Bitcoin

How to Buy Bitcoin at a Discount

June 24, 2022

Want to know an easy way to buy bitcoin at a discount?

Wait a few days.

Zing! I’m here all week folks.

Seriously though, I do have a good idea on how you can buy bitcoin at a reduced price. 30% off as I type. With bitcoin trading at $20k this means you can effectively buy bitcoin at $14k.

You can do this through the Grayscale Bitcoin Trust (GBTC). GBTC has a fixed number of shares and a fixed number of bitcoin backing them. The shares are currently trading at a 30% discount to the value of the bitcoin behind each share.

Arbitrageurs can’t close the gap because the GBTC shares are not redeemable for bitcoin. Therefore the share price is at the mercy of the market.

This will change when the SEC approves GBTC to become an ETF. Once approved, traders will be able to exchange GBTC shares for bitcoin and arbitrage the price. GBTC will start trading at fair value and the discount will be gone. If a 30% discount turns into a 0% discount, that works out to a 43% gain on the share price. Not bad for one day’s work!

This could happen as soon as the first week of July. The SEC is reviewing proposals on two spot bitcoin ETF’s. Bitwise is expecting a decision on July 1st and Grayscale is expecting a decision on July 6th. If the SEC approves the Bitwise spot ETF first, then I anticipate the GBTC shares to go up based on the probability the SEC will approve Grayscale’s application too.

These decisions were supposed to come at the end of 2021 however the SEC has kept delaying. They haven’t been saying no, which I interpret as a good thing. They could delay their decision yet again or say no this time. Either way, I believe a spot bitcoin ETF is inevitable.

Canada has 3 spot ETF’s, Australia and Switzerland each have a spot ETF, the SEC has approved a long futures based ETF, a short futures based ETF, and Fidelity now gives their clients the ability to put 20% of their 401k into bitcoin. It’s rather ridiculous the SEC is holding this up for so long.

Robert E. Whaley agrees. Whaley has developed several indexes, most notably the VIX in 1993. On May 25th, he wrote a letter to the SEC pleading the case for Grayscale’s spot ETF be approved.

The three key elements that cause me to strongly endorse the NYSE Arca application to list and trade shares of GBTC under NYSE Arca Rule 8.201-E as a spot bitcoin ETP are: (a) the XBX bitcoin index that GBTC is priced on is virtually a perfect substitute for the BRR index that underlies the return-risk exposure for the futures-based ETFs that the Commission has already approved, (b) the bitcoin spot market is vastly deeper and more liquid that the bitcoin futures market, and © the product structure is much more transparent and well-designed.

Proposed Rule Change to List and Trade Shares of Grayscale Bitcoin Trust (BTC)

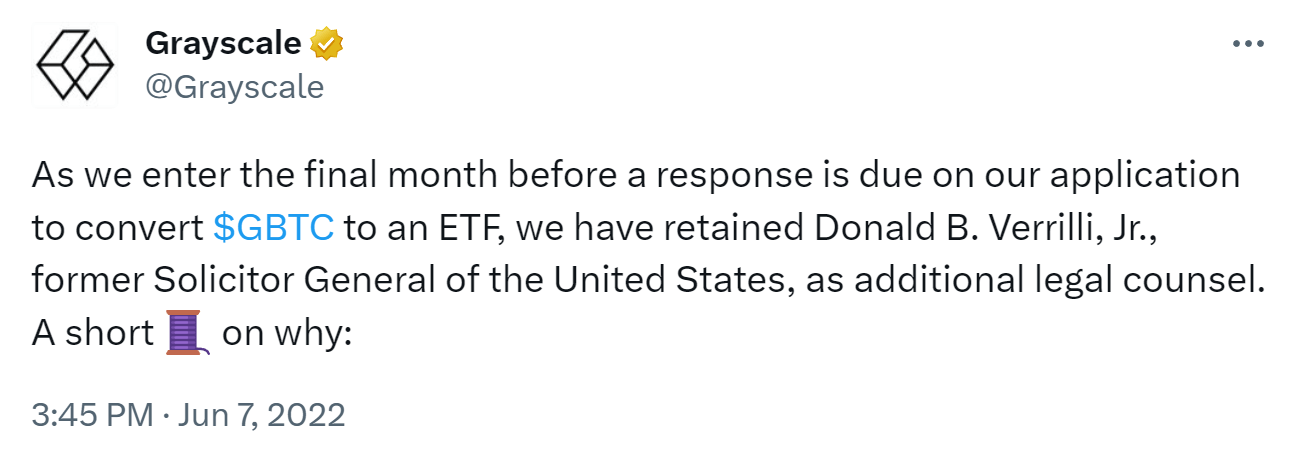

Grayscale also retained a former solicitor general to help push the application through. They are doing everything they can to get approved.

If the SEC does not approve the application, then the GBTC shares will continue trading at a discount like they have been for months. A rejection by the SEC does not mean a spot ETF will never be approved. It just means back to the drawing board and resubmitting the application, addressing the concerns in the rejection. It’s a matter of when, not if, a spot bitcoin ETF will be approved.

If the spot ETF is approved in July, I don’t believe it will have a big impact on the bitcoin price in the short term. It will be a newsworthy event, but it will take time for it to have a positive effect on the bitcoin price.

In the meantime bitcoin could still go lower.

The issues with Three Arrows Capital (3AC) and Celsius Network are not resolved. If either of them collapse, they will most likely take other entities down with them. Even if they don’t fail, other hedge funds could be seeing redemptions right now with the sentiment so negative. There could be more downside yet in the sector. I see bitcoin’s next level of support at $16k and the major level of support at $12k.

I’m viewing the last two weeks as capitulation in the sector. I don’t know how long it will last, but it shouldn’t drag on for several months. When institutions blow up, they’re forced to sell what assets they have left, driving prices down further. This forced selling is the first domino to fall. Once the first one goes, the rest follow, and they all go down at once.

When the dominoes are done falling, we bottom, and the sector will start to recover.

If 3AC and Celsius end up being fine then maybe we’ve already seen the bottom. Only time will tell.

The fundamentals of bitcoin haven’t changed over the last two months. Only the price has. Therefore, we have to ride this out. It gives us an opportunity to buy cheap again, and those who feel like they’ve missed out have another kick at the can.

I know its not funny if you’re down right now, but if you hold and/or buy, in a few years’ time I believe you will have a big smile on your face.

Thank you for reading.

I’m the founder of Youxia Crypto, an asset management company specializing in crypto. I can help you buy and sell precious metals too. I believe crypto is more than just about trying to make money, it’s about creating freedom for oneself and the rest of the world. I’m a contrarian, voluntaryist, and proponent of Austrian Economics. I enjoy downhill skiing, scuba diving, live music, yoga, and traveling.

The intended use of this material is for informational purposes only and is not intended to be an offer or solicitation for the sale of any financial product or service or a recommendation or determination that any investment strategy is suitable for a specific investor. Investors should seek financial advice regarding the suitability of any investment strategy based on the objectives of the investor, financial situation, investment horizon, and their particular needs. This information is not intended to provide financial, tax, legal, accounting or other professional advice since such advice always requires consideration of individual circumstances. The investments discussed herein are not insured by the FDIC or any other governmental agency, are subject to risks, including a total loss of the principal amount invested. Past performance is no guarantee of future returns.