GENERAL,THORCHAIN

THORChain - The 3rd Largest Crypto

December 17, 2024

Bitcoin is the king. It’s always been the largest cryptocurrency by market cap. It’s winning the store of value contest, and as it continues, will slowly absorb the monetary premium from gold, stocks, and real estate. But that doesn’t mean there’s no competition in crypto.

Bitcoin’s competition in the sector is meme coins.

Meme coins won’t be going away any time soon, and if anything, I believe they’ll see the highest percentage gains in 2025. But despite all that money flowing into meme coins, more will go to bitcoin and secure its top spot.

Silver Medal

The number 2 spot is held by ethereum. ETH has held second place for quite some time now. There’s been talk of ethereum overtaking bitcoin at some point, which is referred to as The Flippening. Never say never, but I’m not so sure it will happen.

As new money enters the sector, especially big money, it will start with bitcoin.

We’re still in the early part of the S-Curve of adoption, which means only about 10% of the market is invested in crypto. The next 10 years will see the next 80% of the market start buying and they will begin with bitcoin. This constant bid on bitcoin should keep it on top for some time to come.

Therefore, I believe bitcoin is pretty well secured as the top dog for now. However, I’m not so sure about ethereum holding the number 2 spot because its competition is more serious than meme coins.

Ethereum is a smart contract platform, referred to as a layer one (L1), and there are many different L1s trying to become the next ethereum. Protocols such as Solana and Avalanche.

I believe we’re still early enough for an incumbent smart contract platform to overtake Ethereum. Maybe even one that doesn’t exist yet. Who knows. But I believe there’s room for several different smart contract platforms in the sector, and in my opinion, it’s still too early to know which one will end up being the biggest.

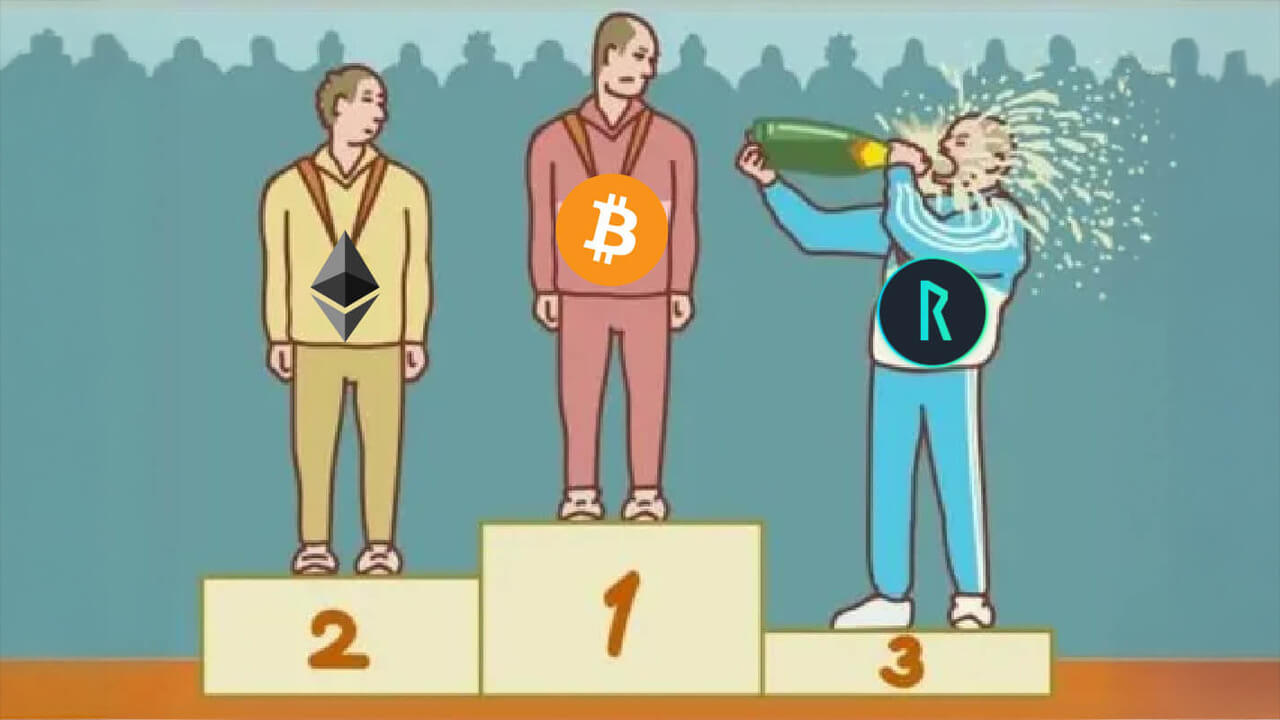

Bronze Medal

The number 3 spot has been somewhat of a revolving door.

