GENERAL,THORCHAIN

Meme Coins Have Value

December 30, 2024

Yes, I’m being serious. And no, I haven’t lost my mind. In fact, I believe this is the most mindful article I’ve written.

Before we get into it, let's review what a meme is.

The term was coined by Richard Dawkins in his 1976 book, The Selfish Gene. Wikipedia says:

A meme is an idea, behavior, or style that spreads by means of imitation from person to person within a culture and often carries symbolic meaning representing a particular phenomenon or theme. A meme acts as a unit for carrying cultural ideas, symbols, or practices, that can be transmitted from one mind to another through writing, speech, gestures, rituals, or other imitable phenomena with a mimicked theme. Supporters of the concept regard memes as cultural analogues to genes in that they self-replicate, mutate, and respond to selective pressures.

Proponents theorize that memes are a viral phenomenon that may evolve by natural selection in a manner analogous to that of biological evolution. Memes do this through processes analogous to those of variation, mutation, competition, and inheritance, each of which influences a meme's reproductive success. Memes spread through the behavior that they generate in their hosts. Memes that propagate less prolifically may become extinct, while others may survive, spread, and (for better or for worse) mutate. Memes that replicate most effectively enjoy more success, and some may replicate effectively even when they prove to be detrimental to the welfare of their hosts.

Memes make up humanity’s body of knowledge, just like genes make up your physical human body.

When you think of a meme, you probably think of a simple picture that you see on social media. However, memes can represent bigger, more complex ideas that have been around for centuries. Such as government, religion, and money.

Money is a Meme

You already know anything can be used as a form of money. Cigarettes, seashells, glass beads, salt, etc. It’s totally arbitrary and the only difference between them is the narrative in vogue at the time and everyone consenting to their use. You can argue there are objective characteristics that make one form of money better than another, and I would agree with you.

But there are no laws of science that decree what money is or should be. The whole idea of money is a human concept. We created it in our heads and all agree to go along with it.

Humans use money to communicate value, and because this meme has benefited humanity over the millennia, the meme has survived the millennia. However, the meme has mutated as different societies have swapped from one form of money to another.

Once you appreciate money as a meme, then it’s easy to understand dollars are a meme, gold is a meme, and bitcoin is a meme.

Bitcoin is a Meme Coin

I take my life in my own hands by saying that. A bitcoin maximalist will cut my tongue out for being so blasphemous.

I don’t say this to denigrate bitcoin. I believe it’s the future. But bitcoin has more in common with meme coins than a maximalist will care to admit.

What gives bitcoin value is the same thing that gives meme coins value. Belief.

It’s the same thing that gives classic cars, famous paintings, and beach front property more value than a new Toyota Corolla, a kids painting, and a plot of land in the desert. Objectively, the characteristics between them all are basically the same.

Both cars will get you from A to B in the same amount of time. Both paintings are a few dollars of ink on the same canvas and frame. And both plots of land are just sand where nothing can be cultivated.

Subjectively, they’re all completely different. It’s the subjective differences, the difference in memetics, that ultimately determine the value of something.

This is the key to understanding investing and how to value things.

Value is Subjective

What is valuable to you may not be valuable to your neighbor.

Based on the memes you personally believe in, you will value things differently than me and everyone else you know. Multiply this millions of times over by millions of unique individuals, and you get yourself an economy.

This is the cornerstone of Austrian Economics. And what led Ludwig von Mises to write Human Action, his magnum opus on the topic. The key to understanding markets is understanding what motivates people to do things.

Instead of getting wrapped up in how the world should work, instead observe how the world does work.

Man is not a rational animal; he is a rationalizing animal.

― Robert A. Heinlein

If humans were rational beings, then everything we do would be predictable like the laws of science.

But you know that isn’t true. Humans are emotional, which makes them irrational.

For example, the classic buying at the top and selling at the bottom. So many people do this. It’s an emotional decision that they find a way to rationalize. I’ve had several clients do this over the years, some so well that they were perfect contrarian indicators. Quite eerie to be honest.

No matter how much objective reasoning I gave them, their minds were made up. They didn’t want to look at things rationally, they insisted on being irrational.

Then heaven forbid I show that person their trading patterns over the course of a few years to point it out. Not to be a jerk, but to help them learn and improve. Nope, they would still refuse to acknowledge they’re doing anything wrong.

This, my friend, is why the markets can stay irrational longer than you can remain solvent.

It’s why you can be right from an objective point of view, but if the market subjectively disagrees with you, none of your brilliant objectivity matters.

Value Investing is a Meme

Everyone loves Warren Buffet.

