THORChain (RUNE)

THORChain - Better Than CEX

December 23, 2022

This lovely lady is Catrinel Menghia from a Fiat Abarth commercial. You have to watch it, it’s only a minute long.

And for those of you attracted to men…

Hopefully the video and pictures are enough foreplay to get you in the mood to keep reading. Your brain will be drooling at the hottest thing since bitcoin and ethereum - THORChain.

THORChain is named after the god of thunder himself, Thor. All the terminology in the project comes from Norse mythology, like its token RUNE.

The shirtless Chris Hemsworth above is from the movie Thor: Ragnarök. There’s a running inside joke in the THORChain community that Chris Hemsworth is their CEO. Why? There is no CEO of THORChain, so why not have fun with it?

There’s no CEO of THORChain because it’s decentralized. Just like there’s no CEO of bitcoin. If a crypto has a CEO, it’s not decentralized.

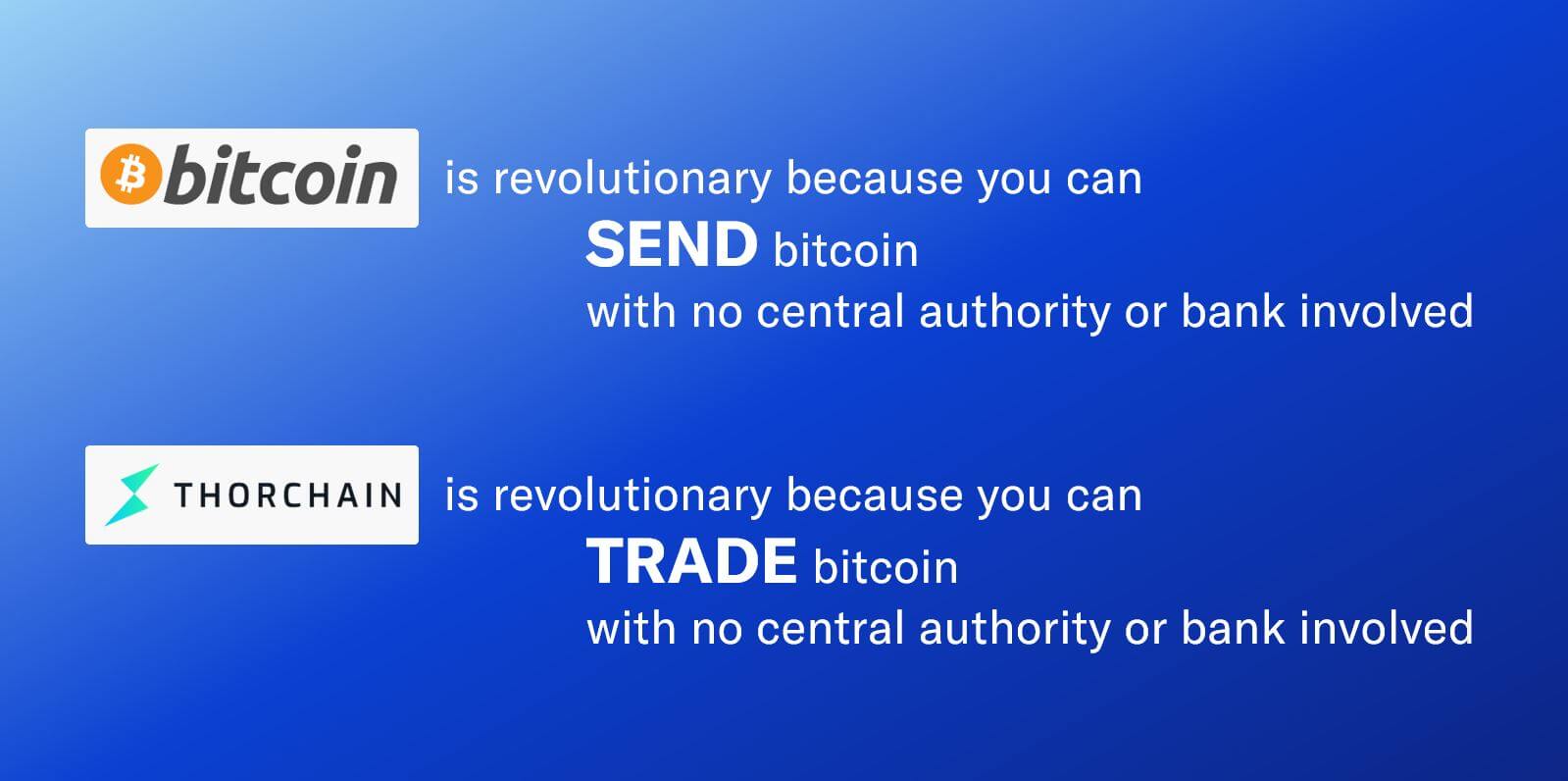

The entire point of crypto is decentralization, not “blockchain.” This is the whole value add with bitcoin. The decentralization of bitcoin is what makes it near impossible to attack from within or from outside the network. Bitcoin is the first form of property that can’t be stopped or stolen by a third party (i.e.) bank or central authority.

But you know that. What’s so great about THORChain then?

Ever since the invention of the second cryptocurrency, Litecoin, the only way to trade Bitcoin for Litecoin was through a centralized exchange (CEX). An exchange that has all your personal information, and more importantly, has custody and control over the crypto in your account. Remember, the point of crypto is cutting out third parties to protect your personal information and maintain custody of your assets. Therefore, using a CEX is actually the antithesis of crypto.

But if you wanted to trade your bitcoin for any other crypto, you had no choice. You had to use a CEX despite the obvious contradiction.

Unfortunately, this led to all the major disasters you’ve heard about in the sector.

- In 2014, Mt. Gox was the largest exchange in the world handling about 70% of all bitcoin trading. The exchange was hacked and 650,000 bitcoin were stolen, about 5% of the total bitcoin supply at the time. At today’s bitcoin price that’s about $11.1 billion.

- QuadrigaCX became Canada’s largest crypto exchange by 2018 with 350,000 clients. After the mysterious death of the CEO, $190 million in crypto went missing, and the company declared bankruptcy. Investigators later concluded QuadrigaCX was a basic Ponzi scheme and likely never invested any client funds.

