General

Will Gary Gensler be Subpoenaed?

October 6, 2023

Franklin Templeton, a global asset manager with $1.5 trillion under management, filed for a spot bitcoin ETF with the SEC a few weeks ago. This brings the list of proposed spot bitcoin ETFs to 12.

Notice the numbers in red mean the SEC has delayed their decision to the next deadline date (in blue). The pink boxes outline those up next waiting for a decision. If past is prologue, then these three will be delayed to January with the majority of others.

The SEC Continues to Frustrate the Crypto Sector

I'm not sure why the SEC is being so difficult. But bitcoiners aren’t the only ones who are tired of their antics. Congress has had enough of Gary Gensler too.

I do not want to be the first chairman of this committee to issue a subpoena to The Securities Exchange Commission. And you should not want to be the first SEC chair to receive a congressional subpoena. It’s time for you to consider the lasting consequences of your actions and what that means to the Securities Exchange Commission's reputation long term. While your time in this role may be temporary the repercussions for your actions may be permanent for the agency.

Patrick McHenry, Chairman of the HFSC

These are McHenry’s opening remarks to the hearing held on Sep 27th. The SEC has been refusing to cooperate with Congress for the last several months and Gary Gensler got a talking to about it.

I’m assuming Gary Gensler is making, or will make, a lot of money off the mess he’s created. House member Tom Emmer even alluded to this when he grilled him.

Politicians Change but the Lobbyists Remain the Same

You know it’s the lobbyists that actually write new laws and regulations and they do it with their own interests at heart. Not yours. It’s been going on for millennia and this time is no different.

This video with Bill Gurley does a fantastic job of explaining it. He walks you through the insidious nature of regulations using real world examples to prove his point.

So, what are we to do if politicians and regulators are working against us? Be patient. The media likes to promote anti crypto pundits to feed people’s fear-porn addiction. But there’s just as many politicians like McHenry and Emmer and regulators like the CFTC that are pro crypto.

Plus, the whole point of bitcoin and decentralization is it can’t be stopped by third parties (ie) regulators. Having the US on board with crypto is nice to have, and will drive prices up sooner, but is not necessary for continued success. Sorry American readers, but there’s a whole other world out there that doesn’t care about the United States. For example, I’m in the Cayman Islands and the crypto industry is flourishing here. If worse comes to worse, the crypto market will just continue to do what it wants and the US will be left behind.

Remember, the whole point of crypto is to replace the existing financial system.

Crypto asset technologies, if not well regulated and supervised, could create de facto a new and alternative financial system.

IMF - Assessing Macrofinancial Risks from Crypto Assets

Even the IMF gets it. Albeit from the wrong perspective.

If we re-word their quote above: “crypto, if well regulated and supervised, could not create a new and alternative financial system.”

The establishment wants to “regulate and supervise” crypto because they want to maintain the status quo, maintain their wealth and control.

Fortunately for us, decentralization will prevail over centralization.

Crypto is Subversive

The picture above is from July 2017 during Janet Yellen’s testimony to Congress. It was quite the story at the time.

