General

Crypto Needs More Regulation Like it Needs More Cowbell

November 29, 2022

Have you seen the ‘More Cowbell’ skit from Saturday Night Live featuring Christopher Walken and Will Ferrell?

I think it’s hilarious. You may think it’s stupid. Either way, it’s obvious that more cowbell is a terrible idea.

Whenever I hear someone say “we need more regulation”, I cringe as if they’re banging a cowbell right in my ear. It’s obvious to any rational person that regulations don’t work and only make things worse. All that happens is honest people follow regulations to their detriment, whereas dishonest people ignore regulations to their benefit. The collapse of the FTX crypto exchange and the fraud surrounding Sam Bankman-Fried (SBF) is a good example. The whole FTX/SBF saga reads like an SNL episode. The story goes back 2 years, but let’s narrow in on the events since October, which led to the FTX collapse.

Digital Commodities Consumer Protection Act

A draft bill in the US, the Digital Commodities Consumer Protection Act (DCCPA), was leaked on October 19th. On the same day, SBF posted his thoughts on regulating crypto here and followed up with a tweet thread here. SBF was basically in support of the DCCPA bill and received backlash from the broader crypto community for it. Why? Because the gist of the bill would create a regulatory moat around FTX and hamstring its competition - decentralized finance (DeFi).

SBF was effectively saying DeFi should be regulated the same way as CeFi (centralized finance). Erik Voorhees, a vocal proponent of DeFi, countered with his own criticisms. The two of them tweeted back and forth until they agreed to have a public debate on October 28th.

It’s over 2 hours long and is worth watching if you have the time. SBF took the side of the regulators and Erik took the side against regulation. You can guess which side I’m on. FWIW, Erik is one of the first people to speak publicly about bitcoin since its inception and is one of the first people to incorporate THORChain into the background of his website - app.shapeshift.com. THORChain is a true decentralized exchange (DEX) that doesn’t do fractional reserve banking and enhances self-custody of assets. It’s the solution to frauds like FTX.

Erik’s stance is that DeFi is already regulated and trying to apply CeFi regulations to DeFi, is like trying to apply horse regulations to automobiles. People involved in crypto are still beholden to traditional regulations that affect all markets, and centralized finance is completely different than decentralized finance, therefore the two must be regulated differently. Also, DeFi is self-regulated.

Free Markets are Self-Regulated

Every business has its own set of rules and standards it adheres to, with the goal of pleasing their customers and attracting new business. A business can voluntarily subscribe to stricter standards than its competitors, however, they’re not required to. No different than an individual in a free market choosing what businesses to buy from or not.

Even in today’s unfree markets, there are still private regulators. ISO (International Organization for Standardization) is a worldwide federation of national standards bodies. A business can become ISO certified by proving it follows the regulations set by the ISO. It’s not free, the business must pay ISO for the privilege to advertise they’re ISO certified. Because ISO has a reputation for regulations that lead to quality products, businesses want to prove to their customers they follow them and can expect a higher quality product.

Another example is Leadership in Energy and Environmental Design (LEED), a green building certification program used worldwide. To become LEED certified, a building owner must prove their building construction uses resources efficiently and responsibly. No one is forced to make their buildings LEED certified, however, those who do it willingly could benefit from improved salability of their property.

Maybe you’re familiar with the organizations above and can point out flaws in their regulations. That might be true, but it misses the point. The point is the market demands regulation. So much so that many business owners will purposely subscribe to increased regulations if they think it will help them attract sales. I’m personally going through this process right now. I was going to set up my company in British Virgin Islands (BVI) because it’s cheaper than Cayman Islands. However, Cayman has a more robust and reputable regulatory regime than BVI. To attract more clients and give them a greater sense of security, I opted to pay more to set up in Cayman.

When it comes to regulating DeFi, it really can’t be any more ‘regulated.’ DeFi is completely open and transparent. All the code is there for anyone to see. All the assets are there for anyone to audit. All the transactions are there for anyone to track.

