Bitcoin

Investment Advisors Will Start Recommending Bitcoin

July 14, 2023

For years, most investment professionals hated on bitcoin. Many still do. They don’t just disagree with bitcoin, they have a vitriol hostility towards it.

Why?

Because bitcoin shines a light on their ignorance and incompetence. Instead of acknowledging they missed out on the best investment of our lifetimes, or that they simply don’t understand it, they have to make up excuses why everyone else is wrong. It’s the same psychology as an investor refusing to sell an investment at a loss when it doesn’t work out. Selling at a loss means having to admit you’re wrong. No one wants to admit they’re wrong, so they ride the investment to zero. Most people would rather die than change their minds.

Successful investors make mistakes too, but they know when to admit they’re wrong and move on. We’re seeing this play out in real time with the largest investment firms in the world. All of them criticized bitcoin for years.

Bitcoin is an index of money laundering.

BlackRock CEO, Larry Fink, 2017

Bitcoin has no future.

Societe Generale CEO, Frederic Oudea, 2017

I don’t have a single portfolio manager who has told me we should buy crypto, not a single portfolio manager.

Citadel CEO, Ken Griffin, 2018

Fast forward to today, and the firms above, along with many others, are now scrambling to get into crypto. Don’t listen to what people say, watch what they do.

BlackRock, the world’s largest asset manager, just applied to the SEC for a spot bitcoin ETF to be traded in the U.S., using Coinbase as the custodian. They’ve applied for 576 ETFs in the past and only 1 has been rejected. They’re the top dog when it comes to creating investment products and allocating money to them.

Therefore, if anyone can get a spot bitcoin ETF approved, it’s BlackRock.

Within days of the BlackRock announcement, Wisdom Tree and Invesco applied for spot bitcoin ETFs. Then Valkyrie Funds applied for one. Then Bitwise Asset Management. Then Fidelity Digital Assets. And Ark Invest amended their previous application to copy BlackRock’s.

The discount to NAV on Grayscale’s Bitcoin Trust (GBTC) went down to 1-year lows on the news (note the double negative). Grayscale is in court with the SEC right now, fighting to get their spot bitcoin ETF approved. There’s a rumor that they could win the case in August. If there’s any truth to the rumor, and the news is being leaked, the discount to NAV on GBTC should creep towards zero as we get closer to the announcement.

In other news, HSBC, the largest bank in Hong Kong, now allows their customers to buy bitcoin ETFs. Deutsche Bank, the largest bank in Germany, is seeking approval to offer custody services for cryptocurrencies. NASDAQ, the second largest U.S. stock exchange, is preparing to launch its own cryptocurrency custody service. Santander Bank just got a license in France to custody crypto. France’s second-largest bank, Societe Generale, already has a crypto custody license. And now we have Fidelity Digital Assets, Charles Schwab, and Citadel Securities launching a new crypto exchange called EDX.

All of the above happened within 2 weeks of the SEC filing charges against Coinbase and Binance. Seems rather suspect.

If you believe the SEC protects the average investor, then you probably think there’s more than two genders. That’s the sales pitch the SEC gives to the public, but who they actually protect is the establishment, by preventing competition. This is what all regulatory bodies do. The SEC is trying to hamstring the competition to allow the TradFi incumbents time to catch up. Meanwhile, I bet you a ribeye steak dinner that Sam Bankman-Fried will not go to jail.

I believe Coinbase and Binance will be fine, but they’ll be distracted by the court cases while their competition gets up and running without impediments.

Nevertheless, this is all great for the price of bitcoin.

What Impact will a Spot ETF have on The Price of Bitcoin?

First, it’s interesting to see what impact the spot gold ETF (GLD) had on the gold price.

Prior to GLD launching in November 2004, gold did pretty much nothing for 15 years. However, after GLD started trading, gold went up 420% over the next 7 years. Gold’s market cap went from $2.2 trillion to $10.5 trillion in that time frame. That’s a gain of $8.3 trillion in market cap.