- Celsius was the largest crypto lender with 1.7 million users. They filed for bankruptcy in June 2022 following the collapse of LUNA and the market. Users are owed $4.7 billion and are unlikely to recover much of it. It’s still unclear whether Celsius failed because of poor lending practices combined with the market crashing and bank run, or if it was a fraud from the beginning.

- Sam Bankman-Fried (SBF) is all the talk right now because of the collapse of FTX. Over 1 million Americans and 5 million others worldwide lost about $8 billion.

There’s many other frauds and hacks that have occurred on various exchanges throughout the years. Of the 10 largest hacks of all time, six have occurred on CEXs. Hopefully this drives home the point that CEXs are one of the largest problems in the industry, if not the biggest problem of all. When you use a CEX to trade and custody your assets, you never truly know if they’re actually buying and holding your crypto.

The obvious solution to a centralized exchange is a decentralized exchange (DEX). An exchange where you can trade with no central authority or third party involved, and maintain custody of your crypto.

There are some DEXs like Uniswap, PancakeSwap, and Trader Joe. However, they can only trade tokens created on their respective blockchains. For example, Uniswap is an Ethereum DEX that can only trade Ethereum based tokens (ERC20). PancakeSwap is a Binance smart chain DEX that can only trade Binance smart chain based tokens (BEP20). Trader Joe is an Avalanche DEX that can only trade Avalanche based tokens (ARC20). Follow the drift? Each layer 1 DEX can only trade their respective protocol’s tokens.

None of these DEXs can trade different layer 1 tokens between each other, most notably bitcoin. At least not directly. They try to get around it by using a “bridge” and “wrapping” tokens.

Think of a bridge like a goldsmith vault, and the receipt you get for depositing gold would be a wrapped token. You could then trade the receipt for the same value as the gold backing it, because buyers of the receipt trust they can exchange it back into gold. But you know all to well the problems throughout history with paper gold.

WBTC is wrapped (paper) bitcoin in an ethereum contract. 1 BTC goes into the contract, 1 WBTC comes out. WBTC can then be used on Uniswap and any other ethereum based application. Today, there’s ~186,000 bitcoin held inside this contract (vault). In October, there was ~265,000 bitcoin, but a lot has been withdrawn since the collapse of FTX and the markets concerns about third party custody.

The WBTC contract is controlled by BitGo, a centralized third party. And since that bitcoin is now held inside an ethereum contract, users are exposed to the vulnerabilities of that code. They no longer have the original protection they had with the bitcoin protocol itself. Despite the risk, WBTC hovers around the 20th largest crypto by market cap. There’s a huge demand to use bitcoin in DeFi.