DeFi is self-regulated because the developers writing the code are doing so in a way to protect users. They can’t attract users if they write malicious code. Despite the chaos in the crypto markets this year, all the DeFi protocols have been performing as they were designed. If anything, regulators should applaud the DeFi sector for creating such a robust and open system.

Now, there could be flaws in code which lead to a hack or failure of a particular cryptocurrency. This is honest human error. Reputable developers will be the first to tell you this will always be a risk even with their own code. So, it always has been and always will be, buyer beware in crypto. No amount of regulation can change this.

However, no one is being forced to buy crypto. If someone thinks crypto is too risky because it’s not ‘regulated’, then they don’t have to buy it. Pretty simple. Live and let live. So, why can’t governments just let people be and make their own decisions and accept the consequences of those decisions?

The regulations being proposed for DeFi have nothing to do with protecting you. The regulators want to eliminate your privacy and track everything you do. This is why the crypto world, founded by staunch advocates of privacy, are so worked up. Eliminating privacy hurts you, it’s the opposite of protecting you.

Another reason governments can’t leave well enough alone is because people like SBF lobby for regulations to prevent competition, entrench themselves, and get away with fraud.

The more corrupt the state, the more numerous the laws.

Tacitus

I doubt SBF will go to jail. He was the second largest donor to Joe Biden during his presidential campaign. FTX was also donating money to democrats for the midterm elections, just weeks before the company filed for bankruptcy. Originally, I was naive enough to think SBF donating to Biden’s campaign was a good signpost for crypto, that big money was starting to lobby in our favor, but now it appears that SBF was simply buying his get out of jail free card. And do you think any of those politicians will return the donations back to the courts to help offset the losses at FTX? Of course not.

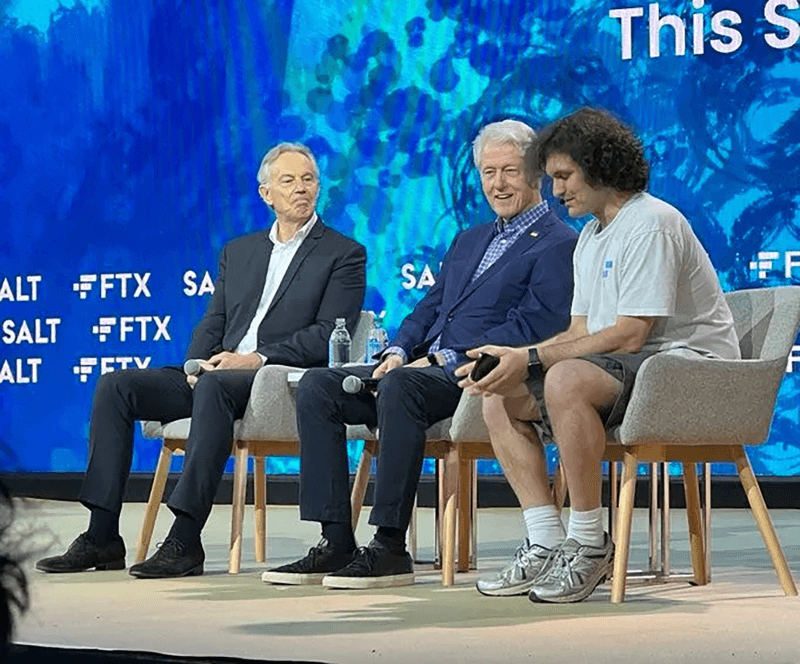

SBF has been rubbing elbows with everyone in the deep state. FTX/SBF organized a crypto conference earlier this year that featured Tony Blair and Bill Clinton.

