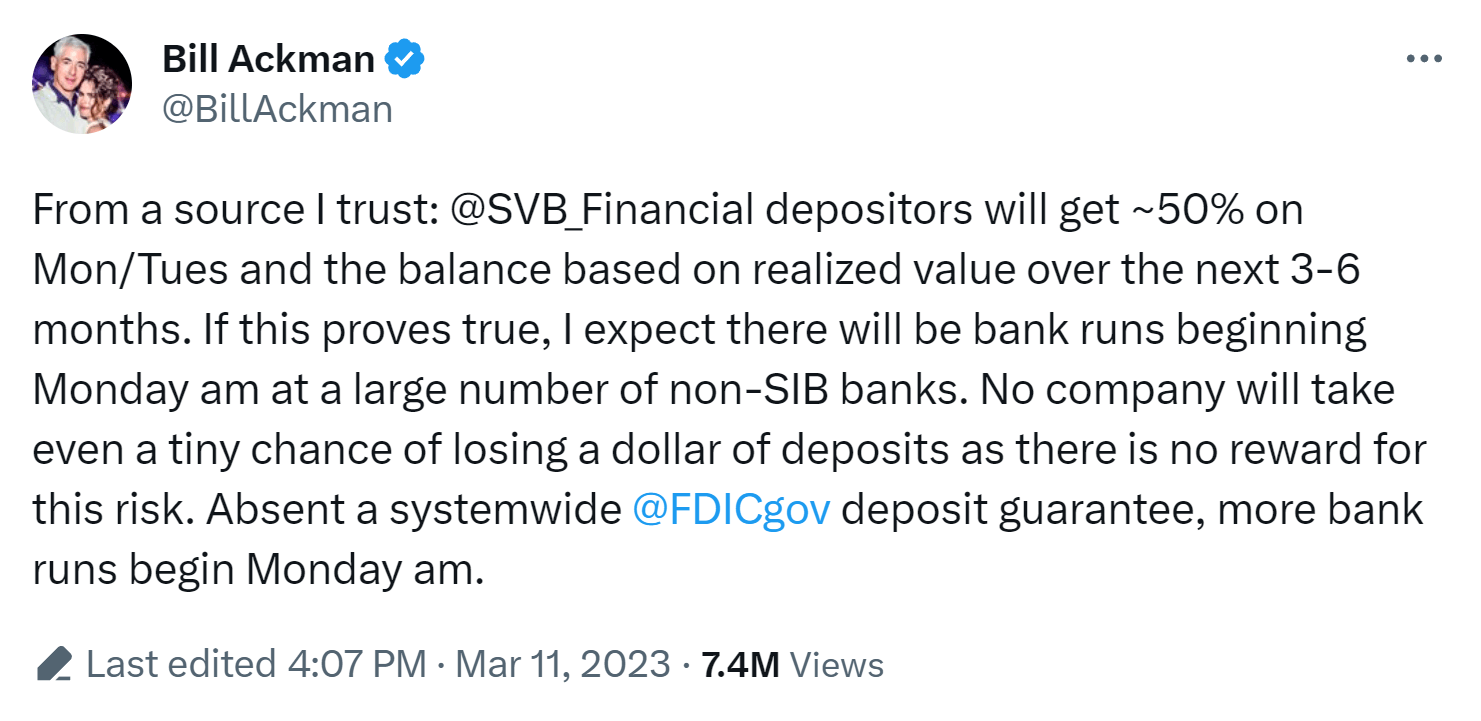

Next on the chopping block was SVB. It’s not clear what exactly started the run on SVB. Rumors on the interweb suggest Silvergate’s failure caused some to worry about their funds at SVB. With Silicon Valley being a small town of sorts, some turned into many, and it became a self-fulfilling prophecy.

SVB had the same business plan as Silvergate. SVB saw their depositor base explode in 2020-2021, they invested all that money into long dated bonds, then everyone tried to withdraw their money at once and SVB had to sell those bonds at a loss. Causing the bank to go under.

