Bitcoin,THORChain (RUNE)

GBTC Outperforms Bitcoin & RUNE Outperforms Crypto

September 12, 2023

GBTC has proven to be a great speculation over the last year. GBTC is outperforming bitcoin because the discount to NAV on the shares is decreasing (note the double negative).

Last summer on June 24th, 2022 I sent you an email titled “How to Buy Bitcoin at a Discount.” On that day, GBTC closed at $13.85. On Aug 31st, 2023, GBTC closed at $18.71, up 35%. Bitcoin closed at $21,216 on June 24th, and on Aug 31st it closed at $25,942, up 22%. GBTC is up 57% more than bitcoin over the last year and a bit.

If you were savvy enough to buy GBTC in December 2022, when everything was down, you would be up 128% right now versus bitcoin only being up 55%. Not bad for a bear market!

Why is this happening?

The decreasing discount to NAV on the GBTC shares is how the market is pricing in the likelihood of a spot bitcoin ETF being approved by the SEC. When a spot bitcoin ETF is approved, the discount to NAV on GBTC should go to zero percent immediately.

The discount to NAV had a big decrease on Aug 29th when Grayscale won their court case against the SEC.

The SEC has been denying Grayscale, and others, from creating a spot bitcoin ETF because they think the spot bitcoin price can be manipulated. If that were true, then why did the SEC approve two ETFs that trade bitcoin futures? If the spot bitcoin price can be manipulated then that would affect the bitcoin futures price, and in turn an ETF trading those futures. Yes, this is how ridiculous the SEC is.

We agree. The denial of Grayscale’s proposal was arbitrary and capricious because the Commission failed to explain its different treatment of similar products. We therefore grant Grayscale’s petition and vacate the order.

Opinion for the Court filed by Circuit Judge RAO

The court ruling in favor of GBTC does not mean a bitcoin ETF has to be approved. The ruling means the SEC can’t keep using the excuse of market manipulation to reject an ETF. The SEC could quite possibly come up with a new reason to reject the ETFs, only time will tell.

The SEC has until mid October to come up with a new excuse or stop being difficult and approve the ETFs. There are 11 total applications and if one gets approved, they all should.

