General

Performance Fees Kill Performance

July 25, 2023

The idea of a performance fee is to pay an investment manager a profit above and beyond your initial investment. Seems fair, right? It is on the surface, but the devil lies in the details.

A Fisher College of Business paper titled The Performance of Hedge Fund Performance Fees analyzed 6,000 hedge funds from 1995 to 2016. The vast majority of the funds had the standard 20% performance fee, however, the effective fee received by the funds ended up being closer to 50%!

Let me explain why.

Imagine your investment in a fund goes from $100,000 to $1,000,000 in a year. The fund manager takes 20% of the profit (i.e. $180,000) and you keep $820,000. You’re up 8.2x, so you’re happy.

In the second year the fund goes down 50%. Your $820,000 now becomes worth $410,000. It sucks, but you’re still up from your initial investment.

In year three, the fund goes up 300%, and your position is now worth $1,230,000. You’re back in profit and have to pay a performance fee again. A slimeball hedge fund will charge you on performance from $410,000 to $1,230,000, which double charges you. To avoid this, most hedge funds have a high water mark in place. In this example, it means the performance fee is based on the difference between $1,230,000 and $1,000,000. And the new high water mark would be set at $1,230,000.

The new performance fee would be $46,000 and your position is worth $1,184,000. Everyone is happy right? Yes.

But what happens in year four, if the fund goes down 50%? Your position is now worth $592,000. You’re tired of the volatility, and withdraw your money. You’ve still made $492,000 over the last four years, so you’re happy.

The hedge fund, in the meantime, has made $180,000 plus $46,000 equalling $226,000. The fund has made $226,000 while you made $492,000. Therefore the effective performance fee charged by the fund is actually 46%!

The problem in the scenario above is you cashed out while being down. If you cashed out at the top, then the effective performance fee would be 20%.

To make matters worse, you take your $592,000 and invest in a new fund. Now you reset your high water mark down to $592,000. If the new fund does well and your investment goes back up to $1,230,000, you have to pay a performance fee on that profit in the new fund. You will effectively double pay the performance fee.

Here’s Where it Gets Ugly

Lots of hedge funds will wind up if they’re down 50-80% because the poor performance is hard to sell to new investors. The fund rolls over their existing investors into the new fund, however their previous high water marks don’t roll over too. The high water mark gets reset, so loyal investors end up double paying on performance fees.

Reputable investment managers won't do this. They'll keep the fund going for as long as it takes to get their investors back to the original high water mark.