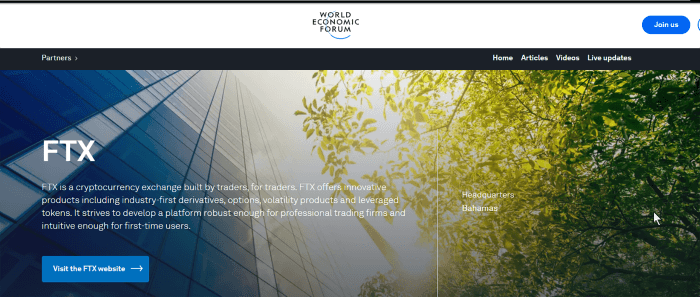

FTX was a partner of the World Economic Forum, but were quietly removed from their website this November.

FTX was even putting money towards covid propaganda! Jeffrey Tucker highlights the connections in his article, The Covid/Crypto Connection: The Grim Saga of FTX and Sam Bankman-Fried.

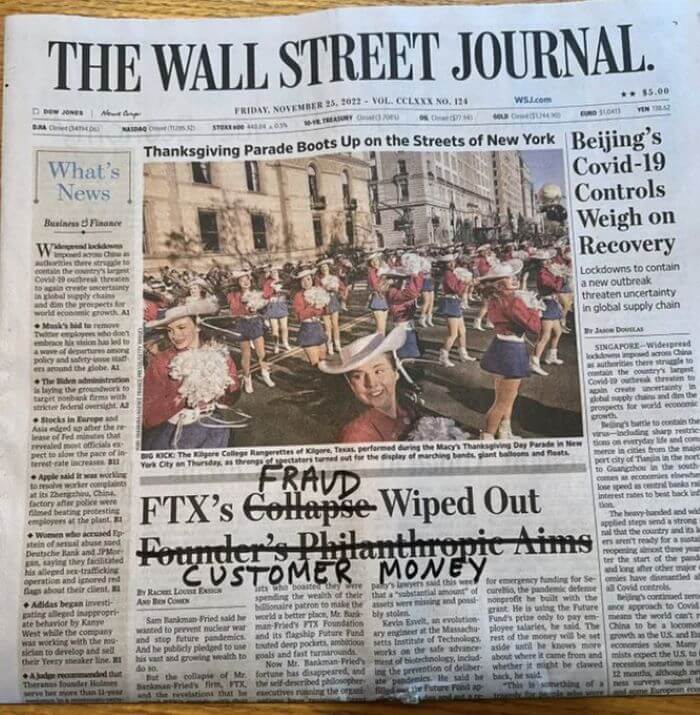

All the money SBF donated is paying dividends now because corporate media has been coming to SBF’s defense over the last few weeks. The Washington Post, Forbes, and New York Times have been writing puff pieces on him, almost defending him as if he’s the victim. Here’s a headline from the Wall Street Journal with some corrections made to it.

If all the above isn’t enough to make you sick, on November 30th, SBF is slated to speak at the New York Times DealBook Summit. Here’s the list of speakers.

You can’t make this stuff up. Here’s a guy who’s behind the largest fraud since Bernie Madoff, and not only is he walking around free, he’s still giving speeches amongst the world’s elite?

What good are regulations if the people who violate them are friends with the people who enforce them? You know this isn’t unique to crypto, this is true in all markets in all of history.

What’s worse, if SBF does go to court, then he might argue he was following regulations and the collapse of FTX was simply bad luck. Because regulations are so numerous and convoluted, it’s possible that everything FTX did was technically legal. No different than what John Corzine did, causing the collapse of MF Global and losing clients money.

The regulators never accept responsibility for any fraud or market crash. Instead, they come up with even more regulations, which leads to even bigger frauds and market crashes. It’s so obvious that it’s frustrating more people don’t get it. But there is someone in this story who does - SBF!