Right now, Ripple (XRP) is holding down the fort. I’m not a fan of Ripple because it's trying to make TradFi better by replacing Swift. For me, it’s like buying a defense stock because you know it will go up as wars increase around the world. It’s not the game I’m interested in playing. However, I do acknowledge the XRP price has had a huge breakout and the momentum can continue. Ultimately, I believe DeFi will reign supreme, and TradFi protocols like Ripple will be dwarfed.

Before Ripple jumped into third place, Tether (USDT) was keeping the chair warm. USDT is a stable coin, so it makes sense that its market cap during the bear market will be relatively larger than others because more people are sidelined in cash. During the bull market, as people deploy their cash, it makes sense for the USDT market cap to grow slower or even go down.

During the 2021 bull market, Binance (BNB) was in the number 3 spot. Binance is a centralized exchange just like Coinbase (COIN). If you compare Coinbase’s market cap back then, it was the 5th largest. Today, Binance is the 6th largest and Coinbase is the 7th largest by market cap.

Despite the different cryptos that have held third place over the last few years, they’re all similar in what they’re doing. They’re all projects having to do with some form of exchange.

Ripple is facilitating the transfer of fiat money. Tether is facilitating the transfer of fiat to crypto. Binance is facilitating the transfer of crypto to crypto.

They’re not trying to be stores of value or smart contract platforms.

So, there’s a long-standing precedent for some type of exchange to be the 3rd largest crypto by market cap.

Go for Bronze

As you start going down the crypto food chain, it becomes easier to compete. Which means it's easier to make money.

Bitcoin has won the store of value and cemented itself in first place.

There’s already lots of L1s trying to overtake ethereum. Solana is the best bet right now, but the majority of the gains in Solana are behind us and it’s hard to know what other L1s stand a chance.

As for the race to 3rd, it’s still early. Since the market has been so focused on the next bitcoin or ethereum, there’s no one really trying to be the next major exchange, let alone talking about it. This is an opportunity for you.

World’s Largest Exchange

The world's largest crypto exchange is Binance. Therefore, we need an exchange bigger than Binance to have a shot at bronze.

It just so happens, the founder of Binance, has been telling us what exchange he thinks will dwarf Binance one day.

“I think in 5-10 years, decentralized exchanges will be bigger than centralized exchanges. This is why we invest very heavily in blockchain development. We invest in multiple wallets, like Trust Wallet. So I would say maximum in 10 years, DEXs are going to be bigger than CEXs.” - CZ

This quote is from July 2022. If we put his 5-10-year prediction into context, he believes DEXs will become bigger than CEXs between 2027 to 2032.

Remember, CZ made billions off Binance and continues to make money from it. So, he has no financial interest in saying his company will one day lose its title as the biggest. But rather than fight the trend, CZ is embracing it and this is why Binance is investing in apps like Trust Wallet, so they don’t get left behind.

It makes sense. After all, the whole point of crypto is decentralization. And CEXs have been the root cause of so many people losing money and having their funds frozen. Therefore, it’s only natural for a DEX, that protects people’s money and won’t freeze their funds, to become the largest exchange in the world.

But which DEX stands a chance?

THORChain

A decentralized exchange is much more difficult to pull off than you would think. And in turn, has made a DEX one of the holy grails in crypto.

Several years ago, the creator of Litecoin, Charlie Lee, tried his hand at solving the problem and invented atomic swaps. These are when a buyer of one crypto meets with the seller of another and uses a smart contract to perform a swap. It works; however, it doesn’t scale.

Atomic swaps require two people to find each other at the exact same time, wanting to swap the same crypto, for the same amount, and the same price. It’s like a dating app that requires two people to swipe right at the exact same time for there to be a match. It technically works but isn’t practical.

In order to scale, you need a pool of capital, an inventory of crypto, always ready to buy or sell on demand. You need a market maker. This short video does a good job explaining what a market maker is. Market makers have long been a fixture in TradFi and are the ones on the other side of the trade when you buy or sell stocks.

The market makers in TradFi are banks and hedge funds, they’re centralized. To avoid those, developers invented a decentralized market maker called an Automated Market Maker (AMM). An AMM is a DEX, and people will use the terms interchangeably.

AMMs solved the problem of atomic swaps not being able to scale. There’s no limit to how big an AMM can grow and people can swap whenever they want.

However, there are limits on what types of tokens can be swapped with an AMM.