Although, this bank failure was much more significant. SVB, with $209.0 billion in assets, was the 16th largest bank in the U.S., eighteen times larger than Silvergate, with only $11.4 billion assets.

The failure of SVB was large enough to make everyone in the U.S. question the safety of their bank.

This prompted a joint statement from the Treasury, Federal Reserve, and FDIC on a Sunday evening to prevent a nationwide bank run in the morning.

In the statement, they threw Signature out with the bath water, citing “similar systemic risk” as the reason. Signature was not having any issues and even increased their dividend in January 2023. About 20% of their business was servicing crypto related clients, however, they’ve been public about reducing that side of their business.

One of Signature’s directors is a former congressman, Barney Frank. Barney was chairman of the U.S. House Financial Services Committee during the 2008 GFC. The Committee is one of the House's most powerful as it oversees the SEC, the Treasury, and the Fed. Barney is also the “Frank” in the Dodd-Frank Act. The Act that was created in response to the 2008 GFC to make the U.S. financial system safer.

Therefore, Barney probably knows a thing or two about the banking system and U.S. politics. Here’s what he had to say regarding Signature being forced to close:

We had no indication of problems until we got a deposit run late Friday, which was purely contagion from SVB. I think part of what happened was that regulators wanted to send a very strong anti-crypto message. We became the poster boy because there was no insolvency based on the fundamentals.

Barney Frank

A couple days later Barney did an interview expanding on his thoughts:

Jen Wieczner: The closure of Signature Bank surprised a lot of people, because it didn’t initially seem affected by the run earlier this year at Silvergate, the California-based bank that primarily served the crypto industry.

Barney Frank: I’m very disappointed to learn, apparently, the Department of Financial Services in New York, which did the closing, hasn’t said we were insolvent! They said, well, they had a problem, because they couldn’t get sufficient data. I mean, I was disappointed when they closed it, and sort of vindicated — they have not argued that we were insolvent. And I think it’s very clear if we had the benefit of those two announcements, we’d still be an ongoing bank.

Now, the question is, why did they react so harshly to what they said was our inability to give them the sufficient data? I believe it was probably to send the message that even though we were doing crypto stuff responsibly, they don’t want banks doing crypto. They denied that in their statement, but I don’t fully believe that. I think that they overreacted to what they saw was our problem with data, which may well have existed, but the data was improving. I think sloppy data is not a reason to close a bank that you have not decided was insolvent, and they’ve never said we were insolvent.

Jen Wieczner: I mean, is that even legal? Can the government just seize any bank, even if it’s not insolvent?

Barney Frank: Well, that’s worrisome. Let me say this. I don’t want to comment on that personally, because as a director, I could be conceivably involved in any kind of lawsuit that anybody brought, but I think that is a very good question you raise. And particularly, somebody ought to look and see, I wonder, are we the first bank to be closed, totally, without being insolvent? And if so, why? I think the DFS, the state of New York people should have to answer that.

That’s why I speculate that using us as a poster child to say “stay away from crypto” was the reason.

Barney Frank Talks More About the Surprise Shuttering of Signature Bank

The plot thickens with anonymous sources from the FDIC saying:

… any buyer of Signature must agree to give up all the crypto business at the bank.

But an FDIC spokesperson told Reuters after publication that the agency would not require divestment of crypto activities as part of any sale, and pointed to prior comments from FDIC Chairman Martin Gruenberg that the agency is not looking to prohibit any particular activity by banks.

U.S. regulator eyes Friday bids for SVB, Signature Bank

Now there are rumors going around that SVB had an acquisition lined up that would have saved them but was blocked by regulators, and Silvergate was pressured by regulators into a situation that made things worse, otherwise they could have remained solvent. Is this all part of the social credit system?

It’s a developing story, so I’m sure more information will come to light over the coming weeks.

What we can be certain of is we’re well past the first they ignore you phase and are now in the then they fight you phase. It sucks, but it means we’re that much closer to the then you win phase.

The traditional financial system (TradFi) won’t go down without a fight, but it’s going down. Current events are evidence of that. Let’s put them into perspective.