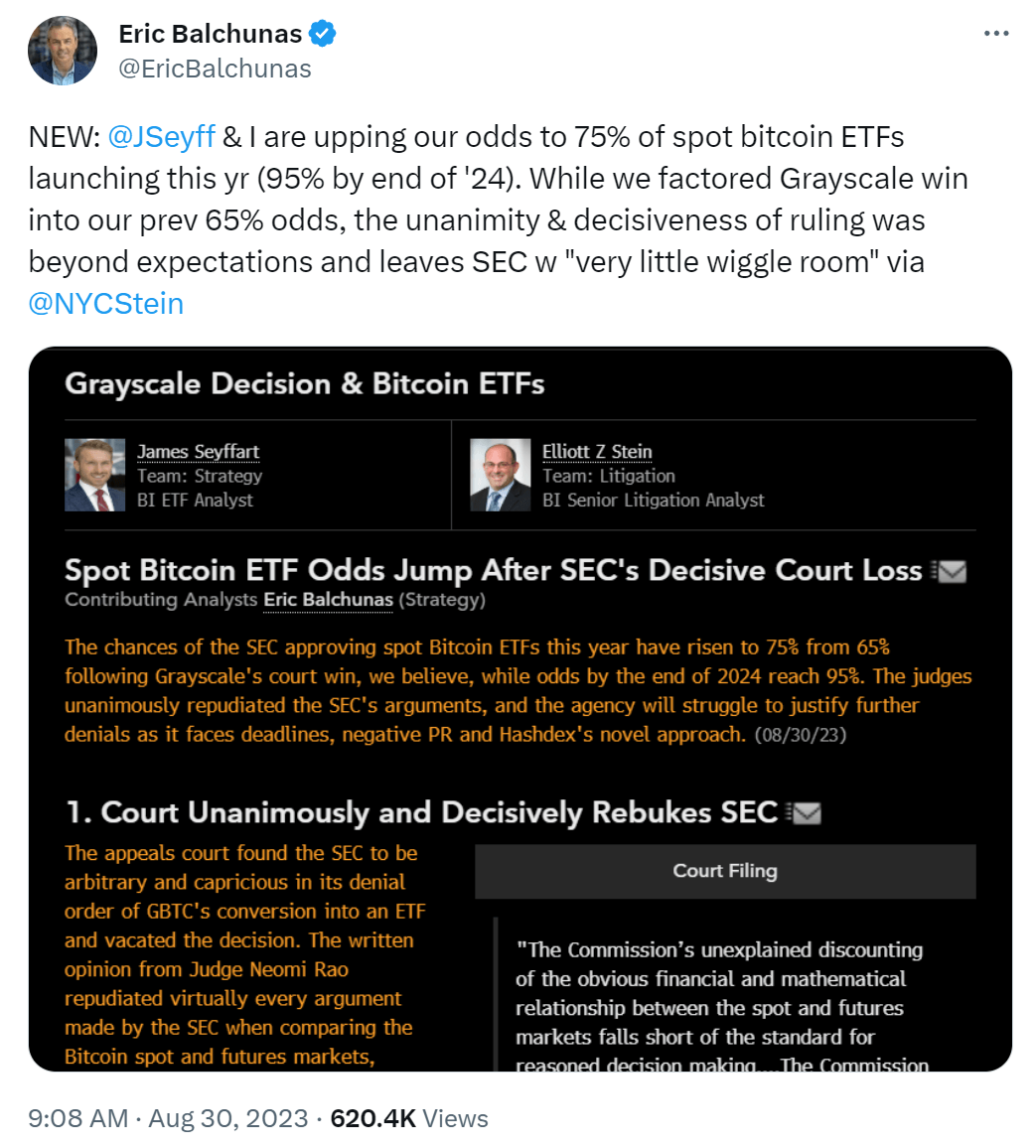

It’s broadly accepted that a spot bitcoin ETF will become a reality. Bloomberg analysts give it a 75% chance by the end of 2023 and a 95% chance by the end of 2024.

Even Jay Clayton weighed in on the subject. He was the SEC Chairman before Gary Gensler and was asked on CNBC if he would approve a spot bitcoin ETF. He said:

It is clear that bitcoin is not a security. It is clear that bitcoin is something that retail investors want access to, that institutional investors want access to. And importantly, some of our most trusted providers, who are fiduciaries or have duties of best interest, want to provide this product to the retail public… An approval is inevitable.

Jay Clayton, Former SEC Chairman

I believe a spot bitcoin ETF will be the catalyst for a new bull market in crypto. It will open the door to a whole new pool of capital that hasn’t been able to buy bitcoin in the past. All it will take is 1% of this money being allocated to have a tremendous effect on the bitcoin price. And when bitcoin takes off, so does the rest of the crypto market.

Therefore, the time to get positioned in crypto is before a spot bitcoin ETF is approved. The timing right now is fantastic because the broader crypto market is still in a bear market, so you couldn’t ask for a better entry point.

The news above overshadows the news on THORChain (RUNE)

In August, RUNE was the best performing crypto of the top 100. Up over 60%. RUNE was one of only four tokens in the green. The rest of the top 100 tokens were down 10–30%.

Two features launched on THORChain at the beginning of August that caused the out performance. Streaming swaps and lending.

Streaming swaps on THORChain are now the cheapest place to swap crypto in the whole sector. Literally. Cheaper than all decentralized exchanges (DEXs) and centralized exchanges (CEXs). This is achieved by taking a single swap and breaking it up into a bunch of smaller swaps done every several seconds (every block). The cheaper fees should attract and boost volume over time, increasing the value of RUNE.

Lending garnered more attention as it’s quite revolutionary, even by crypto standards.

