Bitcoin

Now's the Time to Buy Bitcoin

June 16, 2022

It’s a bloodbath out there, especially in crypto. I couldn’t have picked a better time to start a crypto asset management company. I believe the sector will bottom soon if it hasn't already, and it will take me a few months before I can start raising money, so the timing should work out well for you.

Other than overall market conditions, the recent selloff in crypto over the last few days appears to be from two things. Three Arrows Capital (a large crypto hedge fund) and Celsius Network (a major centralized exchange and borrowing & lending platform) are facing insolvency. Three Arrows and Celsius are being forced to cover giant margin calls. Celsius is experiencing a bank run and have suspended customer withdrawals.

If either of those two players default, it will cause more forced selling, and there will be more carnage in the sector. I have no insight on how it will play out but I believe we should know soon.

I was starting to think bitcoin bottomed in May. I saw some good signs of capitulation on May 12th when bitcoin dropped to $25k. Then it seemed to be holding up well around $30k where there has been lots of support in the past. Obviously, it didn’t hold and now we’re at the $20k support - the real line in the sand. If bitcoin breaks below $20k a lot of stop losses will be hit, tanking the sector further. With the price below $20k, even the most hardcore bulls will have to admit bitcoin is headed lower.

Over the past year I’ve been saying I don’t think bitcoin will drop below $20k unless there is a stock market crash.

I know what you’re thinking. The stock market is crashing! So shouldn't we expect bitcoin to keep going down? Perhaps, but the contrarian in me is perking up. Everyone I talk to and everything I read is saying crypto is going lower and the stock market is going to crash and bond yields are going through the roof. Sentiment is at record lows. No one is bullish. Either this really is the crash many of us have been waiting for or we rally from here. I don't think there is any middle ground because so many indicators are at multi decade extremes. Something has to give. What should we do then?

The Contrarian Thing to do Right now is Buy

I'm scared to do it and I'm scared to put that in writing. What if I'm wrong? What if crypto goes lower? This fear is the hallmark of contrarian investing. It's easy to say "be greedy when others are fearful" but hard to do. I'm seeing extreme fear out there and feeling it myself. I'm not saying now is the time to go all in, but I've been buying in tranches over the last several days. I fully admit I could be trying to catch a falling knife, but whenever I ignore contrary indicators I always regret it.

Other than simply being contrarian, there are some reasons why we could see a bear market rally in stocks and bonds.

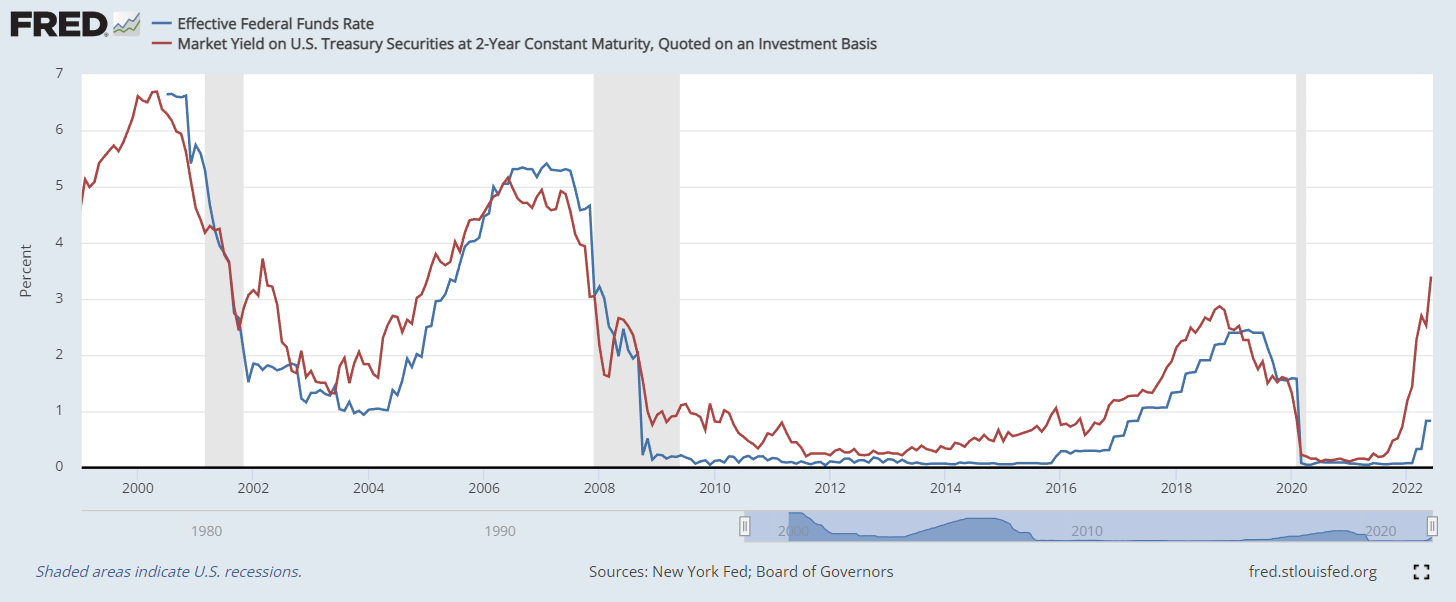

The market is freaked out about The Fed tightening monetary conditions. Yet I’m not so worried about The Fed raising rates. The federal funds rate has gone up in the past without having a big impact on markets. You can see in the chart below how the rate went up from 2004-2007 and 2016-2019. Both periods were bullish for many asset classes. It was when rates started going down, 2007-2008 and 2019-2020, that markets eventually crashed.