Silvergate assets were $11.4 billion.

SVB assets were $209.0 billion.

Even though Signature wasn’t insolvent, let’s include them anyway.

Signature assets were $110.4 billion.

That’s a total of $330.8 billion.

The cumulative total assets of all the banks in the U.S. is $21.7 trillion. Silvergate, SVB, and Signature represent 1.5% of the entire U.S. banking system.

1.5% is Enough to Threaten a Run on the Entire U.S. Banking System!?

How confident does that make you feel? How confident are you in a system that can’t even handle a 1.5% hiccup? How confident are you in a system that must use force to stop its competition?

Let’s put the competition into perspective.

Just before the LUNApocalypse last May, the total crypto market cap was about $1.7 trillion in April. The sector saw two of the largest cryptocurrencies go to zero, one of its largest hedge funds go to zero, two of its largest exchanges go to zero, two of its largest lenders go to zero, and one of its largest investment banks go to zero. Now we have the three largest banks that serve crypto companies going to zero. If you read that for any other market, you’d think the market is toast. It’s over.

However, the total crypto market cap is $1.07 trillion right now. Down 37% from April. Bitcoin and Ethereum make up two thirds of that market cap, so they’re both down about the same (36% and 40%, respectively). The smaller cryptocurrencies have collapsed in price, so it does look awful for them.

There was no bailout for crypto. No backstop. No central planner to press pause and reset the system. It was pure free market forces doing what the free market does. Remove the waste and keep the quality.

So, after all that madness that happened to the sector in 2022, Bitcoin is only down 36%. But that’s just over the last eight months. What if you got in three years ago, around March 2020?

If you bought bitcoin at the low, you would have paid about $4,000 for it. Today, bitcoin is about $24,500, up 513%. No one can buy the bottom, so a more realistic number to use from three years ago is $9,000. There was ample time to buy bitcoin at that price or lower, before and after the crash in March 2020. That would put you up 172%.

What about the whole crypto market? The total crypto market cap at the lows in March 2020 was $109 billion. It’s up 882% from there. But that’s cherry picking. A more appropriate number to use is $265 billion, which means the sector is up 304% since then.

Isn’t it amazing how well bitcoin and crypto is holding up throughout all of this? If that doesn’t make you bullish, then I don’t know what will. Perhaps this will help.

Imagine if Tesla and Facebook went to zero, Citadel went to zero, The New York Stock Exchange and Toronto Stock Exchange went to zero, Goldman Sachs went to zero, then Wells Fargo, Bank of America, and JP Morgan going to zero. What would the stock market look like? What would the financial system look like?

What would your stock and bond portfolio look like? Would it only be down 37%? Would it still be up 304% from three years prior? No of course not, you know that. It would be toast, game over.

Then it begs the question, which system deserves your support? Which system do you trust? Do you feel safer in a system that teeters on the brink of collapse and can only survive as long as politicians force people to stay in it? Or would you be safer in a system that’s already crashed, survived, and continues to thrive?

DeFi is the solution to all the problems in TradFi. The only question is how long it takes for everyone else to figure it out.

Thank you for reading.

I’m the founder of Youxia Crypto, an asset management company specializing in crypto. I can help you buy and sell precious metals too. I believe crypto is more than just about trying to make money, it’s about creating freedom for oneself and the rest of the world. I’m a contrarian, voluntaryist, and proponent of Austrian Economics. I enjoy downhill skiing, scuba diving, live music, yoga, and traveling.

The intended use of this material is for informational purposes only and is not intended to be an offer or solicitation for the sale of any financial product or service or a recommendation or determination that any investment strategy is suitable for a specific investor. Investors should seek financial advice regarding the suitability of any investment strategy based on the objectives of the investor, financial situation, investment horizon, and their particular needs. This information is not intended to provide financial, tax, legal, accounting or other professional advice since such advice always requires consideration of individual circumstances. The investments discussed herein are not insured by the FDIC or any other governmental agency, are subject to risks, including a total loss of the principal amount invested. Past performance is no guarantee of future returns.