Was the whole rally due to GLD? Unlikely because GLD peaked with a $0.07 trillion market cap which was less than 1% of the total gain in gold’s market cap. But offering another way for institutions to buy gold didn’t hurt.

However, the next bitcoin rally could be due to a spot bitcoin ETF getting approved. Prior to GLD it was easy to buy gold and despite it being mocked as an investment, banks still happily supported it.

Today, banks are only just starting to support bitcoin and it’s still rather cumbersome to buy. Especially for institutional investors and asset managers. That will all change when the custodians are established, and a spot bitcoin ETF gets approved in the U.S. It will make bitcoin accessible for the first time to a whole new pool of capital.

What Happens if 1% Moves into Bitcoin?

BlackRock is the world’s largest asset manager with $9.1 trillion in assets under management (AUM).

Fidelity has $11.1 trillion in assets under administration (AUA).

That’s $20.2 trillion right there. Add up all the other companies mentioned above, and we easily get over $25 trillion that will suddenly have access to buying bitcoin.

Once those companies’ products are live, they’re going to promote them. They want them to succeed. Fidelity has been publishing research for a few years now recommending a 1% portfolio allocation to bitcoin. This research isn’t going to kids buying meme coins on reddit. It’s directed towards family offices and pension funds. It’s reasonable to expect BlackRock and the rest to do something similar.

1% of $25 trillion is $250 billion. What would happen to the bitcoin price if $250 billion moved into it?

The current market cap of bitcoin is $600 billion. $250 billion represents 40% of the bitcoin supply. That much buying pressure would send it through the roof!

But let’s dig a little deeper.