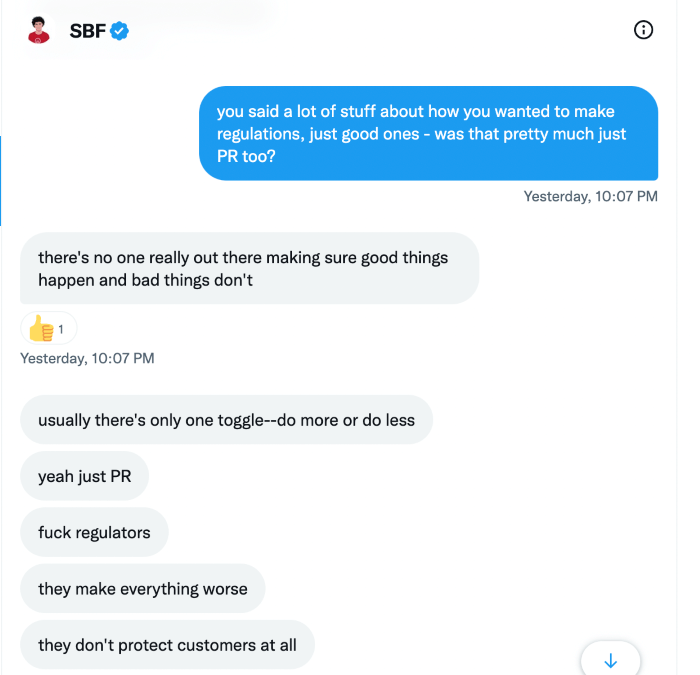

Fuck regulators. They make everything worse. They don’t protect customers at all.

Sam Bankman-Fried

I promise, that’s an honest quote. It comes from this Vox article - Sam Bankman-Fried Tries to Explain Himself. The article is centered around a string of leaked private text messages with SBF. Here’s the source of the quote.

You really can’t make this stuff up. I suppose who better to know regulations don’t work, than the people who abuse them.

We don’t need more regulations, we need more accountability for people who break the law, and only then will that deter others from committing the same crimes.

There’s a theory going around that CZ, CEO and Founder of Binance, figured out what SBF was doing and doled out his own form of justice.

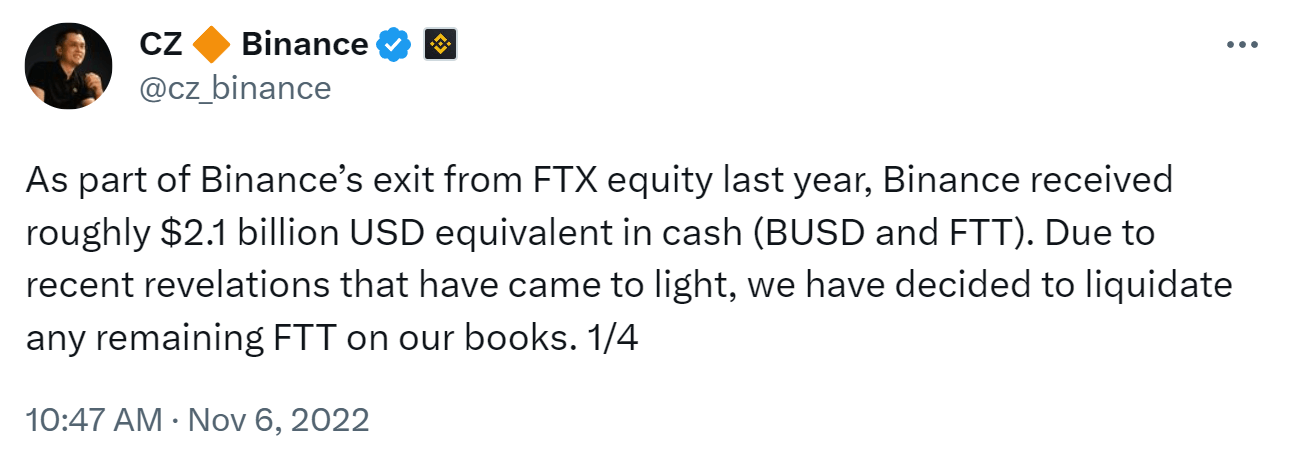

Note CZ’s tweet from Nov 6th.