The idea of being diligent, finding value that others missed, and being patient are virtues of a hard-working man that we can all get behind. Buffet’s labor has paid off well for him and has influenced many others to emulate.

However, the Oracle of Omaha failed to see the shift from active money management to passive money management.

Value investing in the traditional Buffet sense has been underperforming for over 10 years now.

Over the last 10 years, more and more money has been allocated to passive investment funds, where money is just automatically invested in a basket of stocks regardless of their valuations, instead of going to an active manager that does allocate money based on valuations.

As the money going to passive investment funds increases, so does the buying pressure on the stocks within those funds. Passive funds outperform active funds and continue to attract more capital. The cycle repeats, and it becomes a self-fulfilling prophecy.

Right now, the majority of the market believes in the passive investing meme more than the active investing meme.

Traditional value investing only works if everyone else is doing it too.

The people who outperformed Buffet over the last 10 years are not the ones who studied the objective value of stocks. But the people who studied the subjective value of the market.

The key to investing is not finding value hidden in financial statements, buying, and waiting for the rest of the market to figure it out. If that were true, then there would be no such thing as a value trap.

The key is buying something nobody wants today, but everyone will want tomorrow.

Skate to where the puck is going, not where it has been.

- Wayne Gretzky

Valuing a Brand

Despite all the above, it’s still good to calculate traditional valuation metrics on an investment. This gives you a baseline of where you’re at.

I did this all the time with mining stocks. Some will consistently trade at 0.5x NAV and some will consistently trade at 2.0x NAV. Clients would always tell me they want the “undervalued” stock at 0.5x NAV, but more often than not, the stock trading at 2.0x NAV would outperform.

The reason is the stock with the 2.0x NAV has a much better brand. And knowing the relative valuation of the NAVs gives you an idea of that brand’s value.

How to Value a Meme Coin

Meme coins are just brands without a product. This is why everyone balks at meme coins as being ridiculous. How can a brand have value if there is no product?

A startup company could have a high valuation based on the brand of the people involved, but eventually those people would have to build something and generate cash flows to eventually backfill that valuation, or the share price will go down.

When it comes to meme coins, there’s nothing being developed. The token exists and that’s it.

Or is it?

Meme coins actually do have a product. Their product is community, belonging, an escape from reality.

Meme coins are mini religions. They’re cults.

You may think cults are crazy, but they survive the test of time for a reason. People value them.

Therefore, to value a meme coin, you have to determine what value people will place on being involved in a cult.

To go deeper into this topic, I highly recommend you watch Murad Mahmudov’s - The Memecoin Supercycle. It’s only 21 minutes long. He talks quite fast, so you may have to watch it twice or put it on 0.75x speed. Regardless, it’s one of the most insightful pieces on investing I’ve seen in a long time. I’ve watched it 5 times now and I couldn’t agree more with all of his comments. Especially those on venture capital firms, how the crypto market has become savvy to their games, and the tokenomics of meme coins vs. utility coins.

Murad has done many other interviews on this topic where he speaks slower and offers some extra details, so look him up on YouTube if you want to learn more.

Meme Coin Supercycle

Bitcoin maximalism is a cult.

Gold bugs have long been criticized as members of a cult.

Meme coins won’t get anywhere near the valuations of bitcoin or gold, but some will develop similar followings, just much smaller. As people latch onto bitcoin and gold for various memetic reasons, some people will latch on to various meme coins for certain personal reasons.

The driver to these cults will be loneliness and the need to connect with a group. Just like Matias Desmet demonstrated in his book, The Psychology of Totalitarianism, loneliness can drive people to do crazy things. Which means meme coins could be driven to crazy valuations.

This is why I think meme coins as a sector will outperform in 2025.

As far as picking individual tokens are concerned, I agree with Murad’s methods. The token should already exist and have experienced some volatility to ensure the cult still exists and is staying strong.

Murad has been promoting the same meme coins in interviews and his Twitter account. In no particular order they are:

Token - Name

SPX - SPX6900

APU - Apu Apustaja

MOG - Mog Coin

BITCOIN - HarryPotterObamaSonic10Inu

GIGA - GIGACHAD

POPCAT - POPCAT

RETARDIO - RETARDIO

LOCKIN - LOCK IN

mini - mini

I believe AI meme coins will capture people's attention, so I’ve been speculating on these two:

Token - Name

GOAT - Goatseus Maximus

KWEEN - DO KWEEN

I own equal dollar amounts of all of the tokens above because I have no idea which individual ones will succeed, so I’m hoping a basket of them will do well. But I’m buying them with play money. If these don’t work out, I won’t be happy losing that money, but it won’t be the end of the world for me. Allocate accordingly if you decide to play this game.