Bancor invented the AMM model and Uniswap took it to the next level. But both these DEXs can only swap ethereum based tokens (ERC-20s). They can’t swap bitcoin. At least not real bitcoin.

They can swap wrapped bitcoin. A wrapped token is an I.O.U. token just like paper gold is I.O.U. gold. Wrapped tokens are not the real thing.

To drive the point home, check out your buddy Lloyd Christmas from Dumb and Dumber.

So, we’re getting closer to solving one of the biggest problems in crypto and drinking from the holy grail. AMMs work and can scale, but we need one that can handle any type of cryptocurrency, most importantly bitcoin.

Now we have it.

It’s called THORChain. Its token is RUNE.

THORChain is the first AMM that can swap bitcoin. Real native bitcoin, not I.O.U. bitcoin.

THORChain makes it possible to swap bitcoin with thousands of other cryptocurrencies, without using wrapped tokens, and all from within your self-custody wallet.

THORChain is the holy grail DEX the market has been waiting for.

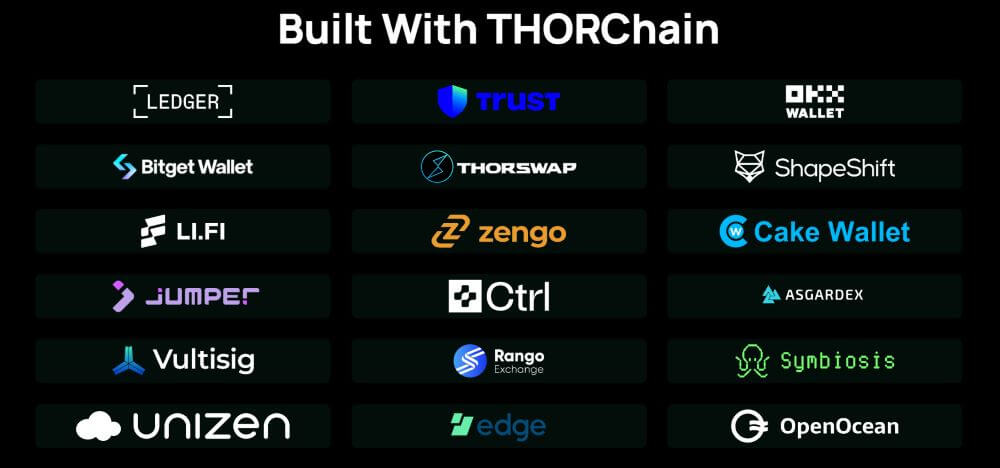

And it’s not just an idea on a whitepaper. It exists. It works. It’s being used. Adoption is growing. Trust Wallet, mentioned by CZ above, has integrated it. Ledger has integrated it. Over a dozen other wallets have integrated it and dozens more are working on it.

The preeminent THORChain front end is THORSwap. Give it a try on this link. Or check out all the other platforms that have integrated THORChain below.

Eventually, every crypto wallet in the world will integrate THORChain.

Why?

Because they can program in their own custom commissions and make money off their users. And it's a no brainer for users to choose a wallet that can swap bitcoin versus one that can’t.

It’s inevitable for THORChain to be integrated everywhere.

How Big Can THORChain Get?

If you add up all the downloads from the apps in the image above, you get 164 million. That’s 164 million people that have access to THORChain right now.

Those wallets will continue to attract new users, and new wallets integrating THORChain will bring in new users. At the current pace, 500 million people will have access to THORChain a few years from now.

Today, there are only 60 thousand people per month using THORChain.

To put that into context, Coinbase has about 8 million users per month.

8 million is only 5% of 164 million. So, it’s not unreasonable for that many people to be using THORChain one day.

If 8 million people start using THORChain, that would be a 133x increase from current levels. With RUNE at $6.76 and its market cap $2.32B, a 133x increase would drive the token to $900 and its market cap to $309B.

That would easily make THORChain the 3rd largest crypto with lots of room to spare.

A 133x increase in users may not directly result in a 133x increase in price. But an increase in users like that will definitely drive up the RUNE price. Let's say it has half the effect and would only drive up RUNE by 66.5x.

66.5 x $6.76 is $450. That would give a market cap of $154B and still be enough to get THORChain the bronze medal.

If anything, 8 million users is on the low end because a DEX like THORChain will eventually dwarf CEXs like Coinbase. Especially as more and more wallets integrate THORChain and the sector continues to grow.

A centralized entity can only grow so big until they begin to plateau. Whereas a decentralized counterpart can grow much bigger.