This is the tweet that sent the FTT token crashing and caused FTX to blow up.

At the time, it didn’t make sense to me. If you want to sell a large position and get the best price possible, you don’t announce to the world what you’re doing so everyone else can front run you. Unless you want people to front run you and drive the price down. But why would CZ want to drive the price of the FTT token down on himself?

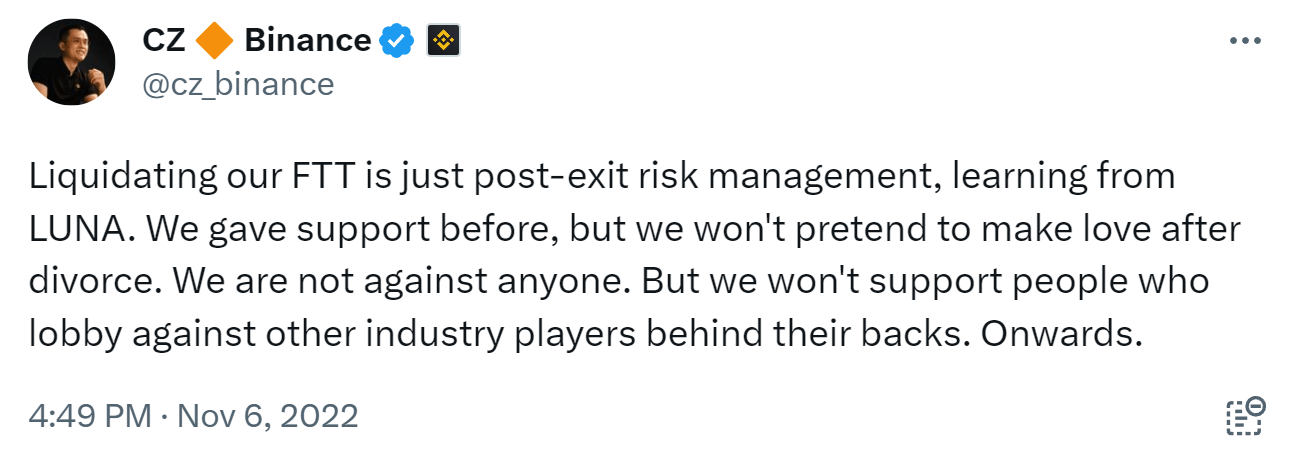

Later that day, CZ posted this:

Notice the last sentence. “But we won’t support people who lobby against other industry players behind their backs.”

Was CZ dumping the FTT token to penalize SBF for supporting the DCCPA bill and effectively backstabbing the crypto market? Did CZ have some insight into the problems underneath the hood of FTX and knew that by crashing the FTT token price he could crash FTX as a whole? Was this CZ’s way of holding SBF accountable to his actions, albeit taking the whole crypto market down too? Did CZ do it because FTX was one of the main competitors to Binance?

I don’t know the answers to these questions. But I wouldn’t be surprised if they’re all some form of ‘yes.’

Regulation is Coming to Crypto

It’s inevitable. Whether we like it or not, it’s going to happen. Especially with all the frauds and bankruptcies this year, it’s probably going to come sooner rather than later. The only question is, what will it look like?

Some people are convinced governments will make crypto illegal. But which government? It’s pointless if the US makes crypto illegal yet it remains legal everywhere else. The only way crypto would have a chance of being banned is if every country in the world cooperated with each other to do it. Even then, computer code doesn’t recognize political borders. You’d have to turn off the internet or electricity to truly stop it, otherwise there would be a healthy black market for it. China outlawed bitcoin mining, but it’s still going on in the country. If the most totalitarian regime in the world can’t stop bitcoin mining in its own back yard, no other country stands a chance.

A government making crypto illegal is just censorship. It’s never lies that are censored, only the truth. If a government is so threatened by crypto that they want to censor it, then what truth is crypto trying to tell you?