Notice on the chart how The Fed just reacts to the 2 yr treasury rate. Interest rates in the economy have already gone up and could be priced in by now. The Fed raising their rate is just catching up with the times.

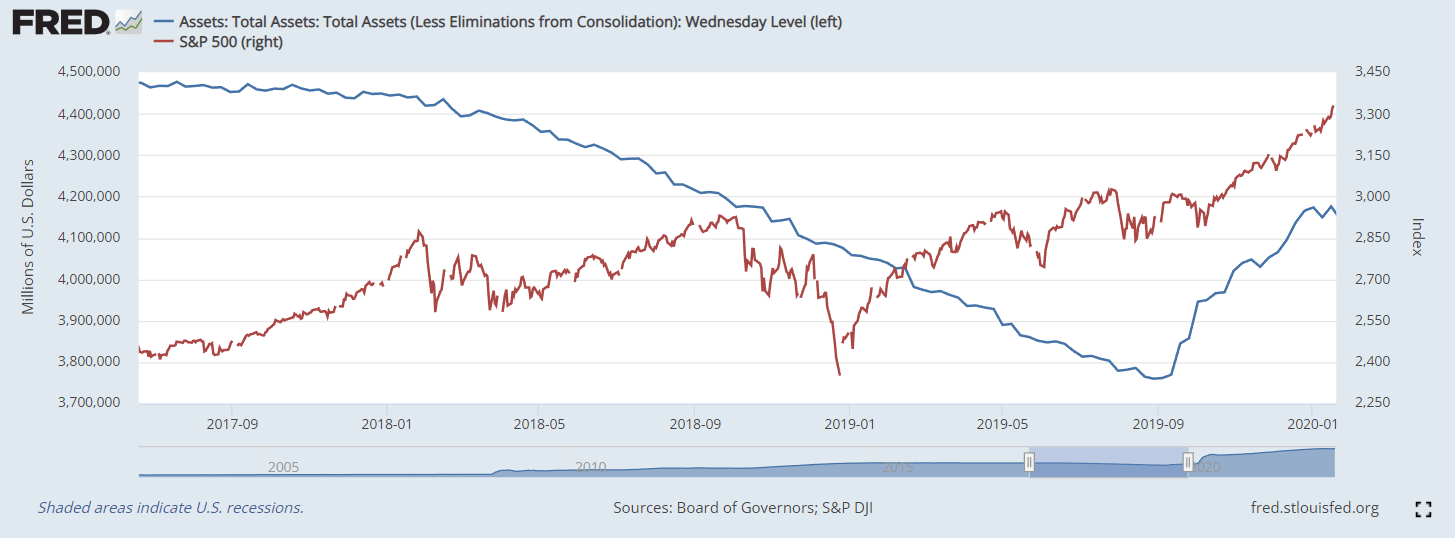

As for The Fed reducing its balance sheet, there isn’t much precedence for it. It’s only happened once before, from Jan 2018 to Sept 2019. Stocks sold off in the Fall of 2018, but then everything rallied at the beginning of 2019, despite The Fed continuing to sell. Therefore, markets can rally even with The Fed is reducing its balance sheet.

With the sentiment in bonds at extreme lows and being the most oversold in decades, we could be due for a dead cat bounce. What if the bond market rallies and The Fed starts selling bonds into the rally? The market could very well absorb it.

The wild card in the above scenario is inflation. I know it doesn’t make sense for bonds to go up if inflation is going up. But it also doesn’t make sense for bonds to have negative interest rates and men to compete in female sports. This is the clown world we live in, so anything is possible.

