GENERAL,BITCOIN

Donald Trump is a Bitcoiner

August 2, 2024

Bitcoin 2024 in Nashville was the third conference I’ve been to. I highly recommend going. Especially if you’re still on the fence about bitcoin and the whole crypto currency sector. It will tip you over.

The energy at this conference is off the charts. So much positivity and hope. No one really talks about the bitcoin price, it’s more about changing the world and making it a better place. No other investment conference comes close to the good vibes at the bitcoin conference.

This year's conference was definitely centered around politics. Edward Snowden gave his thoughts on the subject. So did Russel Brand. Michael Saylor made the case for why there’s only room for 1, maybe 2, countries to truly adopt bitcoin and those will be the countries that win.

Former presidential candidate Vivek Ramaswamy, Senators Bill Hagerty, Marsha Blackburn, Cynthia Lummis, and Congressman Ro Khanna were all headliners campaigning for the bitcoin vote. Politicians are now competing on who can be more pro-crypto and proposing bitcoin to be held by the US Treasury as a strategic reserve.

Ask not what Bitcoin can do for You

Ask what You can do for Bitcoin

RFK junior’s uncle would be proud of him. His speech was definitely the best and is well worth your time to watch. You can tell he’s been talking to the right people in the community and getting the right advice. Of note, was his pledge to remove any taxes on bitcoin transactions. That is the correct path towards mass adoption. Making bitcoin legal tender is not the way. Making bitcoin, or gold, or anything else, legal tender may feel good, but in the end, it’s still forcing people against their will.

Legal tender is money that, if tendered by a debtor in payment of his monetary obligation, may not be refused by the creditor. What if a creditor does not want to accept bitcoin? In a free market, they don’t have to.

People have to voluntarily choose bitcoin, it should not be forced on them. We don’t need a bitcoin standard, we need a free market in money.

Orange Man & Orange Coin

The main event was Donald Trump’s speech, also a must watch. After hearing RFK’s speech the day before, I knew there was no way Trump could top it. In fact, I actually thought Trump might get booed if he said something stupid to offend the crowd. Bitcoiners are philosophically sound and quick to attack anyone who goes against their principles.

But I have to hand it to Trump. I was right about him not topping RFK’s speech, however, he told the crowd what they wanted to hear and didn’t put his foot in his mouth. He said he had 25 million reasons to change his mind on bitcoin. He vowed to fire SEC Chair Gary Gensler, which got the crowd riled up. He could have really won the crowd over if he made a joke about the orange man supporting the orange coin, but didn’t. That was a missed opportunity.

Another thing missing from the speech was Elon Musk.

Trump delayed coming on stage for about an hour. It had everyone in the crowd speculating on what the hold-up was. Well before Trump’s speech, there were already rumors going around that Elon Musk was going to make a surprise visit. As we waited for Trump to come on, Twitter swarmed with images of Elon’s private jet flying towards Nashville. When the jet approached the city, event organizers announced they’re waiting for a special guest who’s 20 minutes away. The time it takes to drive from the airport to the conference center.

As it turned out, Elon’s jet kept going. It never landed. And the whole delay was due to some guy walking into the conference through an exit door, instead of the entrance. The Secret Service grilled him for an hour until they decided he was not a threat and gave Trump the all-clear to go on stage.

Was Elon really going to come, but bailed at the last minute? Were the conference organizers playing into the hype on social media and having some fun with the crowd? I don’t know. But Elon taking the stage with Trump would have broken the internet.

Crypto is a Nonpartisan Issue

I’m not endorsing any of the politicians above and I’m not suggesting you do either. What matters is we have 2 of the top 3 presidential candidates in the USA who are pro-bitcoin.