You can now use your bitcoin as collateral and borrow against it on THORChain. Many centralized finance (CeFi) entities have offered this in the past, but THORChain is the first to offer it in DeFi. And the terms are unparalleled. No interest, no maturation date, no liquidations.

How’s this possible?

It’s because THORChain takes the bitcoin collateral, sells it, uses the proceeds to buy RUNE tokens, then burns those tokens. This is deflationary on the RUNE supply and increases the price. The bitcoin collateral is effectively held as equity in RUNE.

Since this has a positive impact on the RUNE price, from the protocol’s perspective, it never wants users to pay back their loan.

When a user pays back their loan, the protocol then has to create new RUNE tokens, sell them, use the proceeds to buy back the bitcoin, and deliver the bitcoin back to the user. By inflating the RUNE supply and selling the tokens, this will decrease the RUNE price. This is why the protocol never wants the loans to be paid back.

The real question is whether a loan, from open to close, is net inflationary or deflationary on the RUNE supply. The answer is based on the price ratio of RUNE:Bitcoin over time. If the ratio is up from the time the loan was originated, the net effect on the RUNE supply will be deflationary. If the ratio is down from the time the loan was originated, the net effect on the RUNE supply will be inflationary.

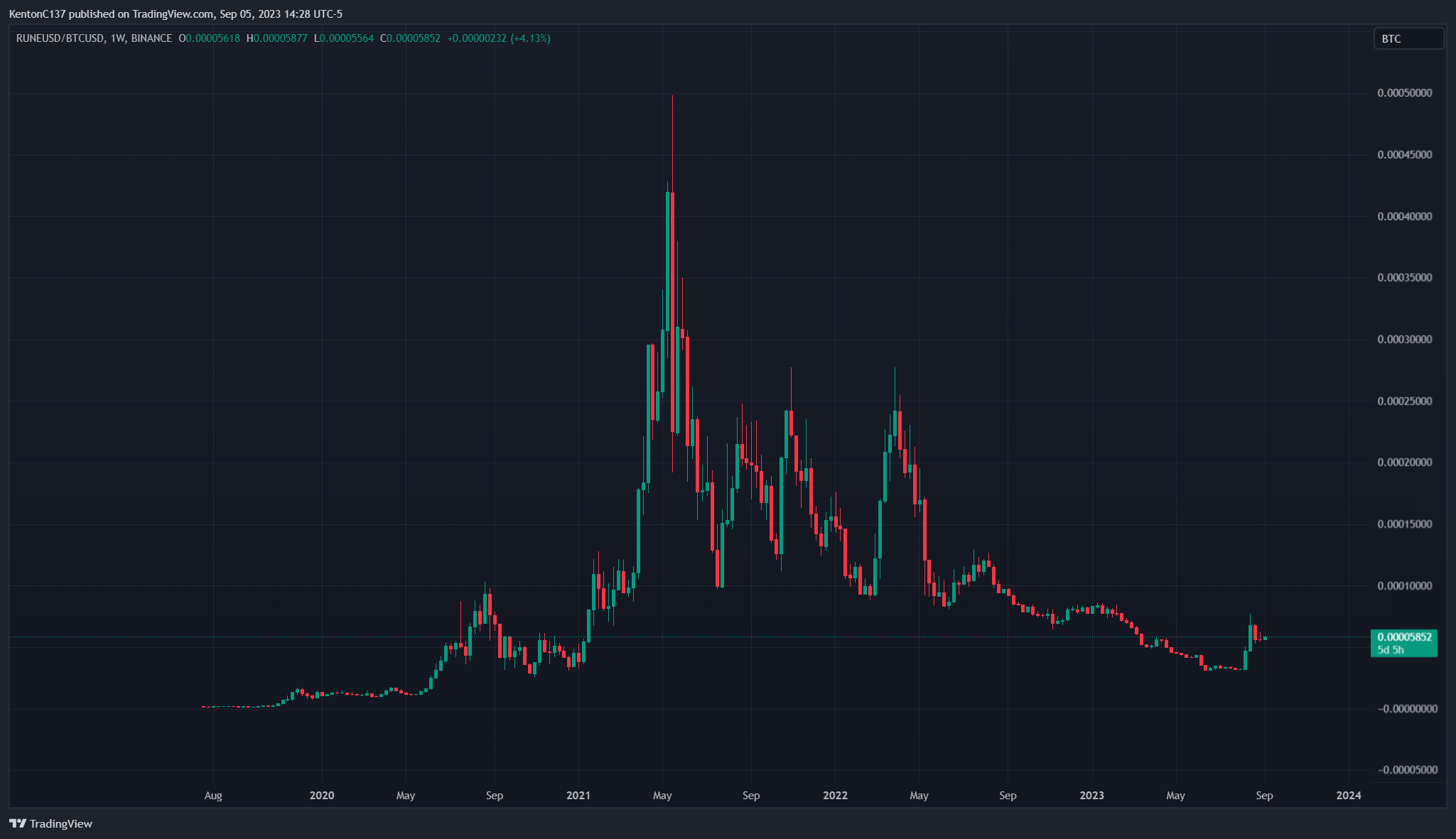

The RUNE:Bitcoin price ratio is at the bottom end of its historical range right now. That’s what the chart below is. Apologies for the small text and numbers, but they aren’t that important anyway. The line says it all.

Since the lending feature is being launched while the RUNE:Bitcoin ratio is so low, it’s likely that in the end the majority of loans taken out and repaid will end up being net deflationary on the RUNE supply. I believe this is why the RUNE price was the top performing crypto in August and was amongst the most heavily traded. The entire market cap of RUNE traded over the month of August.

The market has been piling into RUNE to front run the lending feature before THORChain burns millions of dollars worth of RUNE and drives up the token price.

You should pile in too.

Now’s the time to buy RUNE before the lending feature matures, and drives up the RUNE price. You should also buy RUNE before a bitcoin ETF is approved and drives up the crypto market.

Youxia Crypto RUNE Fund