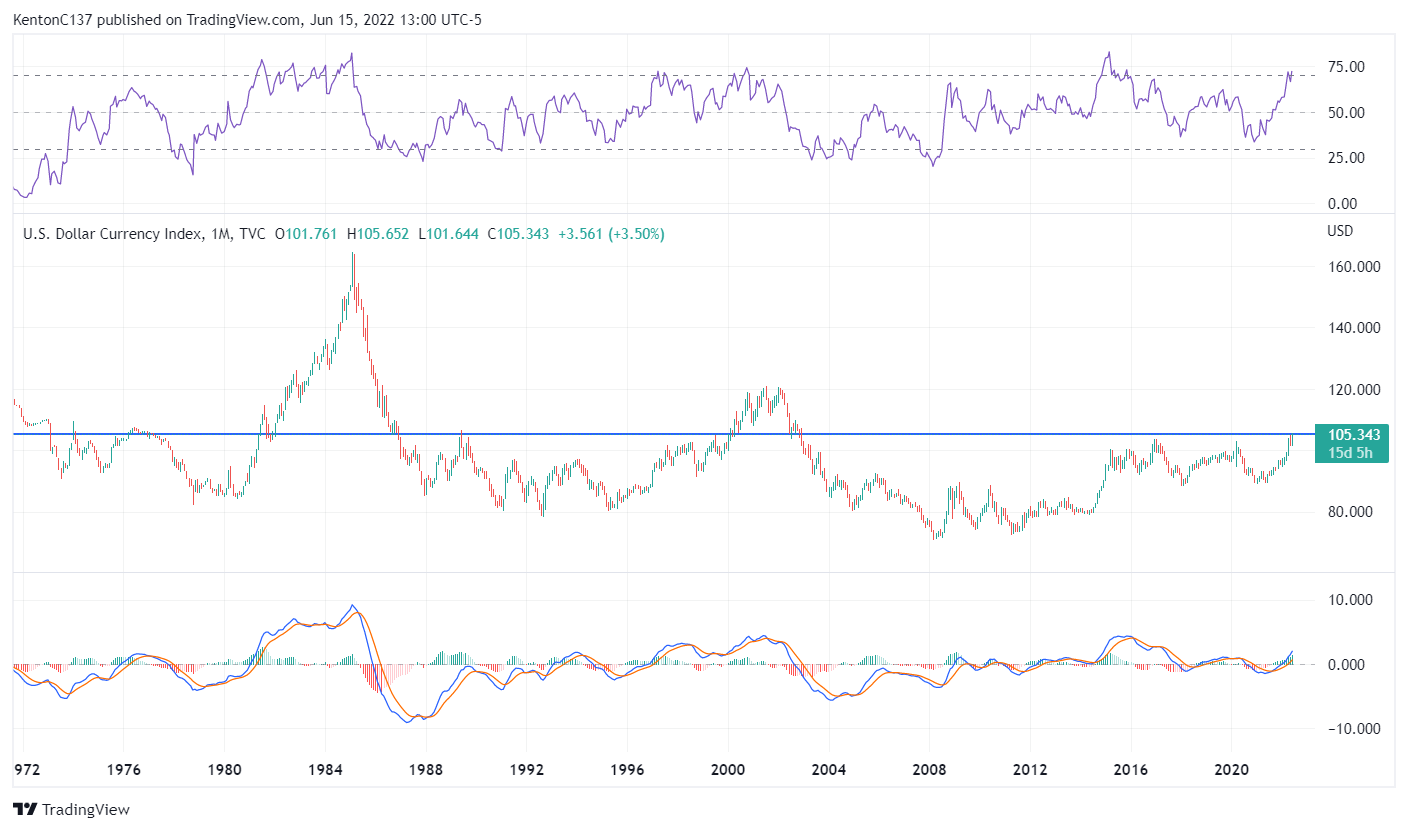

Another thing to consider is when the stock market crashes all correlations go to one. Real estate, precious metals, commodities, etc. all go down together. We aren’t seeing that now. For example, precious metals and oil are holding up quite well so maybe there is enough liquidity in the market to stave off a crash. The one thing that is uncorrelated during a market meltdown is the US dollar. It tends to rally.

The US dollar has already been on a tear over the last year. It’s overbought on a daily, weekly, and monthly basis. The DXY is at 20 year highs and a level of resistance that goes back 50 years. This could be causing the weakness in all markets and a reversal may give markets room to rally.

The strength in the USD highlights how the dollar is still the worlds safe haven. Yes there are problems with the US economy, but there are just as many problems in other countries economies too. Remember, its all relative. Foreigners could view the US stock market as a safer place to invest than their own domestic market. Throughout history, as the periphery collapses, capital flows to the core economy (ie) the United States. If this ensues, the stock market could actually make new highs! How's that for being contrarian?!

I'm not going to hold my breath on that one but I do believe it's plausible. For now, I am holding my breath on crypto finding a bottom soon, if it hasn't bottomed already. If I’m right, then we should see a rally over the next couple months. If I’m wrong, then I still have cash to buy lower and will re-evaluate.

In the meantime, take a big exhale.

Be calm.

Thank you for reading.

I’m the founder of Youxia Crypto, an asset management company specializing in crypto. I can help you buy and sell precious metals too. I believe crypto is more than just about trying to make money, it’s about creating freedom for oneself and the rest of the world. I’m a contrarian, voluntaryist, and proponent of Austrian Economics. I enjoy downhill skiing, scuba diving, live music, yoga, and traveling.

The intended use of this material is for informational purposes only and is not intended to be an offer or solicitation for the sale of any financial product or service or a recommendation or determination that any investment strategy is suitable for a specific investor. Investors should seek financial advice regarding the suitability of any investment strategy based on the objectives of the investor, financial situation, investment horizon, and their particular needs. This information is not intended to provide financial, tax, legal, accounting or other professional advice since such advice always requires consideration of individual circumstances. The investments discussed herein are not insured by the FDIC or any other governmental agency, are subject to risks, including a total loss of the principal amount invested. Past performance is no guarantee of future returns.