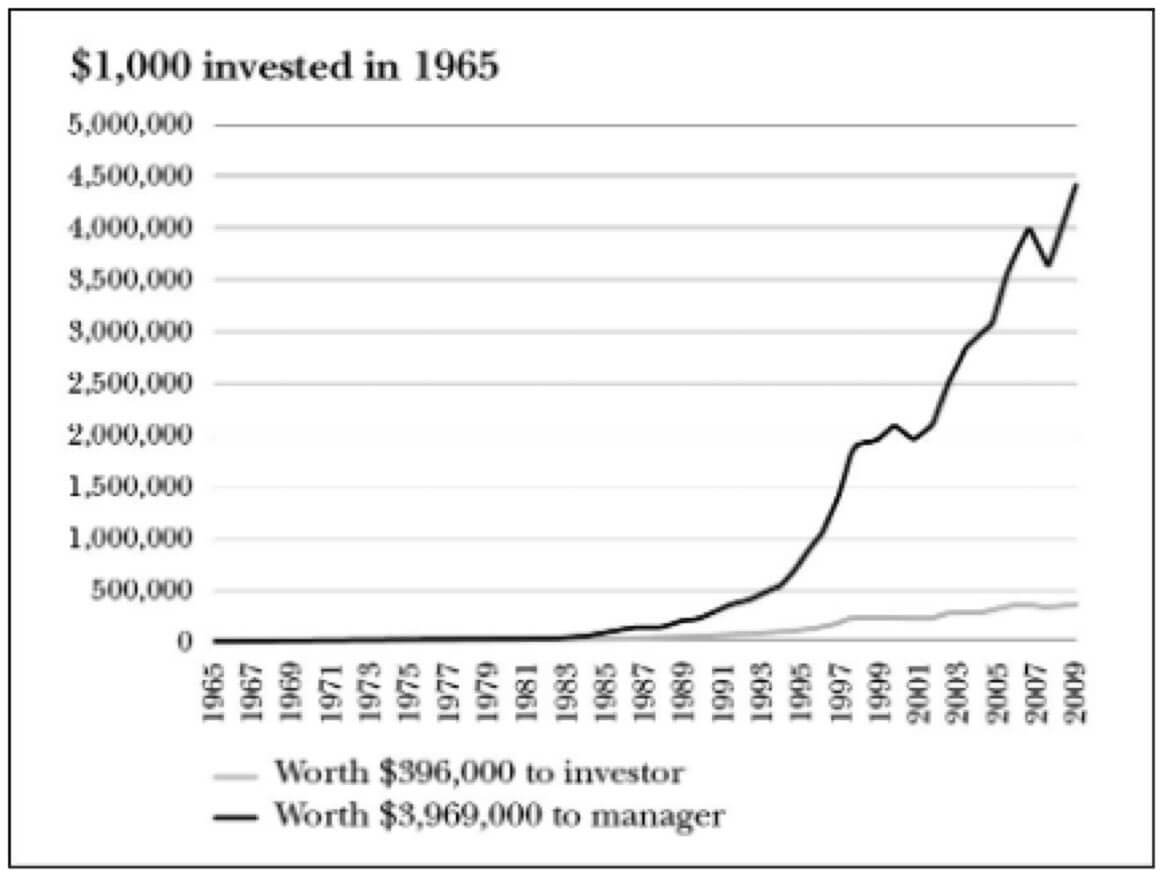

What if you stay in a fund for decades to preserve your high water mark? Paying the performance fees every year can still eat into your total return. Check out this example.

The reason the math above looks so ugly is because the fund’s high water mark is based on the fiat value invested, not the number of Berkshire shares that could have been bought. The performance fee in the fund continuously reduces the number of Berkshire shares allocated to the investor.

Normally when I post a chart and numbers like this I back check them. I didn’t do that for this one, so the numbers may not be correct, but it gets the point across. Performance fees can really kill your upside.

Youxia RUNE Fund Performance Fee is Different

By now you’re thinking, what the hell Kenton, you have a 20% performance fee!

Yes, but I calculate it differently than every other fund in the world.

In my fund, you have to be up in fiat terms *and *RUNE terms before the performance fee will kick in.

Let’s walk through some math to demonstrate.

You invest $100,000 in the RUNE fund. RUNE is $1, so you own 100,000 RUNE tokens. After a year, we earn 10% in yield from running nodes and the RUNE price is $10. So you end up with 110,000 RUNE tokens worth $1,100,000.

Every other hedge fund in the world would charge you 20% performance fee on the increase in fiat value. That works out to $200,000, leaving you with $900,000. You made 9x your money in one year, you should be happy, right?! No.

That $900,000 would only be 90,000 RUNE tokens. However, you started with 100,000 RUNE tokens. You’d be up in fiat terms, but would end up down in RUNE terms. You would be better off just buying 100,000 RUNE tokens on your own at $1 and at $10 it would be worth $1,000,000.

To avoid setting you back further than when you started, my funds performance fee only takes 20% of the increase in RUNE tokens.

Of your 110,000 tokens, your profit in terms of RUNE tokens is 10,000. Therefore, the fund will take 20% of that, so 2,000 tokens. You will be left with 108,000 tokens. At $10 RUNE price, your position would be worth $1,080,000. So you would be ahead $80,000 versus holding RUNE on your own.

Instead of me calculating the performance fee in the fiat value and taking $200,000, I’m calculating it on the increase in RUNE tokens and only taking $20,000. That’s 90% less than what any other hedge fund would charge you! The overall effective performance fee would be $20,000 divided by your $1,000,000 profit, which is only 2%!

The whole point of the RUNE fund is to get you yield and compound the RUNE tokens you have. That would be impossible if I’m taking 20% of the profit on the fiat value. I have to calculate it on the yield in tokens.

Now, say, in year 2, RUNE goes down to $5. The fund is still running nodes and assume it earns another 10% in RUNE tokens. Therefore your 108,000 tokens becomes 118,800 tokens which is worth $594,000.

Would I still take 20% of the new tokens? No! Because you’re down in fiat terms. My high water mark is based on your fiat value and your RUNE tokens. My performance fee would not kick in until you are over $1,100,000 and 110,000 tokens.

If you withdraw your investment when it’s down to $594,000, but you already paid a $20,000 performance fee, then your effective performance fee would only be 4%. You would still come out well ahead in fiat terms and RUNE terms.

By calculating the high water mark in both fiat and RUNE terms, you’re able to compound and grow your position in RUNE. Therefore the RUNE fund should look like the black line in this graph and just holding RUNE tokens on your own should look like the grey line. My goal is to double your RUNE position in several years and still provide yield while continuing to compound.