Crypto is a genuine threat to their power and control. Making crypto illegal would be a capital control and force people to stay in the current financial system. Governments enforce capital controls to prevent a flight out of their economy and the collapse of their currency. However, all capital controls do is delay the inevitable. If the situation is bad enough that governments use force to prevent you from leaving, then you know it’s time to leave. Throughout history, the people who stay end up going down with the ship and losing their life savings.

Governments may not make crypto outright illegal, but they could come up with such onerous regulations that would effectively cripple it. This is the gist of the wording of the DCCPA bill and why people like Erik Voorhees are passionately against it. This is a more plausible scenario in my mind, yet it still only applies to individual countries. If the US tries to regulate crypto to death, then the industry will move out of the US and keep humming along just fine.

Ultimately, the whole point of Bitcoin and DeFi is that it can’t be stopped by a centralized authority (i.e. government). Governments will drive themselves crazy playing whack-a-mole trying to stop crypto because they can’t point a gun at computer code. In the process, they’ll show the world their hand and how weak it is. If the US tries to drown the crypto market with regulations, it will backfire on them and prove there’s nothing they can do to stop it. In turn, demonstrating the true value of DeFi.

No point in dwelling on future events we have no control over. Better to take them as they come. We’ll just have to wait and see what the regulations around crypto are when they come out.

Note, it’s entirely plausible that regulations could be bullish for the sector. Maybe the regulations will be prudent, leave room for innovation, and give institutional investors clarity on the sector and confidence to invest. Wishful thinking? We’ll see.

In the meantime, let’s wrap this up with Erik Voorhees’ closing remarks from the debate he had with SBF on October 28th.

We, those of us in this ecosystem, this industry, have created, essentially, a new financial foundation for the whole world. This is a huge responsibility. And the entire purpose of this financial foundation is that all of humanity can use an open, immutable financial layer. We are separating money from politics. We are separating money from the state. And, in the same way that the church was separated from the state, and everyone now hails that as one of the greatest things that humanity ever did, it comes to us to do the same for money. Money is as, or more, important to people than religion is. We interact with it every day, in all sorts of manners and, just as mathematics or language are immutable and open to the entire human race, so too should the exchange and management of money. That is the system that makes this entire ecosystem important; that is the principle that justifies everything that we do, and if we lose that, it will be something that we regret for the rest of our lives, because we had that opportunity. We can’t protect that principle when it comes to centralized custodians, granted, but we can protect that principle when it comes to decentralized immutable finance, which we call DeFi. That line exists to the degree that we all defend it. So that’s what I’m trying to do. And my request to Sam and anyone else working on this bill is to exclude DeFi from its conception. Not because DeFi shouldn’t ever be regulated, but because it is too important to screw that up and it should not be included in a bill that contemplates how normal custodians should operate. So, it’s a very pragmatic request and hopefully we can have more of these discussions in the future as this bill comes out.

Erik Voorhees

Thank you for reading.

I’m the founder of Youxia Crypto, an asset management company specializing in crypto. I can help you buy and sell precious metals too. I believe crypto is more than just about trying to make money, it’s about creating freedom for oneself and the rest of the world. I’m a contrarian, voluntaryist, and proponent of Austrian Economics. I enjoy downhill skiing, scuba diving, live music, yoga, and traveling.

The intended use of this material is for informational purposes only and is not intended to be an offer or solicitation for the sale of any financial product or service or a recommendation or determination that any investment strategy is suitable for a specific investor. Investors should seek financial advice regarding the suitability of any investment strategy based on the objectives of the investor, financial situation, investment horizon, and their particular needs. This information is not intended to provide financial, tax, legal, accounting or other professional advice since such advice always requires consideration of individual circumstances. The investments discussed herein are not insured by the FDIC or any other governmental agency, are subject to risks, including a total loss of the principal amount invested. Past performance is no guarantee of future returns.