THORChain (RUNE)

How Would John D. Rockefeller Invest in Crypto?

July 3, 2023

If I came to you all excited with an investment idea and summed it up in one word:

Infrastructure!

What would you think? You’d scrunch your face at me and wonder if I’m serious. Infrastructure? Like a utility? Borrrring.

Utilities are considered defensive stocks because they’re relatively stable. Which, in turn, means they don’t go up much either.

Oil pipelines are okay, if you’re looking for income. A railroad might be interesting, like Warren Buffet buying 100% of Burlington Northern Santa Fe in 2009. Burlington was Berkshire’s single biggest investment ever and remains one of their largest positions. The railroad has proven to be a great investment for Buffet, since the Keystone pipeline from Canada to the U.S. got rejected. Instead of oil coming to the U.S. in a pipeline, which is the safest and most environmentally-friendly way to do it, that same oil comes to the U.S. on rail cars. Rail cars owned by, you guessed it, Burlington/Berkshire. The mild-mannered Oracle of Omaha had quite the foresight to make that investment (I’m being facetious because Buffet had ties to the main environmental groups who lobbied against the pipeline).

Unless you can pull off something like Buffet did above, buying infrastructure is one of the most uninteresting things in the world. Yet it’s vital to the economy and our quality of life.

But we’re looking at infrastructure that already exists. A framework that’s been in place for decades. What about building infrastructure from scratch in an emerging economy?

This is Where it Gets Interesting

In the 1800s, America was still being settled. By 1860, the U.S. was the 9th largest economy in the world. Despite the civil war from 1861-1865, the U.S. entered the Gilded Age, and by 1890, was the world’s largest economy. This rapid economic growth was made possible by the investment in infrastructure.

Railroad mileage in the United States tripled between 1865 and 1881. Transported freight increased by 643%. Steel production increased by 7,986% within 16 years. U.S. steel production surpassed the combined totals of Britain, Germany and France!

Those who made this possible, such as J.P. Morgan, Andrew Carnegie and Cornelius Vanderbilt, became the wealthiest people in the world. Their families are still living off those fortunes made 140 years ago. The list isn’t complete without mentioning John D. Rockefeller, considered the richest person in modern history.

Standard Oil Company was established in 1863. 16 years later, Rockefeller controlled 90% of the United States refining capacity. Rockefeller made his fortune by consolidating and vertically integrating America’s oil refineries, transportation and distribution. He didn’t discover oil, he had a monopoly on the entire oil industry’s infrastructure.

The above illustrates the importance of infrastructure to a developing economy and the fortunes that can be made by those who build it.

The Invention of Bitcoin was the Discovery of Digital Property

Digital property is a new frontier being settled right now. And like any physical territory, the crypto economy can’t reach its true potential without infrastructure. Whoever provides that infrastructure should profit handsomely.

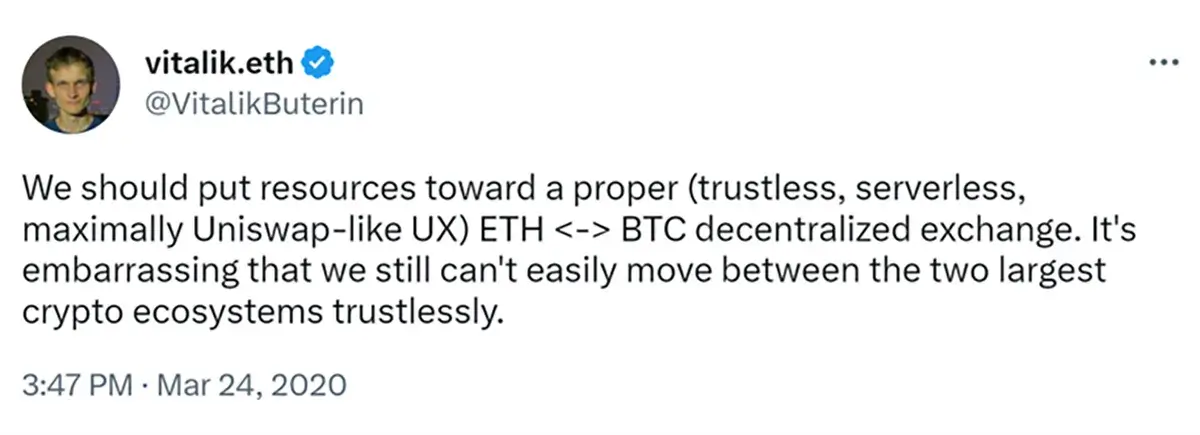

One of the key pieces of infrastructure needed in crypto is the ability to exchange tokens in a decentralized manner. Don’t take it from me though, take it from the inventor of Ethereum.