These aren’t heirlooms either. I intend to sell them all at some point in 2025, regardless of price. If these don’t go up with the crypto bull market, they will never go up.

Join a Cult

Perhaps meme coins aren’t for you and that’s okay.

I present the above to get you thinking about investing from a different angle. Understanding that value is subjective will go a long way to helping you be a better investor.

But maybe you still like the idea of joining a cult.

If you prefer to invest in something more tangible, something solving a material problem, something with real cash flows, well then, do I have a cult for you.

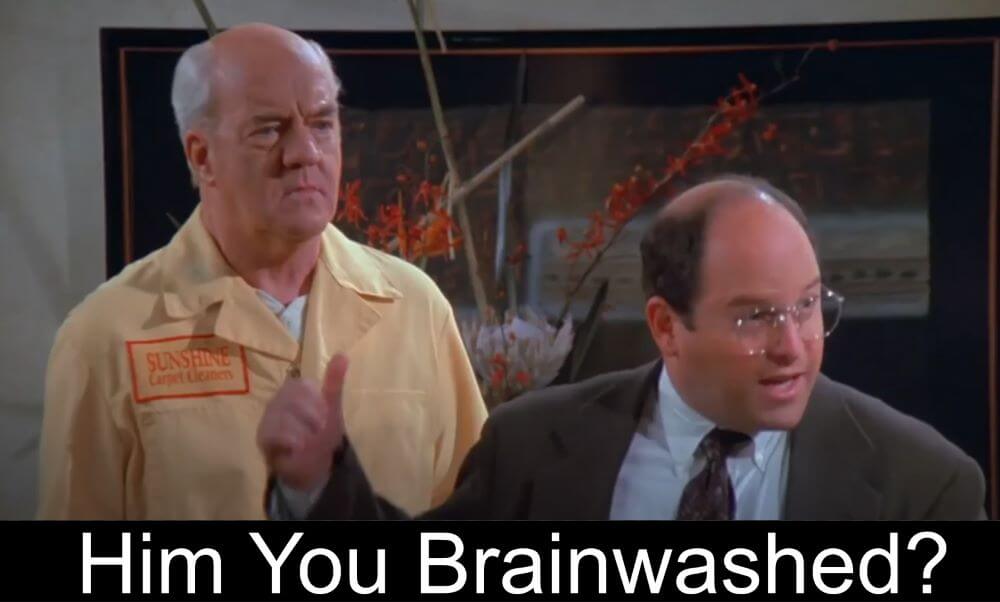

Unlike the Sunshine Carpet Cleaners in Seinfeld, this cult will accept whoever wants to join, even George Costanza, even you.

I’ve been heavily invested in this cult now for a few years. I joined for all the same reasons outlined in Murad’s video above. There are no token unlocks to worry about, no venture capital firms or insiders to dump on us. The token price has gone through multiple sell-offs, yet still persists. It’s a strong community that has grown throughout the bear market.

This community has a similar belief to the Sunshine Carpet Cleaners too. Mr. Wilhelm says “most of the world is carpeted, and one day, we will do the cleaning.” Whereas this cult says “most of the world’s crypto is traded on centralized exchanges, and one day, we will decentralize it.”

The cult I’m talking about is THORChain, its token is RUNE.

Membership is easy through the Youxia RUNE Fund. To invest in the fund, contact me to learn more.

To learn more about THORChain:

Read - THORChain (RUNE) Investors Guide

Watch - THORChain (RUNE) Introduction - Explained for Beginners

Thank you for reading.

I’m the founder of Youxia Crypto, an asset management company specializing in crypto. I can help you buy and sell precious metals too. I believe crypto is more than just about trying to make money, it’s about creating freedom for oneself and the rest of the world. I’m a contrarian, voluntaryist, and proponent of Austrian Economics. I enjoy skiing, beach volleyball, scuba diving, live music, yoga, and traveling.

The intended use of this material is for informational purposes only and is not intended to be an offer or solicitation for the sale of any financial product or service or a recommendation or determination that any investment strategy is suitable for a specific investor. Investors should seek financial advice regarding the suitability of any investment strategy based on the objectives of the investor, financial situation, investment horizon, and their particular needs. This information is not intended to provide financial, tax, legal, accounting or other professional advice since such advice always requires consideration of individual circumstances. The investments discussed herein are not insured by the FDIC or any other governmental agency, are subject to risks, including a total loss of the principal amount invested. Past performance is no guarantee of future returns.