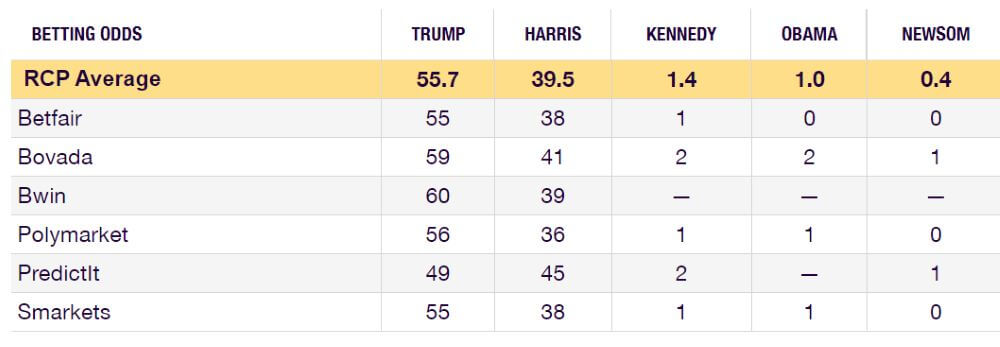

The betting markets, where people put real money down, are the best indicator of who will win. Trump is leading by a wide margin.

The market is pricing in Trump to win, however Bitcoin is not pricing in a pro-crypto president. Therefore, if Trump wins, and keeps his promises, it should be bullish for the sector.