THORChain is the first decentralized exchange (DEX) to solve this problem. It’s the only way to swap bitcoin for ethereum without going through a centralized exchange (CEX). But it doesn’t stop there. THORChain has made it possible to swap bitcoin with tether, the largest trading pair in the world, and thousands more cryptocurrencies.

Just as railroads made it easy to transport people and goods across vast distances, connecting markets like never before, THORChain makes it easy to transport tokens and value across blockchains, connecting those networks like never before. THORChain’s protocol is a crypto railroad, and RUNE is the token making up the rails.

What About Coinbase and Binance?

You might be thinking, we can already swap bitcoin for ethereum on exchanges like Coinbase and Binance and many others. Why do we need another exchange?

Those are all centralized exchanges. All the hacks and frauds in crypto have occurred on CEXs. The whole point of decentralization is to protect ourselves from those scandals. Those problems exist because of centralization. Decentralization neutralizes those risks.

Coinbase and Binance are just necessary evils to get us to where we want to end up. They do serve a purpose as on/off ramps to fiat money, so they aren’t going away anytime soon. They will just be dwarfed by THORChain, and they will even end up using THORChain in the background.

Plus, only 2 billion people have access to Coinbase and Binance. The 6 billion unbanked and underbanked people in the world can’t access a CEX because they don’t use the traditional financial system (TradFi). But they do have smartphones and they can download a crypto wallet.

THORChain is Core Infrastructure for Crypto

Rockefeller didn’t explore and drill for oil, he refined it, he created new products with it, he made it more accessible to the U.S.

THORChain is building products around bitcoin and making it more accessible to the whole world.

THORChain is more than the first DEX to support bitcoin. THORChain is the first DEX to have the ability to deposit bitcoin to earn yield off it, like a savings account. Soon, THORChain will be the first DEX that offers borrowing against bitcoin, so people don’t have to sell it and can free up capital. Perpetual futures are being worked on. All these products already exist in centralized finance (CeFi), but THORChain is bringing them to decentralized finance (DeFi). Just like railroads existing in Europe, and the industrialists bringing them to America and making fortunes.

THORChain has a monopoly on bitcoin’s DeFi infrastructure. It has a huge head start on its network effects, which should cement it in place for many years to come. Just like building railroads, pipelines and roads - once in place, they tend to stay there a very long time.

Anyone can interact with THORChain, and anyone can integrate it. Trust Wallet has already done it. Ledger is working on it. Many more are working on it and, eventually, every wallet will integrate THORChain, strengthening its monopoly.

Why?

Because everyone wants the ability to swap bitcoin inside their wallet and the wallet provider can start earning revenue.

Crypto wallets follow the Silicon Valley business model of getting lots of users, then finding a way to monetize them later. These wallets have been around for several years without any means to generate revenue. Until now. By integrating THORChain, a wallet can customize their own commissions on each swap and start making money.

As each new integration goes through, it puts pressure on other wallets to follow suit because who wants to use a wallet that can’t swap bitcoin? And what wallet will say no to revenue? It’s a win-win.

Eventually, everyone will take for granted the ability to swap bitcoin inside their wallets just like we take running water for granted today.

Infrastructure Inversion

This video by Andreas Antonopoulos is an excellent, easy to understand, explanation of how crypto is going to take over the financial system. It will help you understand how a DEX like THORChain will eventually engulf CEXs like Coinbase and Binance.

Learn More About THORChain

Read this report — THORChain Investors Guide

and

Watch this video — THORChain Introduction — Explained for Beginners

Thank you for reading.

I’m the founder of Youxia Crypto, an asset management company specializing in crypto. I can help you buy and sell precious metals too. I believe crypto is more than just about trying to make money, it’s about creating freedom for oneself and the rest of the world. I’m a contrarian, voluntaryist, and proponent of Austrian Economics. I enjoy downhill skiing, scuba diving, live music, yoga, and traveling.

The intended use of this material is for informational purposes only and is not intended to be an offer or solicitation for the sale of any financial product or service or a recommendation or determination that any investment strategy is suitable for a specific investor. Investors should seek financial advice regarding the suitability of any investment strategy based on the objectives of the investor, financial situation, investment horizon, and their particular needs. This information is not intended to provide financial, tax, legal, accounting or other professional advice since such advice always requires consideration of individual circumstances. The investments discussed herein are not insured by the FDIC or any other governmental agency, are subject to risks, including a total loss of the principal amount invested. Past performance is no guarantee of future returns.