Take Uber and Airbnb for example. Uber is the world's largest taxi company because its inventory of taxis is decentralized. Airbnb is the world's largest hotel company because its inventory of hotel rooms is decentralized. THORChain can become the world's largest crypto exchange because its inventory of crypto is decentralized.

People used to think it was ridiculous to get in a stranger's car or sleep in a stranger's home. Now look at us.

It’s not ridiculous at all to suggest THORChain becoming the world's largest crypto exchange, and if anything, is quite reasonable when you stop to think about it.

Binance 2.0

Bitcoin is considered gold 2.0. For many years now bitcoiners have had their eyes set on bitcoin reaching gold’s market cap and going higher. Gold’s market cap acts as a North Star for the bitcoin price.

I believe it will happen, it’s just a matter of time.

THORChain is considered Binance 2.0. And for many years now THORChads have had their eyes set on RUNE reaching Binance’s market cap and going higher. Binance’s market cap acts as a North Star for the RUNE price.

I believe it will happen, it's just a matter of time.

THORChain the L1

Bitcoin is an L1 blockchain. In the early days of crypto, many people wanted to experiment and add different features to it. There were a lot of disagreements about the direction bitcoin should take. In the end, those who wanted to keep it simply as a store of value and medium of exchange, won.

Those who lost, so to speak, moved on to invent a different L1 blockchain, ethereum.

Ethereum was created to be the Apple app store of crypto. A platform where different apps could be built to serve different purposes. These decentralized apps (dApps) work based on a series of smart contracts coded onto ethereum.

Ethereum was first to create this dApp platform and it took the crypto world by storm.

NFTs and tokenizing real-world assets (RWA) are examples of some dApps. The potential for so many dApps and users on ethereum is what keeps the valuation high.

Being first with an original product has given ethereum a huge head start in its network effects and helped it secure the number 2 spot in crypto. Just like bitcoin being the first store of value gave it a huge head start in network effects and secured its number 1 spot.

THORChain is a unique L1 blockchain, the first DEX that can swap bitcoin, and has a huge head start in network effects. All characteristics worthy of the number 3 spot.

Instead of dApps being built on THORChain, exchange apps can be built on it.

Just like anyone can build an app on top of ethereum, anyone can build an exchange on top of THORChain. In fact, this is how THORChain is designed to work. It needs to have different apps, wallets, and front ends to integrate it.

Eventually, every platform involved in trading crypto will integrate THORChain. And if they don’t, they’ll be indirectly using one that does. All the different exchanges, OTC desks, etc. will be connected to THORChain in one form or another, making it the largest crypto exchange in the world.

When this happens, maybe THORChain will be valued as an L1 like ethereum, instead of just an exchange. This would help boost its valuation and could propel it to bronze.

The Prophecy of 3th

I honestly believe there’s a decent chance for THORChain to become the 3rd largest crypto by market cap. I’ve been saying it for a couple years now based on the reasoning laid out above.

Then, the other day, someone criticized me for that prediction, but kept writing “3th.”

If you click on the image, you can read the whole thread and feel my pain, LOL.

Instead of being triggered, I decided to have some fun with it, and posted this.

This led others to respond with their predictions of 3st, 3nd, and THORd. Some even think that’s bearish and THORChain could become the 2rd largest

So, I’ve doubled down on my prediction and refer to it as The Prophecy of 3th, and will have more fun posting memes about it.

Jokes aside, how many times have the critics been proven wrong about crypto? Five years ago it was crazy to think there would be an ethereum ETF and the US government would create a bitcoin strategic reserve. What’s possible in the next five years?

Is it really that crazy to think the first DEX that can swap bitcoin will become the largest crypto exchange in the world, and make its token the 3th largest by market cap?

Believe in something.

Thank you for reading.

I’m the founder of Youxia Crypto, an asset management company specializing in crypto. I can help you buy and sell precious metals too. I believe crypto is more than just about trying to make money, it’s about creating freedom for oneself and the rest of the world. I’m a contrarian, voluntaryist, and proponent of Austrian Economics. I enjoy skiing, beach volleyball, scuba diving, live music, yoga, and traveling.

The intended use of this material is for informational purposes only and is not intended to be an offer or solicitation for the sale of any financial product or service or a recommendation or determination that any investment strategy is suitable for a specific investor. Investors should seek financial advice regarding the suitability of any investment strategy based on the objectives of the investor, financial situation, investment horizon, and their particular needs. This information is not intended to provide financial, tax, legal, accounting or other professional advice since such advice always requires consideration of individual circumstances. The investments discussed herein are not insured by the FDIC or any other governmental agency, are subject to risks, including a total loss of the principal amount invested. Past performance is no guarantee of future returns.