Wrapping and bridges are where the industry has gravitated towards. However, it’s also attracted hackers. You know all the hacks you’ve heard about over the last year and a half? They’ve all been on bridges used to trade tokens between various blockchains.

The top two hacks of all time were from bridge’s totaling $1.2 billion.

Almost every negative thing you’ve heard about crypto, has occurred on exchanges and bridges. There needs to be a solution and whoever solves it stands to profit handsomely. It just so happens there is one. THORChain.

When I discovered THORChain, it was the most exciting feeling I had since learning about bitcoin back in 2011.

Erik Voorhees

THORChain is a true decentralized exchange (DEX). It’s the first, and only, DEX that can trade bitcoin with ethereum with Litecoin with whatever coin. No bridges, no wrapping, no paper, all “physical” layer 1 crypto with other “physical” layer 1 crypto. Every trade has final settlement on the perspective block chains and you maintain custody of your crypto, even in cold storage.

Now you can avoid using a CEX to trade. You can have custody of your tokens and trade them whenever you want. Anyone in the world can use THORChain, all you need is a wallet with crypto in it. There’s no one to ask for permission, no account paperwork to fill out. THORChain is the epitome of DeFi.

We firmly believe that the crypto industry is going to continue to evolve towards true decentralization. It’s what the tech was invented for. It’s the most exciting part about the tech. And it’s where the tech shows the most obvious sort of opportunities for the global economy and for the average user... But CZ has been real clear… there’s a good chance that Binance might not even have an exchange 10 years from now, because, again, we foresee that DeFi is going to continue to move towards greater adoption and will eventually reign supreme.

Patrick Hillman, Chief Strategy Officer, Binance

CZ, the founder and CEO of Binance - the largest crypto exchange in the world - thinks his exchange might not be around 10 years from now. If there’s anyone in the world who has every financial reason for that not to happen, it’s CZ.