I hope you understand how fair and equitable this is. I’m quite proud of it because I know my competition and I don’t believe any other fund is doing this, let alone this forthright. And for what it’s worth, I do need compensation like this so I can reinvest back into the fund by hiring developers and buying physical servers. The more successful the fund is, the greater the need to protect our investment by hiring top talent and hardware.

How Much of Kenton’s Net Worth is in RUNE?

People often ask how much of my net worth is in the fund. I have a significant portion of my net worth in this because opportunities like this only come by once every 10-20 years. I’ll prove how unique this opportunity is in future write-ups, but how can I prove what amount of my net worth is in the fund?

I can’t.

No fund manager can do that. It’s impossible. I can, however, prove my commitment indirectly.

Instead of believing what I say, look at my actions.

I left Sprott to start this fund. I wasn’t fired. On the contrary, I was one of the senior investment executives at the firm. I left on great terms and some of my previous colleagues want to offer this fund to their clients. I wasn’t losing clients. Virtually all positions in all my accounts were in the black and clients were happy. My departure caught clients and Sprott by surprise.

Why did I walk away from a successful 10 year career? There were various reasons (that I’m happy to go over on the phone), but the main one being I personally did not want my money in mining stocks anymore.

How can I honestly manage clients' money in mining stocks if I was pulling out? It would have been impossible for any client to know what I was doing personally. But I would know and I’d be lying to clients.

Therefore, I had to leave Sprott to prove you can trust me.

If you think about it, the smartest move for Kenton would have been to not tell anyone about THORChain. Just quietly liquidate my mining stocks and invest in RUNE. I would keep my job at Sprott as the perfect hedge. If RUNE doesn’t work out for whatever reason, no one would know, and I’d continue to collect income from Sprott. I could recover and no one would have any idea what happened.

I have almost 20 years experience investing in resource stocks, so I easily could have coasted on that knowledge and quietly spent my time keeping an eye on my personal investment in RUNE. At worst, it would have taken clients a few years to notice if I was being deficient or not.

What would happen if I’m right about THORChain? Then I would have no more financial reason to stay at Sprott, and still end up leaving. When clients ask why, I could make something up or tell them I made money in something outside of mining stocks. Either way, clients would have suffered a few years with a disinterested manager or feel spited if I made a fortune in something I didn’t tell them about. After all, as a client you expect me to be trying to make you money, right?

All of the above is what I should have done if I’m just looking out for numero uno. But I’m not. My business and my brand is looking out for you too, my client. You want to feel safe and secure in your investments, and the best way to feel that way is knowing I’m investing alongside you and both our interests are aligned.

I can’t guarantee THORChain will succeed, but I can guarantee we will win or lose together.

Youxia Crypto RUNE Fund

Invest alongside someone you can trust.

The fund will buy the RUNE token for capital gains potential and stake the token in the THORChain network for yield. Staking on THORChain means running nodes on THORChain.

Running nodes is where it gets fun. The nodes secure the exchange and, in return, they collect revenue from the swapping fees. The exchange will grow proportionally with the revenue from the fees. Therefore, the yield should prove to be as good as the capital gain.

$1 invested today could yield $1/year and eventually $1/month. All while sitting on a large capital gain.

The plan is to compound the yield for the first few years and wait for the token price to go up, then start paying the yield out to you as income. Ideally, the fund will last for decades. There’s no reason to wind it up if we can collect passive income for decades to come.

You can invest with fiat, crypto, or a mix of fiat and crypto.

Let me know if you want to get access to the offering documents.

To learn more about THORChain:

Read this report — THORChain Investors Guide

and

Watch this video — THORChain Introduction — Explained for Beginners

Thank you for reading.

I’m the founder of Youxia Crypto, an asset management company specializing in crypto. I can help you buy and sell precious metals too. I believe crypto is more than just about trying to make money, it’s about creating freedom for oneself and the rest of the world. I’m a contrarian, voluntaryist, and proponent of Austrian Economics. I enjoy downhill skiing, scuba diving, live music, yoga, and traveling.

The intended use of this material is for informational purposes only and is not intended to be an offer or solicitation for the sale of any financial product or service or a recommendation or determination that any investment strategy is suitable for a specific investor. Investors should seek financial advice regarding the suitability of any investment strategy based on the objectives of the investor, financial situation, investment horizon, and their particular needs. This information is not intended to provide financial, tax, legal, accounting or other professional advice since such advice always requires consideration of individual circumstances. The investments discussed herein are not insured by the FDIC or any other governmental agency, are subject to risks, including a total loss of the principal amount invested. Past performance is no guarantee of future returns.