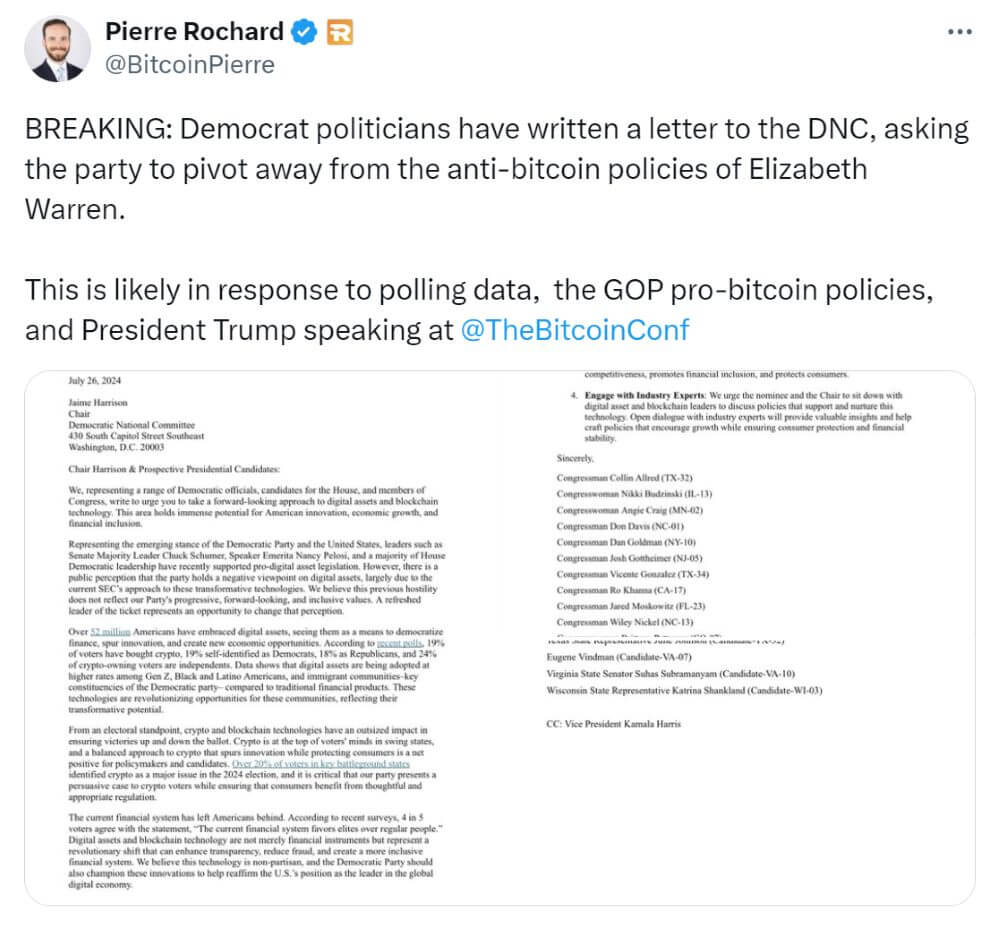

Kamala Harris was invited to speak at the bitcoin conference, but declined. I wouldn’t read much into that. What you should read into is the push from members of the Democratic party to come up with their own stance on bitcoin and crypto. 14 Democrat congressmen wrote a letter to the Democratic National Committee urging them to come up with a pro-crypto position.

Over 52 million Americans have embraced digital assets... According to recent polls, 19% of voters have bought crypto, 19% self-identified as Democrats, 18% as Republicans, and 24% of crypto-owning voters are independents... Over 20% of voters in key battleground states identified crypto as a major issue in the 2024 election.

- Letter to the Democratic National Committee

Bitcoin becoming a major talking point in the USA presidential election would have sounded crazy 10 years ago. But here we are. This will spread to all politicians around the world. The game theory is playing out right in front of our eyes.

What if I’m Wrong?

Too many people still think bitcoin will be made illegal and the USA won’t embrace it, and is being reflected in the price. What if the market is wrong?

With investing, you always have to factor in “what if I’m wrong?” What would your investment go to, if your premise is wrong?

In crypto’s case, the “what if I’m wrong” scenario is actually a positive outcome. The majority of the market is pricing in crypto failing, crypto being made illegal, etc. They completely discount the fact it could succeed and be embraced.

No one is positioned for the USA embracing crypto. If you fancy yourself a savvy contrarian investor, you should be betting on the USA becoming pro-crypto.

Ethereum ETF

Let’s ignore the positive crypto talk from the politicians above. Talk is cheap, right? They’ll say anything to get elected. I agree. Actions speak louder than words.

Did you hear about the USA approving spot Ethereum ETFs? They started trading on July 23rd.

From the media I follow, it seems like a rather anticlimactic event. The bitcoin ETF had much more fanfare when it was approved. Whereas the hype around the Ethereum ETF seems rather meh. This, despite the fact only two months ago the Ethereum ETF was given a nil chance of being approved this year.

The SEC did a complete one-eighty on the Ethereum ETF in a short period of time. Perhaps the tide has already changed within the US government and they now need to appease the crypto community, if they want to keep their jobs and attract campaign money.

The ethereum price has not rallied at all since the launch of the ETFs. Further proof the market is not pricing in the USA embracing crypto.

THORTruck

Look what I found while I was in Nashville. This cyber truck is the first one to be bought with crypto. The Satoshi of THORChain, JP, bought it and had it wrapped with the THORChain logo and what not.

I know it looks retarded.

You have to remember, the guys who built and continue to develop THORChain are in their 20s and 30s. They’re young geniuses. As long as the code works we can forgive them on their choice of aesthetics.

That being said, THORChain’s market is wallets with other 20- and 30-year old geniuses working there, which arguably have a similar sense of humor. The THORChain developers have to build relationships with those people to get THORChain integrated across the sector. So, the THORTruck may not be as bad an idea as it looks. It was definitely turning heads at the conference.

Youxia RUNE Fund

I had dinner with JP and THORChain’s core development team (Nine Realms) while in Nashville. Everything behind the scenes is moving forward full steam ahead.

