GENERAL

Profit on Markets Crashing

August 5, 2024

Why is everything tanking?

Because the Japanese Yen is going up.

In March, the Bank of Japan hiked rates for the first time in 17 years! Then on August 1st, they did another rate hike. This appears to be the straw that broke the camel's back. Now the whole Yen carry trade is unwinding and taking markets around the world with it.

For the last 17 years, the Yen carry trade has been quite popular amongst the big boys. With interest rates so low in Japan, big institutions can borrow Yen at low interest rates, convert it to USD, then invest in USD assets such as Treasuries with higher interest rates, and pocket the difference. So long as the Yen:USD exchange rate cooperated and you could hedge the risk for cheap, it’s basically a guaranteed trade. Then add a dash of leverage for taste.

This gravy train kept going until Japan’s monetary conditions strengthened, relative to the USA. Assets that were bought, such as US Treasuries, now need to be sold to repay the Yen debt.

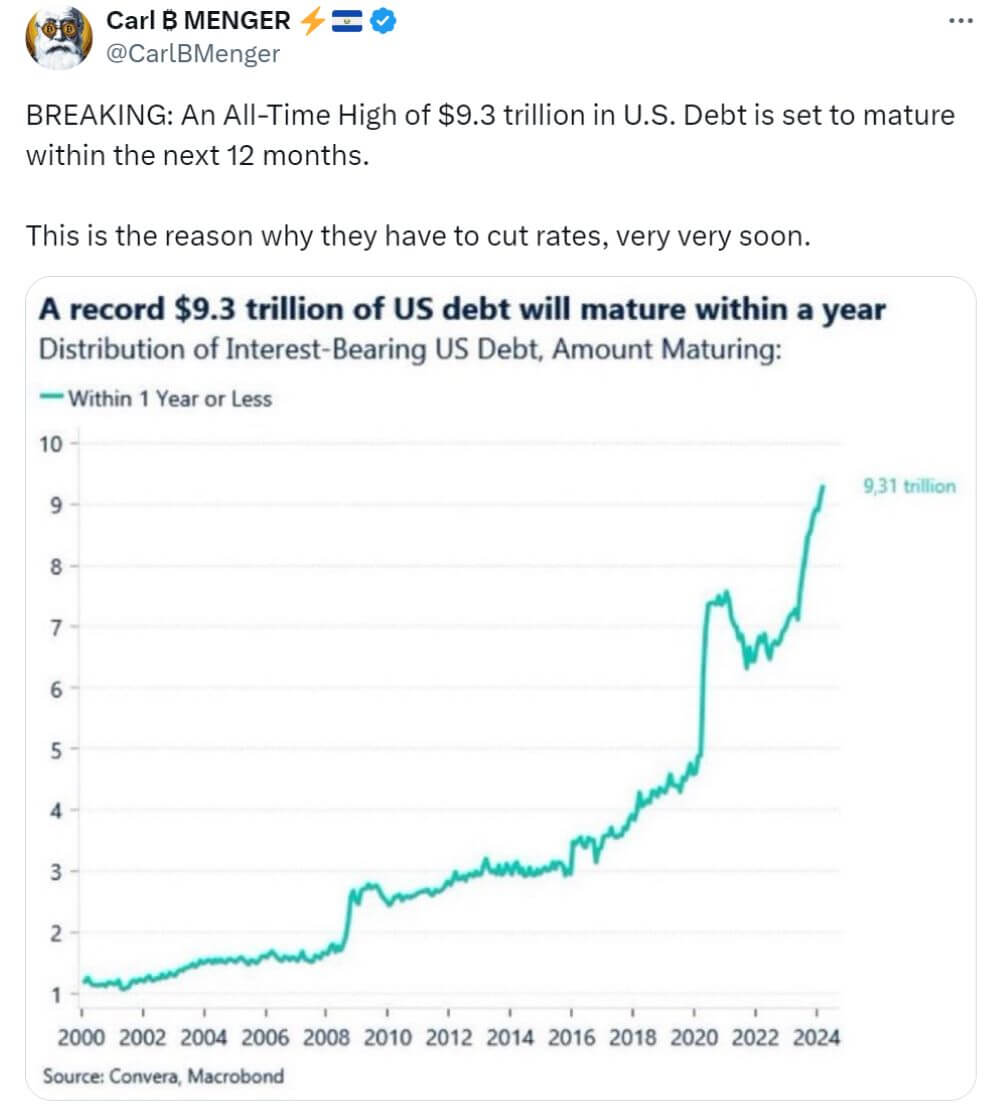

This is bad for US Treasuries which forces interest rates up, at the exact time the Treasury needs to refinance one third of its debt.

I don’t believe the Fed will allow the markets to crash.