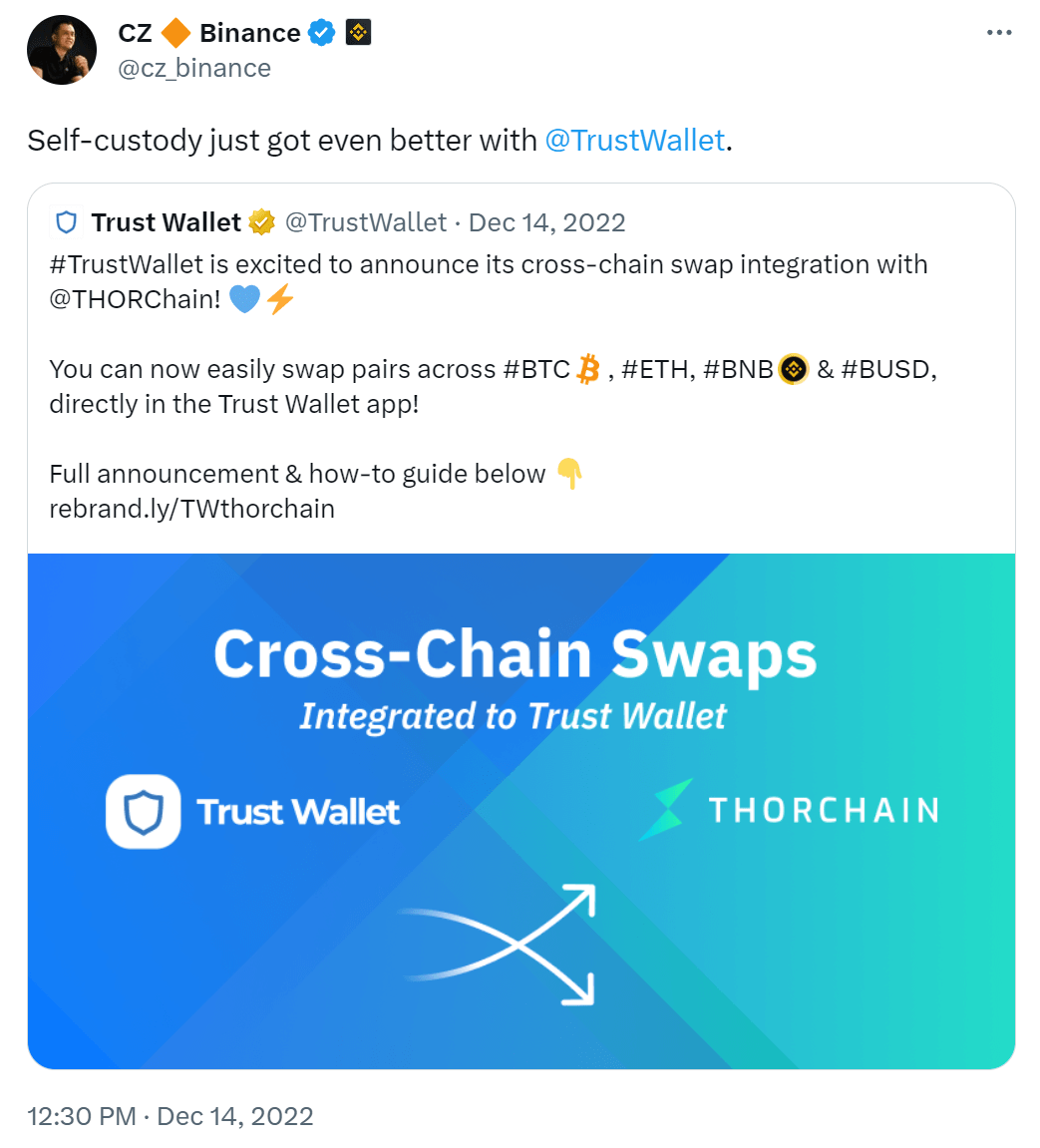

But CZ is wise enough to know he can’t stop it from happening. DEXs are the future. Therefore, Binance is heavily investing in Trust Wallet as their bet on the future of DEXs. And guess what Trust Wallet just announced? Their integration with THORChain.

Trust Wallet has 50 million downloads and 10 million active users per month. THORChain instantly went from counting its user base in the thousands to potentially 50 million people. Read that again:

THORChain instantly went from counting its user base in the thousands to potentially 50 million people!

If that doesn’t turn you on, I don’t know what will. Maybe this will get you going. FTX had 6 million users and was once worth tens of billions of dollars. THORChain now has an order of magnitude more potential users, a market cap of $415 million, and is literally the solution to the FTXs of the world.

The best part is any wallet, website, or app can integrate THORChain in their background. It’s not proprietary to Trust Wallet. Now that Trust Wallet has done it, other wallets have to follow suit to stay relevant. More than just adding a feature their users want, for the first time, wallets can monetize their audience by programming in their own commissions on trades. Wallets now have every incentive to integrate THORChain, especially with the bear market in crypto.

This sets the stage for the trading volume on THORChain to explode.