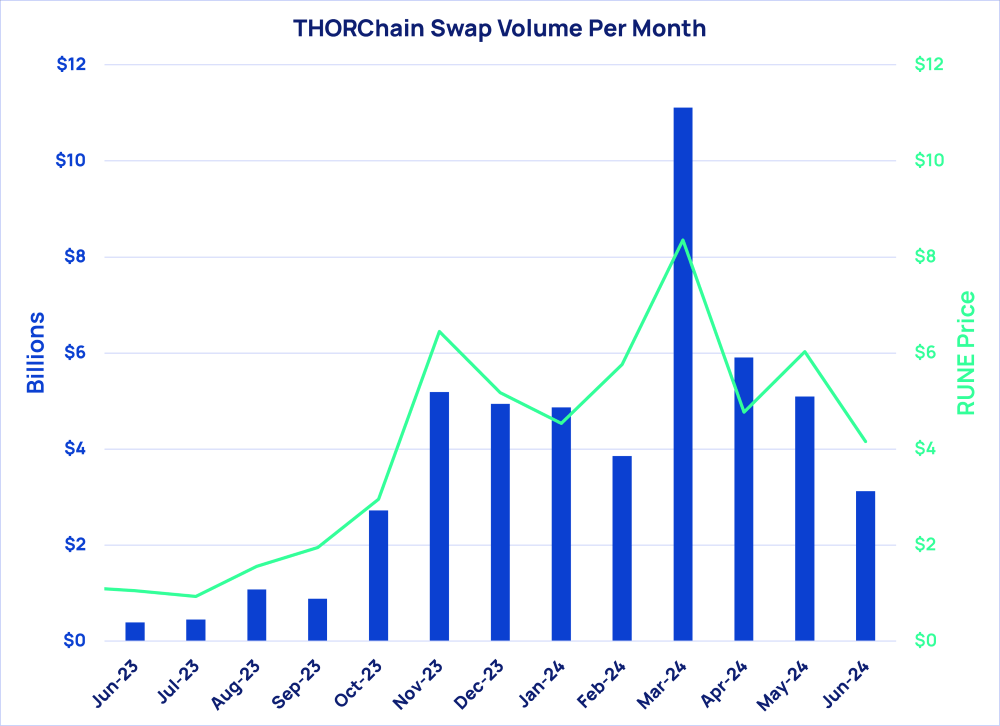

The RUNE price has not been moving forward full steam ahead. It’s at 6-month lows right now. The pullback in the price is simply from the lull in trading activity. The sentiment in the crypto market is quite poor right now and is reflected by lower trading volumes.

You can see how trading volume on the exchange, which drives network revenue, ultimately affects the RUNE price.

During dinner and online, I’ve been campaigning to increase swap fees and to stop the inflation on the RUNE supply. Many others are on board and I believe we will see a concerted effort to increase network revenue in the next 6 months. THORChain is drastically undercharging for its product and I expect that will change.

With more wallet integrations on the way, with revenue set to increase on THORChain, with a good chance the next USA administration will be pro-crypto, and the liquidity cycle easing over the next year, now is a great time to invest in RUNE.

Contact me to get started.

To learn more about THORChain (RUNE) click on the following:

Read - THORChain (RUNE) Investors Guide

Video - THORChain (RUNE) Introduction - Explained for Beginners

Thank you for reading.

I’m the founder of Youxia Crypto, an asset management company specializing in crypto. I can help you buy and sell precious metals too. I believe crypto is more than just about trying to make money, it’s about creating freedom for oneself and the rest of the world. I’m a contrarian, voluntaryist, and proponent of Austrian Economics. I enjoy skiing, beach volleyball, scuba diving, live music, yoga, and traveling.

The intended use of this material is for informational purposes only and is not intended to be an offer or solicitation for the sale of any financial product or service or a recommendation or determination that any investment strategy is suitable for a specific investor. Investors should seek financial advice regarding the suitability of any investment strategy based on the objectives of the investor, financial situation, investment horizon, and their particular needs. This information is not intended to provide financial, tax, legal, accounting or other professional advice since such advice always requires consideration of individual circumstances. The investments discussed herein are not insured by the FDIC or any other governmental agency, are subject to risks, including a total loss of the principal amount invested. Past performance is no guarantee of future returns.