Join Youxia Crypto’s RUNE Fund.

The fund will buy the RUNE token for capital gains potential and stake the token in the THORChain network for yield. Staking on THORChain means running nodes on THORChain.

Running nodes is where it gets fun. The nodes secure the exchange and, in return, they collect revenue from the swapping fees. The exchange will grow proportionally with the revenue from the fees. Therefore, the yield should prove to be as good as the capital gain.

$1 invested today could yield $1/year and eventually $1/month. All while sitting on a large capital gain.

The plan is to compound the yield for the first few years and wait for the token price to go up, then start paying the yield out to you as income. Ideally, the fund will last for decades. There’s no reason to wind it up if we can collect passive income for decades to come.

You can invest with fiat, crypto, or a mix of fiat and crypto.

Let me know if you want to get access to the offering documents.

To learn more about THORChain:

Read this report — THORChain Investors Guide

and

Watch this video — THORChain (RUNE) Introduction — Explained for Beginners

Thank you for reading.

I’m the founder of Youxia Crypto, an asset management company specializing in crypto. I can help you buy and sell precious metals too. I believe crypto is more than just about trying to make money, it’s about creating freedom for oneself and the rest of the world. I’m a contrarian, voluntaryist, and proponent of Austrian Economics. I enjoy downhill skiing, scuba diving, live music, yoga, and traveling.

The intended use of this material is for informational purposes only and is not intended to be an offer or solicitation for the sale of any financial product or service or a recommendation or determination that any investment strategy is suitable for a specific investor. Investors should seek financial advice regarding the suitability of any investment strategy based on the objectives of the investor, financial situation, investment horizon, and their particular needs. This information is not intended to provide financial, tax, legal, accounting or other professional advice since such advice always requires consideration of individual circumstances. The investments discussed herein are not insured by the FDIC or any other governmental agency, are subject to risks, including a total loss of the principal amount invested. Past performance is no guarantee of future returns.