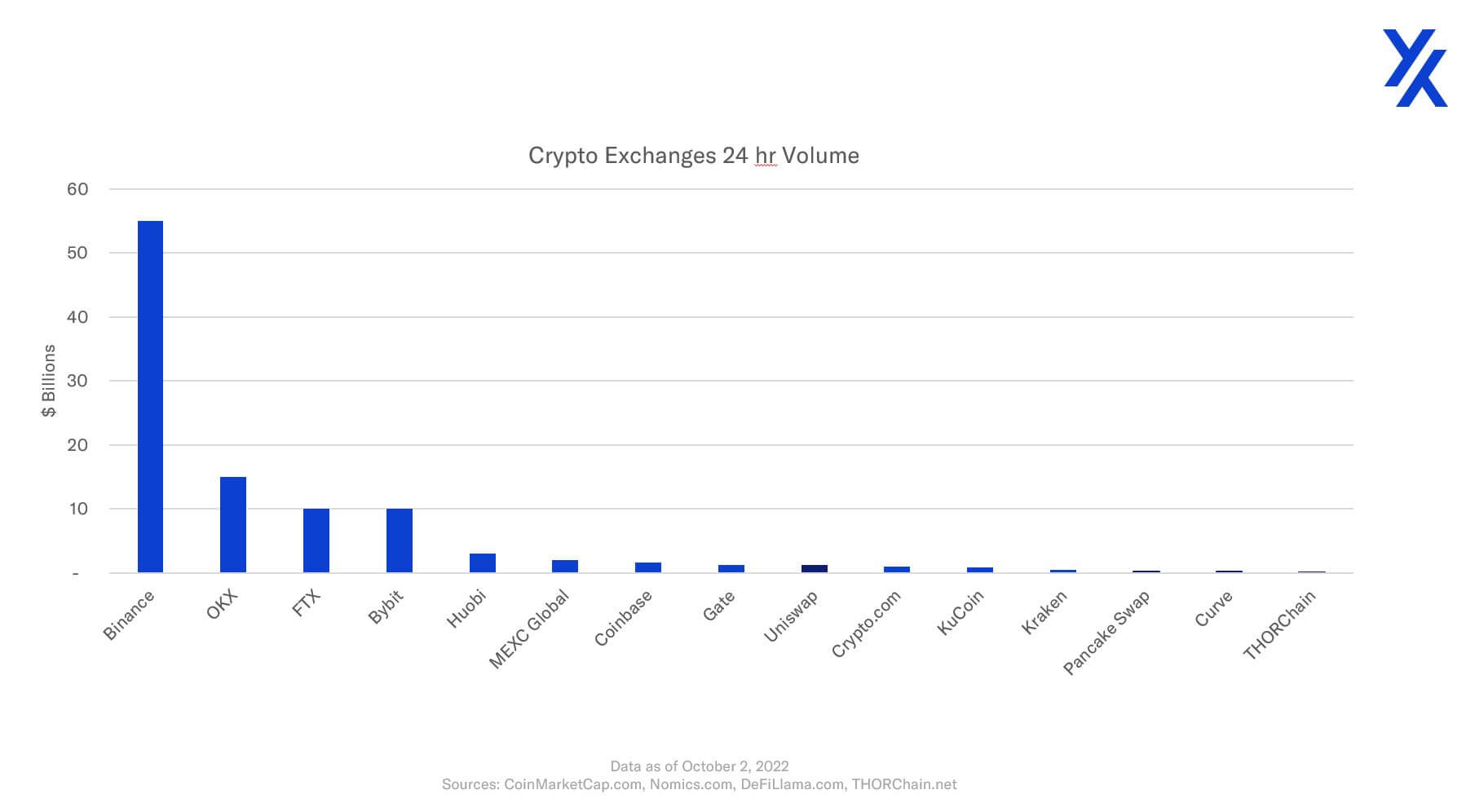

Let’s compare the volume on THORChain to Binance. For every $1 traded on THORChain there’s about $2,000 traded on Binance. It’s less than a rounding error on Binance’s volume.

It doesn’t mean all that volume on Binance will suddenly shift to THORChain. However, it’s plausible that eventually the trading volume on THORChain dwarfs that of Binance. Remember, Binance executives themselves are saying and betting on it. Since THORChain is decentralized, it can grow much bigger than its centralized counterparts.

Take Uber and Airbnb for example. Within a few years, Uber became the worlds largest taxi company without owning a single vehicle because its inventory is decentralized. Airbnb became the largest hotel company in the world, without owning any properties, because its inventory is decentralized. It’s not crazy to believe THORChain will become the largest crypto exchange in the world, because its inventory of crypto is decentralized.

Are you in awe yet?

THORChain is stunning. It has everything you desire.

For now, don’t worry about how it works, just accept that it does. No different than what Catrinel Menghia is saying in the commercial. You don’t know what she’s saying, but you know it works.

I’ll have a writeup on THORChain’s design soon. It’s complicated, sleek, and exotic. When I first came across THORChain it stopped me dead in my tracks. The beautiful design was mesmerizing. I couldn’t get enough. The more I learned the more it turned me on. But I didn’t look away in shame.

I fell in love.

Thank you for reading.

I’m the founder of Youxia Crypto, an asset management company specializing in crypto. I can help you buy and sell precious metals too. I believe crypto is more than just about trying to make money, it’s about creating freedom for oneself and the rest of the world. I’m a contrarian, voluntaryist, and proponent of Austrian Economics. I enjoy downhill skiing, scuba diving, live music, yoga, and traveling.

The intended use of this material is for informational purposes only and is not intended to be an offer or solicitation for the sale of any financial product or service or a recommendation or determination that any investment strategy is suitable for a specific investor. Investors should seek financial advice regarding the suitability of any investment strategy based on the objectives of the investor, financial situation, investment horizon, and their particular needs. This information is not intended to provide financial, tax, legal, accounting or other professional advice since such advice always requires consideration of individual circumstances. The investments discussed herein are not insured by the FDIC or any other governmental agency, are subject to risks, including a total loss of the principal amount invested. Past performance is no guarantee of future returns.