It’s the well-connected money that’s benefitting from the Yen carry trade, so they have Jerome Powell’s ear. Plus, there’s the election in the fall. The Democrats won’t get re-elected if the market crashes. And using history as a guide, the Fed comes up with new rounds of quantitative easing every 4 years to refinance the US government's debt.

Arthur Haye’s article Shikata Ga Nai does a great job going over the above ideas in more detail. I agree with his conclusion, that the Fed is going to print money like it’s going out of style. Indeed, fiat money is going out of style.

Buy The Dip

Some of you have already reached out asking if this is the time to buy? Great instincts! These are times you want to close both eyes and buy, however, maybe just buy a tranche. I believe you should wait and see what the Fed does before going all in.

The market is already expecting the Fed to do an emergency rate cut and I think you should wait for it to actually happen. Markets will rally on the news and you will miss the bottom, however, at least you can have comfort that you’re buying on the way up and should not have any more downside to worry about.

There’s the possibility the Fed does not cut rates, or does not cut what the market is pricing in, and markets continue to decline. This is what I’m worried about. It could get ugly fast. But, if that happens, it will just force the Fed to cut rates even more. Eventually the Fed will cut rates to bail out the system and markets will rally. This is what I’m expecting over the next year.

After we get through the election, and all the government debt is refinanced for another 4 years, then I think we could see markets truly sell off. Say, last half of 2025. If you’re conspiracy-minded, wouldn’t that be nice if the Democrats stave off a market crash until Trump is elected, then let the markets tank on his watch?

Youxia Hedge Fund

Do you want to bet on the market crashing? To try and make money in times like this?

I’ve been toying with the idea of setting up a new fund to bet on the markets crashing. A back-to-basics true hedge fund, what they were invented for. But no short selling or leverage will be used.

The fund would take the money raised, convert it to stable coins, lend them out to earn yield, then use that yield to buy put options on the stock market.

The idea is to protect your principal, so if you put in $100,000 and the market doesn’t crash for several years, then you still have $100,000. Meanwhile, only the interest earned on that money is used to keep buying put options over and over again. So, you could stay short the market for a long time with no direct cost. There would be the opportunity cost of your money going sideways for several years. But that’s okay because only 5-10% of your portfolio should be in this fund. The other 90-95% of your portfolio would stay invested and you would get your returns there. You would have more comfort staying invested with your 90-95% because you know you have this hedge protection that will kick in if markets tank. Whatever amount your main portfolio goes down could be offset by how much the Youxia Hedge Fund goes up.

If the markets crash and the fund makes a good return, then that money can be re-invested near the bottom, and ride the market back up, further enhancing your gains. Let’s walk through some numbers.

Say, your portfolio is worth $1,000,000 and you put $100,000 into this fund.

I should be able to structure the payout on the options to be 5x-10x. The bigger the crash, the bigger the payout. If the market goes down 50%, $100,000 could turn into $500,000 to $1,000,000. Your main portfolio is down to $450,000, but if you include the gain from the fund, your total portfolio is worth $950,000 to $1,450,000 in the depths of the crash.

If we invest the gains from the fund during the crash, and the market goes back to even, then your portfolio becomes worth $1,900,000 to $2,900,000.

As I get more into the weeds of buying the options, I might be able to get some more leverage out of it, but 5x-10x should be the minimum.

I was doing this for clients of mine at Sprott for a few years. I was putting 1-2% of the portfolio into options to hedge for a market crash. It worked out beautifully in March 2020 until the Fed bailed out the corporate debt market. It’s a story for another time. But the point is the strategy works.

With my new fund, I think we can get 5-7% yield to invest in options. Roughly 5x more options than what I was buying at Sprott. If you were a client of mine in March 2020, this fund is targeting 5x more upside potential than what you saw back then.

Please let me know if you’re interested in investing in a fund like this. If there’s enough interest, then I’ll put it together.

In the meantime, embrace the volatility.

Thank you for reading.

I’m the founder of Youxia Crypto, an asset management company specializing in crypto. I can help you buy and sell precious metals too. I believe crypto is more than just about trying to make money, it’s about creating freedom for oneself and the rest of the world. I’m a contrarian, voluntaryist, and proponent of Austrian Economics. I enjoy skiing, beach volleyball, scuba diving, live music, yoga, and traveling.

The intended use of this material is for informational purposes only and is not intended to be an offer or solicitation for the sale of any financial product or service or a recommendation or determination that any investment strategy is suitable for a specific investor. Investors should seek financial advice regarding the suitability of any investment strategy based on the objectives of the investor, financial situation, investment horizon, and their particular needs. This information is not intended to provide financial, tax, legal, accounting or other professional advice since such advice always requires consideration of individual circumstances. The investments discussed herein are not insured by the FDIC or any other governmental agency, are subject to risks, including a total loss of the principal amount invested. Past performance is no guarantee of future returns.