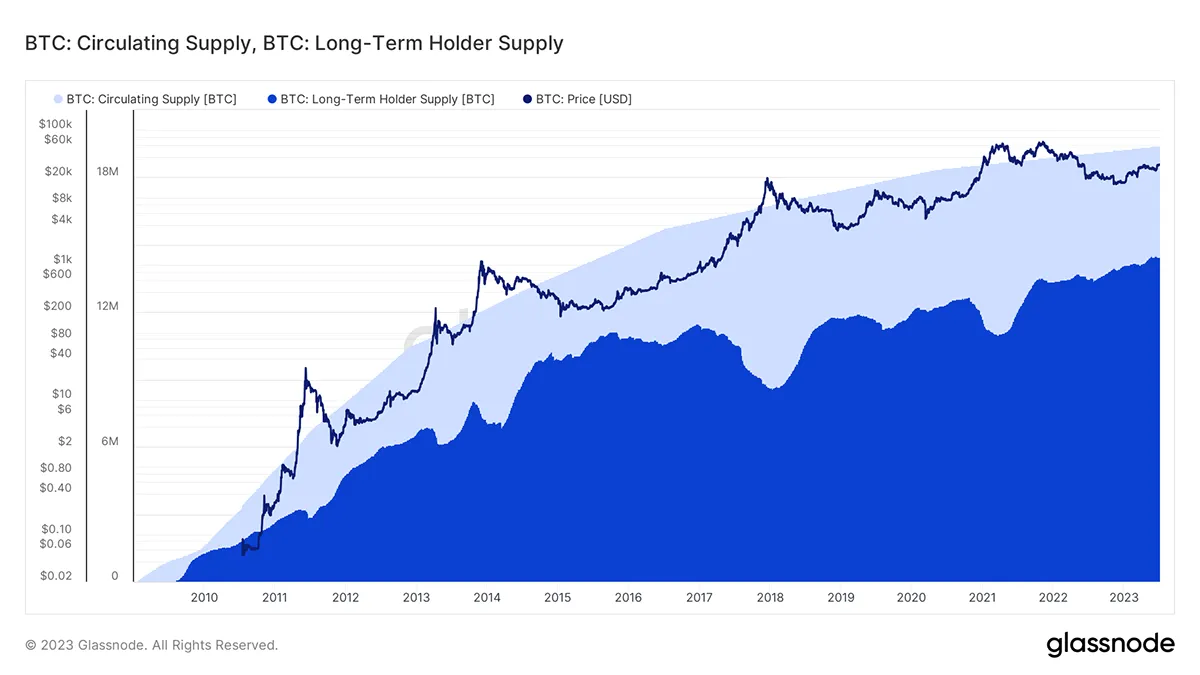

Notice the blue Long-Term Holder Supply on the chart above. This represents the bitcoin that hasn’t moved in 155 days or longer. Notice how it’s been steadily increasing over time. These holders are considered strong hands and they only sell into the big bull markets. The Long-Term Supply is 14.47 million right now. Subtract that from the total supply of 19.42 million and the free float on bitcoin is 4.95 million.

That means only 4.95 million bitcoin are available for sale right now, or 25% of the supply. At $30,000/bitcoin, that’s $148.5 billion. What will happen when $250 billion of buying pressure goes after that $148.5 billion bitcoin?

It will cause another bull market.

No one noticed the bull market in 2013. The bull run in 2017 piqued people’s curiosity. The rally in 2021 put bitcoin on the map. Now everyone knows about it and every investment advisor in the world has been asked about it. What will happen during the next bull run? Will people be tired of missing out? Now with all the major financial institutions supporting bitcoin, will we see a flood of money coming in?

Any investment advisor who continues to dismiss bitcoin is effectively shorting it with their entire career. When the next bull market comes, who would stay with an advisor that keeps getting it wrong? Their clients will leave.

An advisor with half a brain will tell their clients to put just a couple percent in bitcoin. Even if they still think bitcoin is stupid, they’ll do it to cover their ass. This way, if bitcoin takes off, they can pat themselves on the back. And if it tanks, well it was only a couple percent. No harm, no foul. No matter what happens, they won’t really lose any money, their clients will be okay, and the advisor will keep his book.

I’m sure this is what BlackRock is doing. Like every other asset manager in the world, their clients have been bugging them about bitcoin. Rather than lose those clients and AUM to another firm, they’re creating a bitcoin ETF to keep those clients happy and keep that money at BlackRock. BlackRock doesn’t necessarily care about the underlying investments their clients own, they just want to collect fees on the money they manage.

Larry Fink on Bitcoin

Watch the narrative in the mainstream news change over the next year. Instead of fear-mongering headlines about bitcoin that have dominated the airwaves, they will change their tune as the Larry Finks of the world start promoting their new products. For example, check out the first 5 minutes of this interview.

Get Positioned for the Next Bull Market

Bitcoin has always led the crypto market. When bitcoin breaks out to new highs, it brings the rest of crypto with it. And that’s when we see sparks fly in the smaller tokens, like THORChain. To learn more about it:

Read this report — THORChain Investors Guide

and

Watch this video — THORChain Introduction — Explained for Beginners

Thank you for reading.

I’m the founder of Youxia Crypto, an asset management company specializing in crypto. I can help you buy and sell precious metals too. I believe crypto is more than just about trying to make money, it’s about creating freedom for oneself and the rest of the world. I’m a contrarian, voluntaryist, and proponent of Austrian Economics. I enjoy downhill skiing, scuba diving, live music, yoga, and traveling.

The intended use of this material is for informational purposes only and is not intended to be an offer or solicitation for the sale of any financial product or service or a recommendation or determination that any investment strategy is suitable for a specific investor. Investors should seek financial advice regarding the suitability of any investment strategy based on the objectives of the investor, financial situation, investment horizon, and their particular needs. This information is not intended to provide financial, tax, legal, accounting or other professional advice since such advice always requires consideration of individual circumstances. The investments discussed herein are not insured by the FDIC or any other governmental agency, are subject to risks, including a total loss of the principal amount invested. Past performance is no guarantee of future returns.