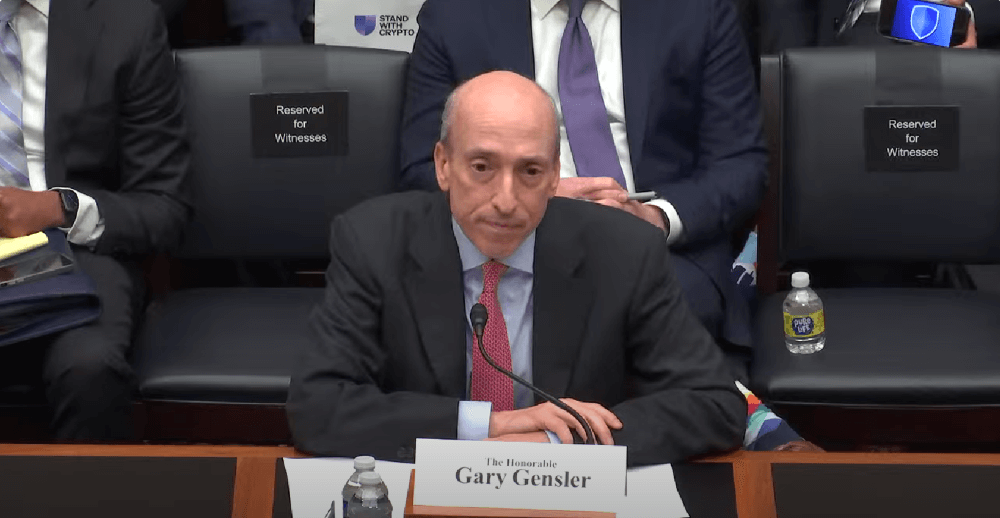

Now take a look at this picture from last week at the same HFSC hearing referenced earlier. Notice at the top the blue shield “STAND WITH CRYPTO” piece of paper and the cell phone with the blue shield logo.

Stand with Crypto was created by Coinbase to lobby on behalf of the crypto market.

These photobombs might seem silly at first, but think about it further. Imagine the planning involved to make them happen. To know exactly where the cameras will be. Getting there early to have the perfect seats.

It represents the thought and dedication that goes into crypto. What other industry is this passionate? This is why crypto will prevail. There are people from all over the world, from all walks of life, all working towards the same goal.

A Spot Bitcoin ETF will be Approved

After the yellow notepad “Buy Bitcoin” photobomb, bitcoin went up 800% in 5 months. Could the same thing happen again after this “Stand With Crypto” photobomb? I think it’s possible when a spot bitcoin ETF gets approved. That would put bitcoin at $220,000.

Sounds crazy?

Think of it this way. I count 9 gold ETFs in the US market and the gold market cap is 24 times larger than the bitcoin market cap. What will happen to the bitcoin price when 12 bitcoin ETFs all get approved at the same time, opening the door to a whole new pool of capital, and start buying an asset 1/24th the size of the gold market? It should have quite an impact.

If the bitcoin price moves like that, the rest of crypto will explode higher. To take advantage of it, you need to get positioned now before the bitcoin ETF is approved.

Youxia Crypto RUNE Fund

THORChain (RUNE) has been the best performing crypto in the top 100 over the last two months. It’s now edged its way into the top 50. I believe RUNE will be the next top 10 crypto and could very well take the number 3 spot.

The reason for the outperformance is the new lending feature added in August that is deflationary on the token supply. This new feature is just starting to be used, and should continue to gain traction. Therefore, the price performance from the last several weeks should continue.

Not only should you get positioned before the bitcoin ETF is approved, you should buy RUNE before the lending feature matures and drives the price up.

The best way to invest in RUNE is through my fund.

The fund will buy the RUNE token for capital gains potential and stake the token in the THORChain network for yield. Staking on THORChain means running nodes on THORChain.

Running nodes is where it gets fun. The nodes secure the exchange and, in return, they collect revenue from the swapping fees. The exchange will grow proportionally with the revenue from the fees. Therefore, the yield should prove to be as good as the capital gain.

$1 invested today could yield $1/year and eventually $1/month. All while sitting on a large capital gain.

The plan is to compound the yield for the first few years and wait for the token price to go up, then start paying the yield out to you as income. Ideally, the fund will last for decades. There’s no reason to wind it up if we can collect passive income for decades to come.

You can invest with fiat, crypto, or a mix of fiat and crypto.

Let me know if you want to get access to the offering documents.

To learn more about THORChain:

Read this report — THORChain Investors Guide

and

Watch this video — THORChain (RUNE) Introduction — Explained for Beginners

Thank you for reading.

I’m the founder of Youxia Crypto, an asset management company specializing in crypto. I can help you buy and sell precious metals too. I believe crypto is more than just about trying to make money, it’s about creating freedom for oneself and the rest of the world. I’m a contrarian, voluntaryist, and proponent of Austrian Economics. I enjoy downhill skiing, scuba diving, live music, yoga, and traveling.

The intended use of this material is for informational purposes only and is not intended to be an offer or solicitation for the sale of any financial product or service or a recommendation or determination that any investment strategy is suitable for a specific investor. Investors should seek financial advice regarding the suitability of any investment strategy based on the objectives of the investor, financial situation, investment horizon, and their particular needs. This information is not intended to provide financial, tax, legal, accounting or other professional advice since such advice always requires consideration of individual circumstances. The investments discussed herein are not insured by the FDIC or any other governmental agency, are subject to risks, including a total loss of the principal amount invested. Past performance is no guarantee of future returns.